alue Of d. If the firm merges with another firm that will reduce the growth rate to 2% and raise the required return to 16%, the nearest cent.) e. If the firm acquires a subsid1ary operation from another manufacturer that will increase the dividend growth rate to 8% and increase the required return to 16%, the value of the firm will be $- (Round to the nearest cent.)

alue Of d. If the firm merges with another firm that will reduce the growth rate to 2% and raise the required return to 16%, the nearest cent.) e. If the firm acquires a subsid1ary operation from another manufacturer that will increase the dividend growth rate to 8% and increase the required return to 16%, the value of the firm will be $- (Round to the nearest cent.)

Chapter7: Common Stock: Characteristics, Valuation, And Issuance

Section: Chapter Questions

Problem 20P

Related questions

Question

Answer d and e

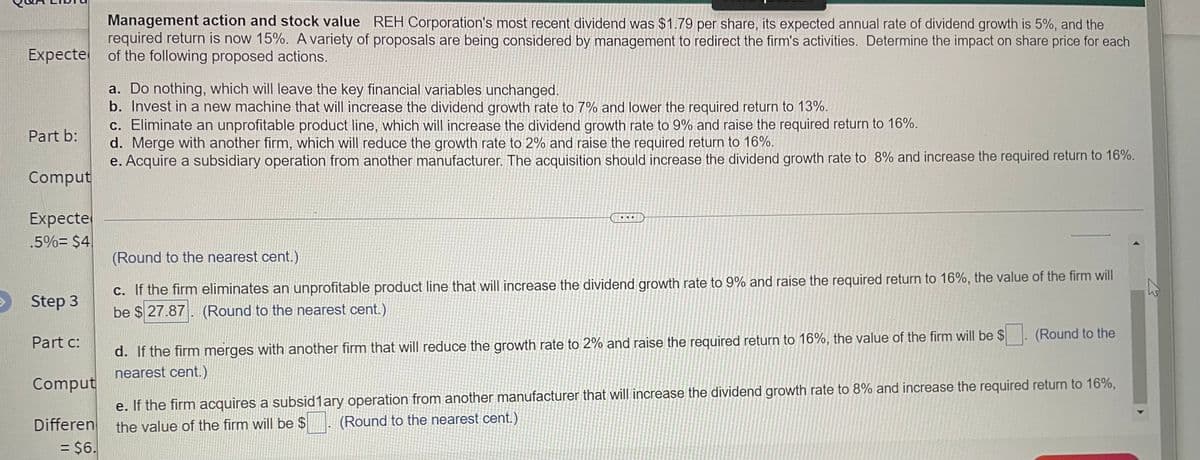

Transcribed Image Text:Management action and stock value REH Corporation's most recent dividend was $1.79 per share, its expected annual rate of dividend growth is 5%, and the

required return is now 15%. A variety of proposals are being considered by management to redirect the firm's activities. Determine the impact on share price for each

Expecte of the following proposed actions.

a. Do nothing, which will leave the key financial variables unchanged.

b. Invest in a new machine that will increase the dividend growth rate to 7% and lower the required return to 13%.

c. Eliminate an unprofitable product line, which will increase the dividend growth rate to 9% and raise the required return to 16%.

d. Merge with another firm, which will reduce the growth rate to 2% and raise the required return to 16%.

e. Acquire a subsidiary operation from another manufacturer. The acquisition should increase the dividend growth rate to 8% and increase the required return to 16%.

Part b:

Comput

Expecte

.5%= $4.

..

(Round to the nearest cent.).

C. If the firm eliminates an unprofitable product line that will increase the dividend growth rate to 9% and raise the required return to 16%, the value of the firm will

be $ 27.87. (Round to the nearest cent.).

Step 3

d. If the firm merges with another firm that will reduce the growth rate to 2% and raise the required return to 16%, the value of the firm will be $

nearest cent.)

(Round to the

Part c:

Comput

e. If the firm acquires a subsid1ary operation from another manufacturer that will increase the dividend growth rate to 8% and increase the required return to 16%,

(Round to the nearest cent.)

Differen

= $6.

the value of the firm will be $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning