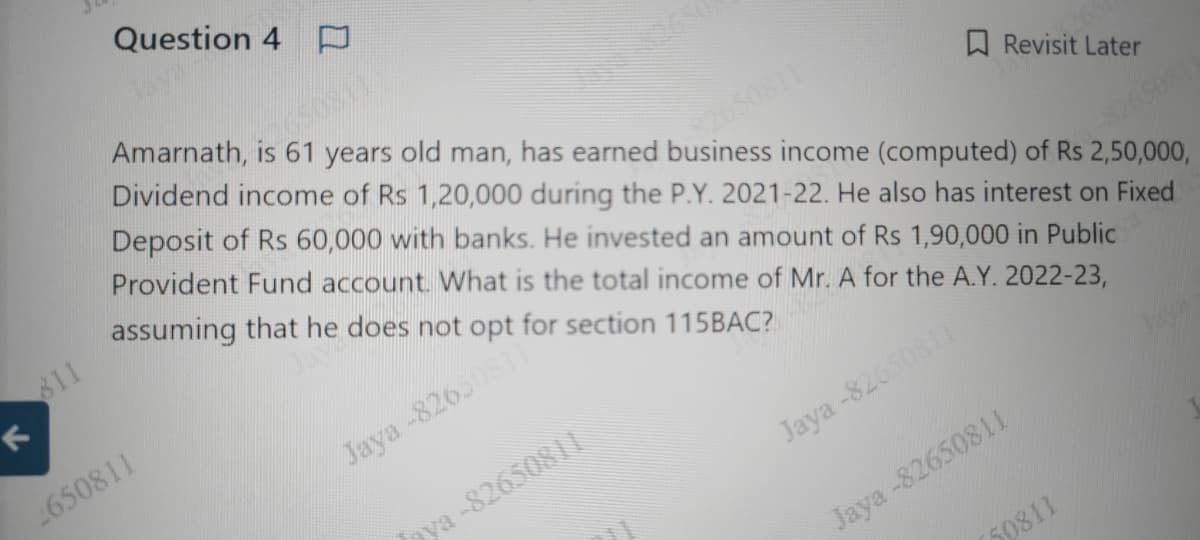

Amarnath, is 61 years old man, has earned business income (computed) of Rs 2,50,000, Dividend income of Rs 1,20,000 during the P.Y. 2021-22. He also has interest on Fixed Deposit of Rs 60,000 with banks. He invested an amount of Rs 1,90,000 in Public Provident Fund account. What is the total income of Mr. A for the A.Y. 2022-23, assuming that he does not opt for section 115BAC?

Amarnath, is 61 years old man, has earned business income (computed) of Rs 2,50,000, Dividend income of Rs 1,20,000 during the P.Y. 2021-22. He also has interest on Fixed Deposit of Rs 60,000 with banks. He invested an amount of Rs 1,90,000 in Public Provident Fund account. What is the total income of Mr. A for the A.Y. 2022-23, assuming that he does not opt for section 115BAC?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.10P

Related questions

Question

Transcribed Image Text:Question 4 D

Revisit Later

Amarnath, is 61 years old man, has earned business income (computed) of Rs 2,50,000,

Dividend income of Rs 1,20,000 during the P.Y. 2021-22. He also has interest on Fixed

Deposit of Rs 60,000 with banks. He invested an amount of Rs 1,90,000 in Public

Provident Fund account. What is the total income of Mr. A for the A.Y. 2022-23,

assuming that he does not opt for section 115BAC?

Jaya

811

K

2650811

Jaya -82650811"

aya-8265081

ARRANG

Jaya-82650811

Jaya -82650811

50811

-82650811

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning