American Opportunity tax credit

Chapter12: Alternative Minimum Tax

Section: Chapter Questions

Problem 30P

Related questions

Question

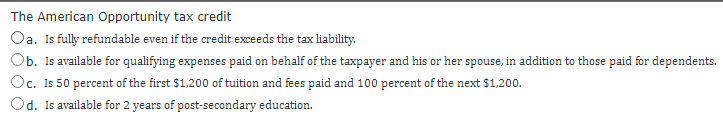

Transcribed Image Text:The American Opportunity tax credit

Oa. Is fully refundable even if the credit exceeds the tax liability.

Ob. Is available for qualifying expenses paid on behalf of the taxpayer and his or her spouse, in addition to those paid for dependents.

Oc. Is 50 percent of the first $1,200 of tuition and fees paid and 100 percent of the next $1,200.

Od. Is available for 2 years of post-secondary education.

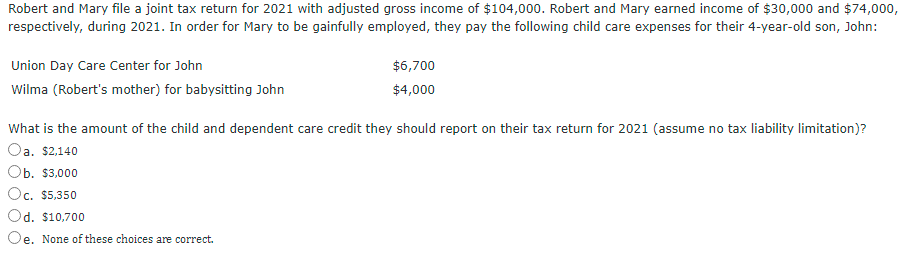

Transcribed Image Text:Robert and Mary file a joint tax return for 2021 with adjusted gross income of $104,000. Robert and Mary earned income of $30,000 and $74,000,

respectively, during 2021. In order for Mary to be gainfully employed, they pay the following child care expenses for their 4-year-old son, John:

Union Day Care Center for John

$6,700

Wilma (Robert's mother) for babysitting John

$4,000

What is the amount of the child and dependent care credit they should report on their tax return for 2021 (assume no tax liability limitation)?

Oa. $2,140

Ob. $3,000

Oc. $5,350

Od. $10,700

Oe. None of these choices are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT