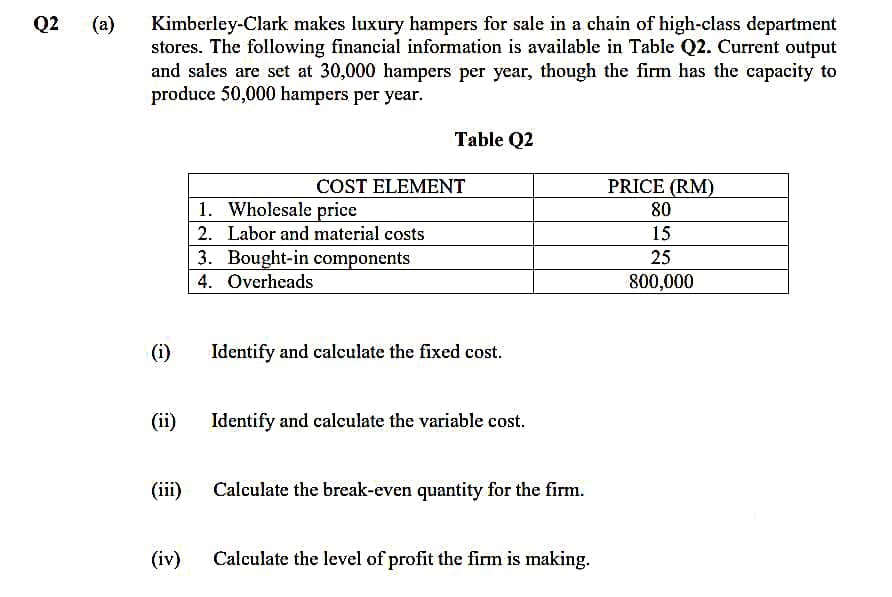

Kimberley-Clark makes luxury hampers for sale in a chain of high-class department stores. The following financial information is available in Table Q2. Current output and sales are set at 30,000 hampers per year, though the firm has the capacity to produce 50,000 hampers per year. Table Q2 COST ELEMENT PRICE (RM) 80 1. Wholesale price 2. Labor and material costs 15 3. Bought-in components 4. Overheads 25 800,000 (i) Identify and calculate the fixed cost. (ii) Identify and calculate the variable cost. (iii) Calculate the break-even quantity for the firm. (iv) Calculate the level of profit the firm is making.

Kimberley-Clark makes luxury hampers for sale in a chain of high-class department stores. The following financial information is available in Table Q2. Current output and sales are set at 30,000 hampers per year, though the firm has the capacity to produce 50,000 hampers per year. Table Q2 COST ELEMENT PRICE (RM) 80 1. Wholesale price 2. Labor and material costs 15 3. Bought-in components 4. Overheads 25 800,000 (i) Identify and calculate the fixed cost. (ii) Identify and calculate the variable cost. (iii) Calculate the break-even quantity for the firm. (iv) Calculate the level of profit the firm is making.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 13P: Deuce Sporting Goods manufactures a high-end model tennis racket. The company’s forecasted income...

Related questions

Question

Please answer please arjent help

Transcribed Image Text:Q2

(a)

Kimberley-Clark makes luxury hampers for sale in a chain of high-class department

stores. The following financial information is available in Table Q2. Current output

and sales are set at 30,000 hampers per year, though the firm has the capacity to

produce 50,000 hampers per year.

Table Q2

COST ELEMENT

PRICE (RM)

1. Wholesale price

80

2. Labor and material costs

15

3. Bought-in components

4. Overheads

25

800,000

(i)

Identify and calculate the fixed cost.

(ii)

Identify and calculate the variable cost.

(ii)

Calculate the break-even quantity for the firm.

(iv)

Calculate the level of profit the firm is making.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning