is Distributors, a sporting goods distribution company, in January 20X1 and engaged in utors and its customers take advantage of all cash discounts. ONS s started Evans Distributors with an investment of $55,000. He also invested E worth $7,500. merchandise for cash, $11,500, Check 100. handise on account to Rivera Corporation, $850, terms 2/10, n/30, Invoice 1001 merchandise on account from Tsang Company, $2,000, terms 1/10, n/30, Invoice and paid freight charges related to January 4 purchase of merchandise from Tsa rporation returned mérchandise purchased on January 3; issued credit memo #10: in full from Rivera Corporation, after the return of January 10 and a: sont

is Distributors, a sporting goods distribution company, in January 20X1 and engaged in utors and its customers take advantage of all cash discounts. ONS s started Evans Distributors with an investment of $55,000. He also invested E worth $7,500. merchandise for cash, $11,500, Check 100. handise on account to Rivera Corporation, $850, terms 2/10, n/30, Invoice 1001 merchandise on account from Tsang Company, $2,000, terms 1/10, n/30, Invoice and paid freight charges related to January 4 purchase of merchandise from Tsa rporation returned mérchandise purchased on January 3; issued credit memo #10: in full from Rivera Corporation, after the return of January 10 and a: sont

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter8: Receivables

Section: Chapter Questions

Problem 8.6APR: Sales and notes receivable transactions The following were selected from among the transactions...

Related questions

Question

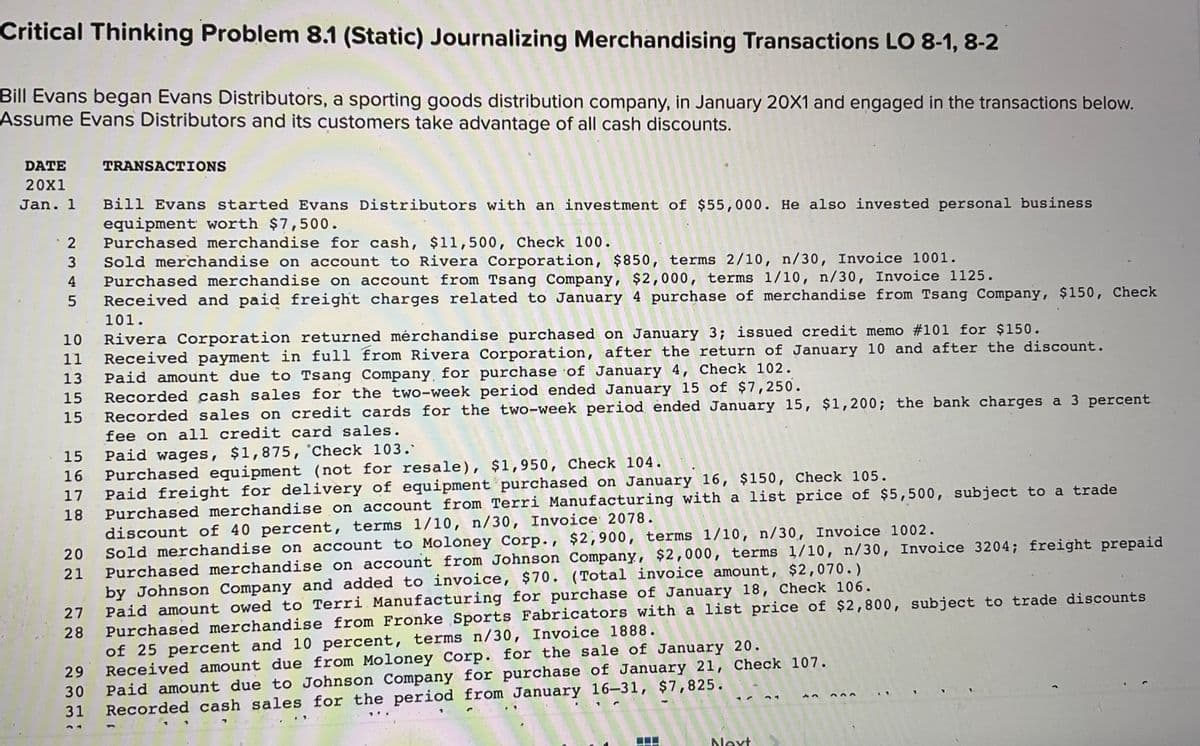

Transcribed Image Text:Critical Thinking Problem 8.1 (Static) Journalizing Merchandising Transactions LO 8-1, 8-2

Bill Evans began Evans Distributors, a sporting goods distribution company, in January 20X1 and engaged in the transactions below.

Assume Evans Distributors and its customers take advantage of all cash discounts.

DATE

TRANSACTIONS

20X1

Bill Evans started Evans Distributors with an investment of $55,000. He also invested personal business

equipment worth $7,500.

2

Purchased merchandise for cash, $11,500, Check 100.

Sold merchandise on account to Rivera Corporation, $850, terms 2/10, n/30, Invoice 1001.

Purchased merchandise on account from Tsang Company, $2,000, terms 1/10, n/30, Invoice 1125.

Received and paid freight charges related to January 4 purchase of merchandise from Tsang Company, $150, Check

3

4

101.

Rivera Corporation returned mérchandise purchased on January 3; issued credit memo #101 for $150.

Received payment in full from Rivera Corporation, after the return of January 10 and after the discount.

Paid amount due to Tsang Company for purchase of January 4, Check 102.

Recorded cash sales for the two-week period ended January 15 of $7,250.

Recorded sales on credit cards for the two-week period ended January 15, $1,200; the bank charges a 3 percent

10

11

13

15

15

fee on all credit card sales.

Paid wages, $1,875,°Check l03.

16 Purchased equipment (not for resale), $1,950, Check 104.

15

Paid freight for delivery of equipment purchased on January 16, $150, Check 105.

Purchased merchandise on account from Terri Manufacturing with a list price of $5,500, subject to a trade

discount of 40 percent, terms 1/10, n/30, Invoice 2078.

Sold merchandise on account to Moloney Corp., $2,900, terms 1/10, n/30, Invoice 1002.

Purchased merchandise on account from Johnson Company, $2,000, terms 1/10, n/30, Invoice 3204; freight prepaid

by Johnson Company and added to invoice, $70. (Total invoice amount, $2,070.)

27 Paid amount owed to Terri Manufacturing for purchase of January 18, Check 106.

Purchased merchandise from Fronke Sports Fabricators with a list price of $2,800, subject to trade discounts

17

18

20

21

28

of 25 percent and 10 percent, terms n/30, Invoice 1888.

Received amount due from Moloney Corp. for the sale of January 20.

Paid amount due to Johnson Company for purchase of January 21, Check 107.

Recorded cash sales for the period from January 16-31, $7,825.

29

30

31

Next

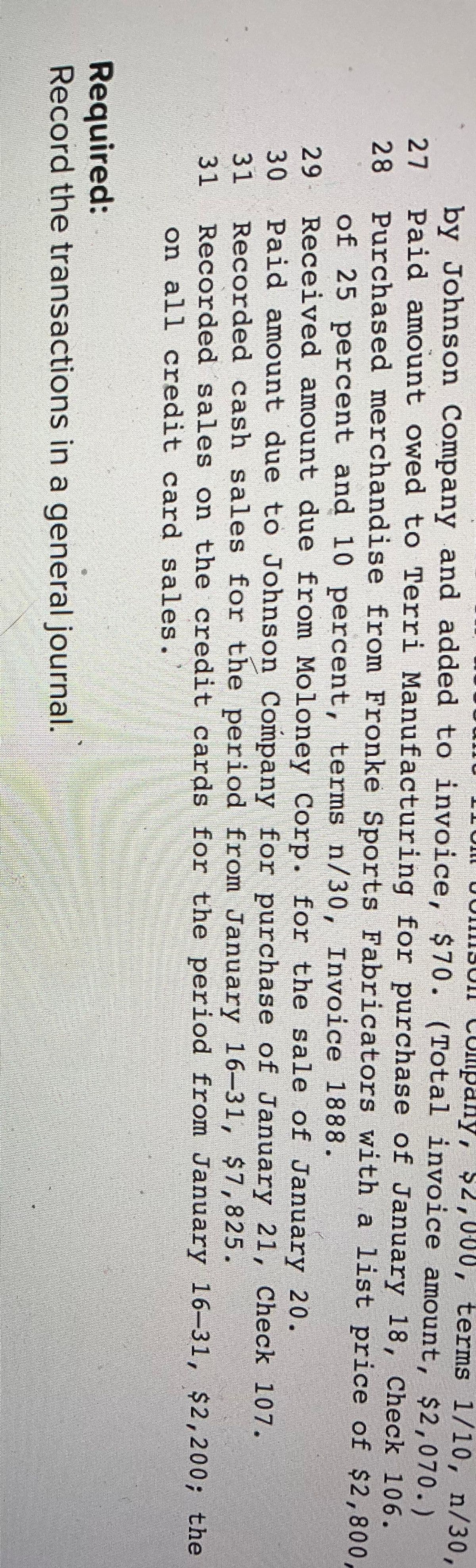

Transcribed Image Text:UUIIIIBUII CUmpany, $2,000, terms 1/10, n/30,

by Johnson Company and added to invoice, $70. (Total invoice amount, $2,070.)

27 Paid amount owed to Terri Manufacturing for purchase of January 18, Check 106.

Purchased merchandise from Fronke Sports Fabricators with a list price of $2,800,

of 25 percent and 10 percent, terms n/30, Invoice 1888.

Received amount due from Moloney Corp. for the sale of January 20.

Paid amount due to Johnson Company for purchase of January 21, Check 107.

Recorded cash sales for the period from January 16-31, $7,825.

Recorded sales on the credit cards for the period from January 16-31, $2,200; the

on all credit card sales.

28

29

30

31

31

Required:

Record the transactions in a general journal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning