Exercise 8-19 Amortization of intangible assets LO P4 Milano Gallery purchases the copyright on an oil painting for $240,000 on January 1, 2017. The copyright legally protects its owner for 12 more years. The company plans to market and sell prints of the original for 19 years. Prepare entries to record the purchase of the copyright on January 1, 2017, and its annual amortization on December 31, 2017. View transaction list Journal entry worksheet 2 Record the purchase of the copyright on an oil painting for $240,00o0 cash. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Journal entry worksheet Record the year-end adjusting entry for the amortization expense of the copyright. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31

Exercise 8-19 Amortization of intangible assets LO P4 Milano Gallery purchases the copyright on an oil painting for $240,000 on January 1, 2017. The copyright legally protects its owner for 12 more years. The company plans to market and sell prints of the original for 19 years. Prepare entries to record the purchase of the copyright on January 1, 2017, and its annual amortization on December 31, 2017. View transaction list Journal entry worksheet 2 Record the purchase of the copyright on an oil painting for $240,00o0 cash. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Journal entry worksheet Record the year-end adjusting entry for the amortization expense of the copyright. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 62E

Related questions

Question

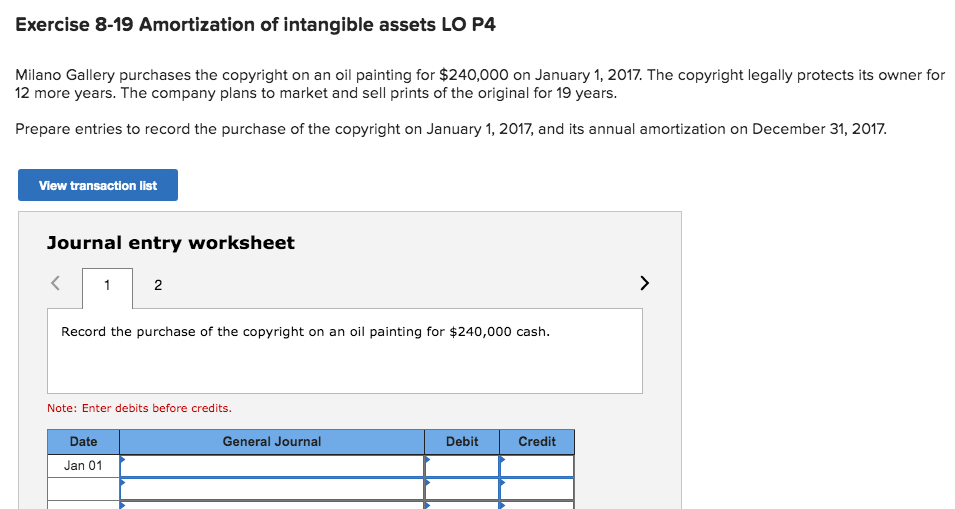

Transcribed Image Text:Exercise 8-19 Amortization of intangible assets LO P4

Milano Gallery purchases the copyright on an oil painting for $240,000 on January 1, 2017. The copyright legally protects its owner for

12 more years. The company plans to market and sell prints of the original for 19 years.

Prepare entries to record the purchase of the copyright on January 1, 2017, and its annual amortization on December 31, 2017.

View transaction list

Journal entry worksheet

2

Record the purchase of the copyright on an oil painting for $240,00o0 cash.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Jan 01

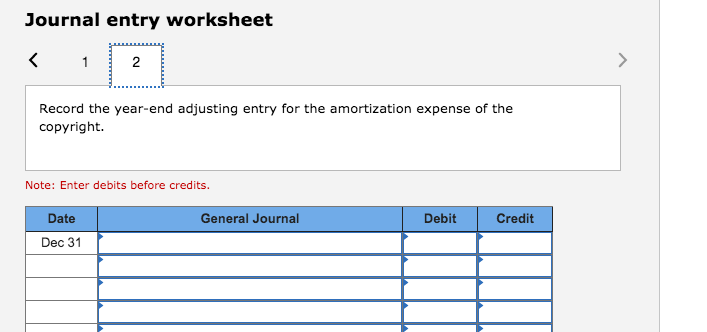

Transcribed Image Text:Journal entry worksheet

Record the year-end adjusting entry for the amortization expense of the

copyright.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Dec 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning