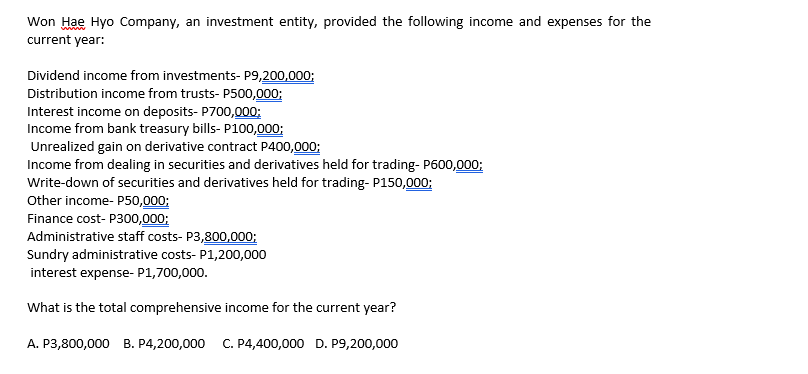

Won Hae Hyo Company, an investment entity, provided the following income and expenses for the current year: Dividend income from investments- P9,200,000; Distribution income from trusts- P500,000; Interest income on deposits- P700,000; Income from bank treasury bills- P100,000; Unrealized gain on derivative contract P400,000; Income from dealing in securities and derivatives held for trading- P600,000; Write-down of securities and derivatives held for trading- P150,000; Other income- P50,000; Finance cost- P300,000; Administrative staff costs- P3,800,000; Sundry administrative costs- P1,200,000 interest expense- P1,700,000. What is the total comprehensive income for the current year? A. P3,800,000 B. P4,200,000 C. P4,400,000 D. P9,200,000

Won Hae Hyo Company, an investment entity, provided the following income and expenses for the current year: Dividend income from investments- P9,200,000; Distribution income from trusts- P500,000; Interest income on deposits- P700,000; Income from bank treasury bills- P100,000; Unrealized gain on derivative contract P400,000; Income from dealing in securities and derivatives held for trading- P600,000; Write-down of securities and derivatives held for trading- P150,000; Other income- P50,000; Finance cost- P300,000; Administrative staff costs- P3,800,000; Sundry administrative costs- P1,200,000 interest expense- P1,700,000. What is the total comprehensive income for the current year? A. P3,800,000 B. P4,200,000 C. P4,400,000 D. P9,200,000

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 28E

Related questions

Question

Transcribed Image Text:Won Hae Hyo Company, an investment entity, provided the following income and expenses for the

current year:

Dividend income from investments- P9,200,000;

Distribution income from trusts- P500,000;

Interest income on deposits- P700,000;

Income from bank treasury bills- P100,000;

Unrealized gain on derivative contract P400,000;

Income from dealing in securities and derivatives held for trading- P600,000;

Write-down of securities and derivatives held for trading- P150,000;

Other income- P50,000;

Finance cost- P300,000;

Administrative staff costs- P3,800,000;

Sundry administrative costs- P1,200,000

interest expense- P1,700,000.

What is the total comprehensive income for the current year?

A. P3,800,000 B. P4,200,000

C. P4,400,000 D. P9,200,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning