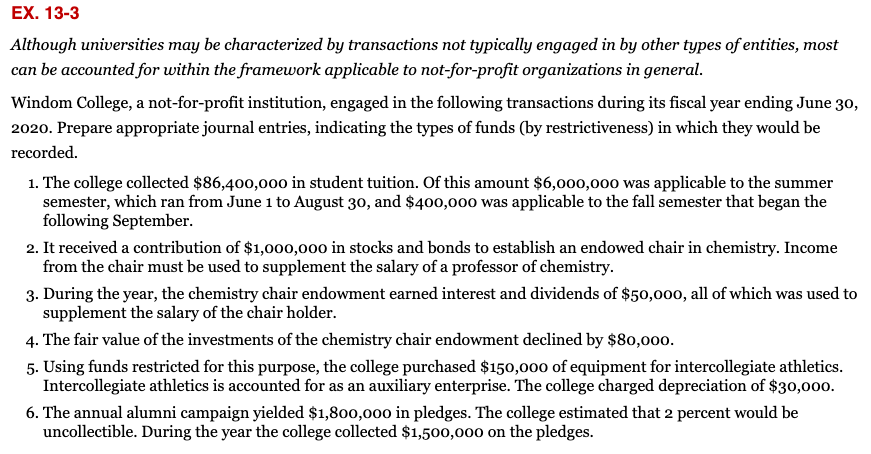

Although universities may be characterized by transactions not typically engaged in by other types of entities, most can be accounted for within the framework applicable to not-for-profit organizations in general. Windom College, a not-for-profit institution, engaged in the following transactions during its fiscal year ending June 30, 2020. Prepare appropriate journal entries, indicating the types of funds (by restrictiveness) in which they would be recorded. 1. The college collected $86,400,000 in student tuition. Of this amount $6,000,000 was applicable to the summer semester, which ran from June 1 to August 30, and $400,000 was applicable to the fall semester that began the following September. 2. It received a contribution of $1,000,000 in stocks and bonds to establish an endowed chair in chemistry. Income from the chair must be used to supplement the salary of a professor of chemistry. 3. During the year, the chemistry chair endowment earned interest and dividends of $50,000, all of which was used to supplement the salary of the chair holder. 4. The fair value of the investments of the chemistry chair endowment declined by $80,000. 5. Using funds restricted for this purpose, the college purchased $150,000 of equipment for intercollegiate athletics. Intercollegiate athletics is accounted for as an auxiliary enterprise. The college charged depreciation of $30,000. 6. The annual alumni campaign yielded $1,800,000 in pledges. The college estimated that 2 percent would be uncollectible. During the year the college collected $1,500,00o on the pledges.

Although universities may be characterized by transactions not typically engaged in by other types of entities, most can be accounted for within the framework applicable to not-for-profit organizations in general. Windom College, a not-for-profit institution, engaged in the following transactions during its fiscal year ending June 30, 2020. Prepare appropriate journal entries, indicating the types of funds (by restrictiveness) in which they would be recorded. 1. The college collected $86,400,000 in student tuition. Of this amount $6,000,000 was applicable to the summer semester, which ran from June 1 to August 30, and $400,000 was applicable to the fall semester that began the following September. 2. It received a contribution of $1,000,000 in stocks and bonds to establish an endowed chair in chemistry. Income from the chair must be used to supplement the salary of a professor of chemistry. 3. During the year, the chemistry chair endowment earned interest and dividends of $50,000, all of which was used to supplement the salary of the chair holder. 4. The fair value of the investments of the chemistry chair endowment declined by $80,000. 5. Using funds restricted for this purpose, the college purchased $150,000 of equipment for intercollegiate athletics. Intercollegiate athletics is accounted for as an auxiliary enterprise. The college charged depreciation of $30,000. 6. The annual alumni campaign yielded $1,800,000 in pledges. The college estimated that 2 percent would be uncollectible. During the year the college collected $1,500,00o on the pledges.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please answer properly

Transcribed Image Text:EX. 13-3

Although universities may be characterized by transactions not typically engaged in by other types of entities, most

can be accounted for within the framework applicable to not-for-profit organizations in general.

Windom College, a not-for-profit institution, engaged in the following transactions during its fiscal year ending June 30,

2020. Prepare appropriate journal entries, indicating the types of funds (by restrictiveness) in which they would be

recorded.

1. The college collected $86,400,00o in student tuition. Of this amount $6,000,000 was applicable to the summer

semester, which ran from June 1 to August 30, and $400,000 was applicable to the fall semester that began the

following September.

2. It received a contribution of $1,000,000 in stocks and bonds to establish an endowed chair in chemistry. Income

from the chair must be used to supplement the salary of a professor of chemistry.

3. During the year, the chemistry chair endowment earned interest and dividends of $50,000, all of which was used to

supplement the salary of the chair holder.

4. The fair value of the investments of the chemistry chair endowment declined by $80,000.

5. Using funds restricted for this purpose, the college purchased $150,000 of equipment for intercollegiate athletics.

Intercollegiate athletics is accounted for as an auxiliary enterprise. The college charged depreciation of $30,000.

6. The annual alumni campaign yielded $1,800,000 in pledges. The college estimated that 2 percent would be

uncollectible. During the year the college collected $1,500,000 on the pledges.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education