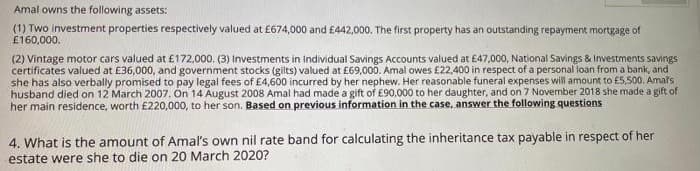

Amal owns the following assets: (1) Two investment properties respectively valued at £674,000 and E442,000. The first property has an outstanding repayment mortgage of E160,000. (2) Vintage motor cars valued at £172,000. (3) Investments in Individual Savings Accounts valued at £47,000, National Savings & Investments savings certificates valued at E36,000, and government stocks (gilts) valued at £69,000. Amal owes £22,400 in respect of a personal loan from a bank, and she has also verbally promised to pay legal fees of E4,600 incurred by her nephew. Her reasonable funeral expenses will amount to E5,500. Amals husband died on 12 March 2007. On 14 August 2008 Amal had made a gift of £90,000 to her daughter, and on 7 November 2018 she made a gift of her main residence, worth £220,000, to her son. Based on previous information in the case, answer the following questions 4. What is the amount of Amal's own nil rate band for calculating the inheritance tax payable in respect of her estate were she to die on 20 March 2020?

Amal owns the following assets: (1) Two investment properties respectively valued at £674,000 and E442,000. The first property has an outstanding repayment mortgage of E160,000. (2) Vintage motor cars valued at £172,000. (3) Investments in Individual Savings Accounts valued at £47,000, National Savings & Investments savings certificates valued at E36,000, and government stocks (gilts) valued at £69,000. Amal owes £22,400 in respect of a personal loan from a bank, and she has also verbally promised to pay legal fees of E4,600 incurred by her nephew. Her reasonable funeral expenses will amount to E5,500. Amals husband died on 12 March 2007. On 14 August 2008 Amal had made a gift of £90,000 to her daughter, and on 7 November 2018 she made a gift of her main residence, worth £220,000, to her son. Based on previous information in the case, answer the following questions 4. What is the amount of Amal's own nil rate band for calculating the inheritance tax payable in respect of her estate were she to die on 20 March 2020?

Chapter12: Nonrecognition Transactions

Section: Chapter Questions

Problem 22P

Related questions

Question

Transcribed Image Text:Amal owns the following assets:

(1) Two investment properties respectively valued at £674,000 and £442,000. The first property has an outstanding repayment mortgage of

£160,000.

(2) Vintage motor cars valued at £172.000. (3) Investments in Individual Savings Accounts valued at £47,000, National Savings & Investments savings

certificates valued at £36,000, and government stocks (gilts) valued at £69,000. Amal owes £22,400 in respect of a personal ioan from a bank, and

she has also verbally promised to pay legal fees of £4,600 incurred by her nephew. Her reasonable funeral expenses will amount to f5,500. Amals

husband died on 12 March 2007. On 14 August 2008 Amal had made a gift of £90,000 to her daughter, and on 7 November 2018 she made a gift of

her main residence, worth £220,000, to her son. Based on previous information in the case, answer the following questions

4. What is the amount of Amal's own nil rate band for calculating the inheritance tax payable in respect of her

estate were she to die on 20 March 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you