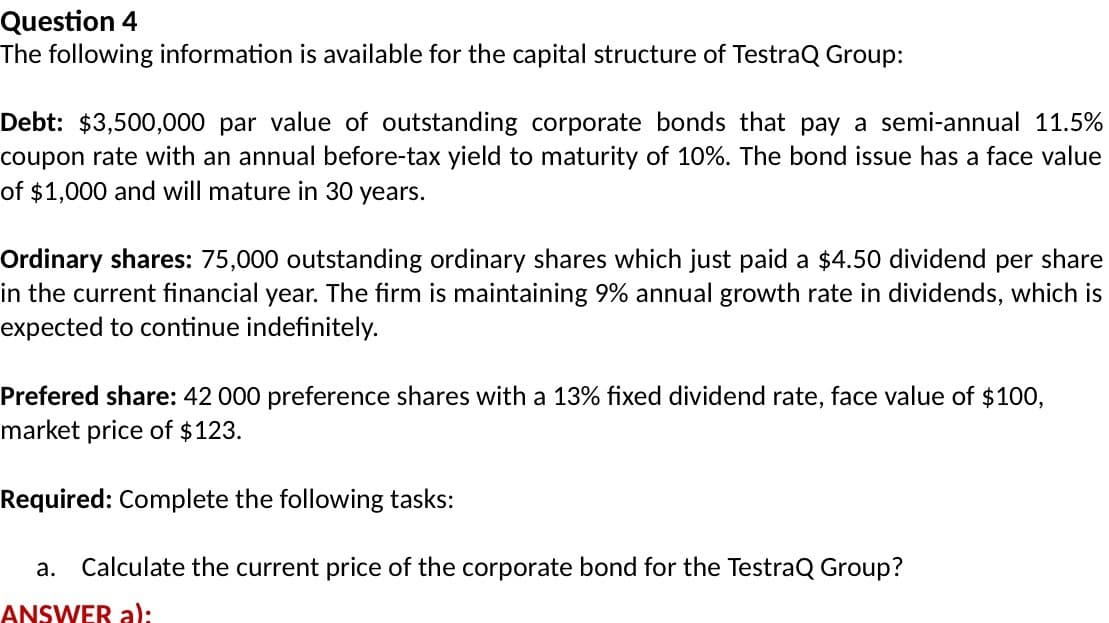

Question 4 The following information is available for the capital structure of TestraQ Group: Debt: $3,500,000 par value of outstanding corporate bonds that pay a semi-annual 11.5% coupon rate with an annual before-tax yield to maturity of 10%. The bond issue has a face value of $1,000 and will mature in 30 years. Ordinary shares: 75,000 outstanding ordinary shares which just paid a $4.50 dividend per share in the current financial year. The firm is maintaining 9% annual growth rate in dividends, which is expected to continue indefinitely. Prefered share: 42 000 preference shares with a 13% fixed dividend rate, face value of $100, market price of $123. Required: Complete the following tasks: a. Calculate the current price of the corporate bond for the TestraQ Group? ANSWER a):

Question 4 The following information is available for the capital structure of TestraQ Group: Debt: $3,500,000 par value of outstanding corporate bonds that pay a semi-annual 11.5% coupon rate with an annual before-tax yield to maturity of 10%. The bond issue has a face value of $1,000 and will mature in 30 years. Ordinary shares: 75,000 outstanding ordinary shares which just paid a $4.50 dividend per share in the current financial year. The firm is maintaining 9% annual growth rate in dividends, which is expected to continue indefinitely. Prefered share: 42 000 preference shares with a 13% fixed dividend rate, face value of $100, market price of $123. Required: Complete the following tasks: a. Calculate the current price of the corporate bond for the TestraQ Group? ANSWER a):

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter13: Capital Structure And Leverage

Section: Chapter Questions

Problem 11P: RECAPITALIZATION Currently, Forever flowers Inc. has a capital structure consisting of 25% debt and...

Related questions

Question

100%

Give me answer within an hour I will give you positive rating immediately ...

Transcribed Image Text:Question 4

The following information is available for the capital structure of TestraQ Group:

Debt: $3,500,000 par value of outstanding corporate bonds that pay a semi-annual 11.5%

coupon rate with an annual before-tax yield to maturity of 10%. The bond issue has a face value

of $1,000 and will mature in 30 years.

Ordinary shares: 75,000 outstanding ordinary shares which just paid a $4.50 dividend per share

in the current financial year. The firm is maintaining 9% annual growth rate in dividends, which is

expected to continue indefinitely.

Prefered share: 42 000 preference shares with a 13% fixed dividend rate, face value of $100,

market price of $123.

Required: Complete the following tasks:

a. Calculate the current price of the corporate bond for the TestraQ Group?

ANSWER a):

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning