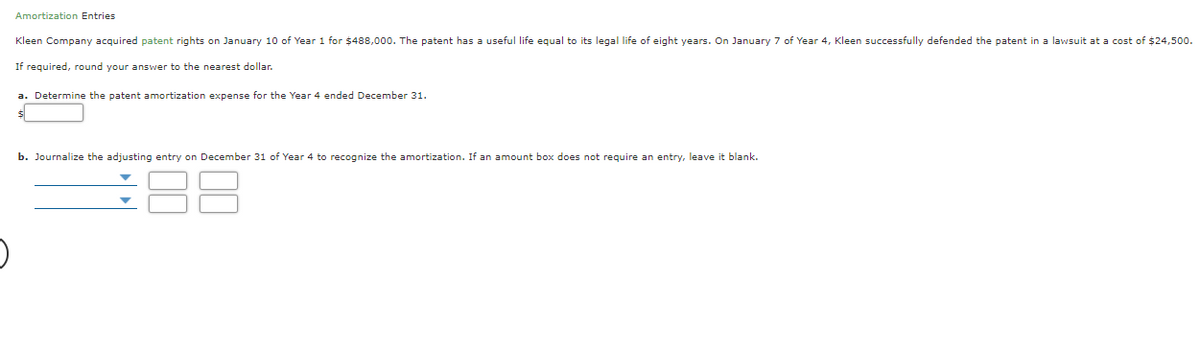

Amortization Entries Kleen Company acquired patent rights on January 10 of Year 1 for $488,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $24,500. If required, round your answer to the nearest dollar. a. Determine the patent amortization expense for the Year 4 ended December 31. b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an amount box does not require an entry, leave it blank.

Amortization Entries Kleen Company acquired patent rights on January 10 of Year 1 for $488,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $24,500. If required, round your answer to the nearest dollar. a. Determine the patent amortization expense for the Year 4 ended December 31. b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an amount box does not require an entry, leave it blank.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 64E

Related questions

Question

I put the choices for part be in the order they appear on the drop down box.

Part B.

1.

- Accumulated Depletion

- Amortization Expense-Patents

- Cash

- Patent

- Repairs and Maintenance Expense

2.

- Amortization Expense-Patents

- Cash

- Depletion Expense

- Patents

- Repairs and Maintenance Expense

Transcribed Image Text:Amortization Entries

Kleen Company acquired patent rights on January 10 of Year 1 for $488,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $24,500.

If required, round your answer to the nearest dollar.

a. Determine the patent amortization expense for the Year 4 ended December 31.

b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an amount box does not require an entry, leave it blank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning