Amortization and Depletion Entries Data related to the acquisition of timber rights and intangible assets of Gemini Company during the current year ended December 31 are as follows: On December 31, Gemini Company determined that $3,000,000 of goodwill was impaired. Governmental and legal costs of $920,000 were incurred by Gemini Company on June 30 in obtaining a patent with an estimated economic life of eight years. Amortization is to be for one-half year. Timber rights on a tract of land were purchased for $1,350,000 on March 6. The stand of timber is estimated at 15,000,000 board feet. During the current year, 3,300,000 board feet of timber were cut and sold. Instructions: 1. Determine the amount of the amortization, depletion, or impairment for the current year for each of the foregoing items. Item Amortization, Depletion, or Impairment a. $ (I answered 3000000) b. $ (I answered 5750) c. $ (I answered 297000) 2. Illustrate the effects on the accounts and financial statements of recording the following transactions. For decreases in accounts or outflows of cash, enter your answers as negative numbers. If no account or activity is affected, select "No effect" from the dropdown and leave the corresponding number entry box blank. a. On December 31, Gemini Company determined that $3,000,000 of goodwill was impaired. (chart attached in screenshot) (Options in the drop down for Assets): Accounts receivable, accumulated depreciation, goodwill, no effect + (Options in the drop down for Assets): Accounts payable, accumulated depreciation, cash, no effect. = (Options in the drop down for Liabilities): Accounts payable, capital stock, goodwill, no effect. + (Options in the drop down for Stock. equity): Capital stock, Loss from impaired goodwill, retained earnings, no effect ---- (Options in the drop down for Statememt of cash flows): Financing, Investing, Operating, No effect. (Options in the drop down for Income Statement): Goodwill, Loss from impaired goodwill, sales, no effect. b. Governmental and legal costs of $920,000 were incurred by Gemini Company on June 30 in obtaining a patent with an estimated economic life of eight years. Amortization is to be for one-half year. (chart attached in screenshot) (Options in the drop down for Assets): Accounts receivable, accumulated depreciation, patents no effect + (Options in the drop down for Assets): Accounts payable, accumulated receivable, cash, no effect. = (Options in the drop down for Liabilities): Accounts payable, capital stock, patents, no effect. + (Options in the drop down for Stock. equity): Capital stock, patents, retained earnings, no effect ------- (Options in the drop down for Statememt of cash flows): Financing, Investing, Operating, No effect. (Options in the drop down for Income Statement): Amortization expense - patents, patents, sales, no effect c. Timber rights on a tract of land were purchased for $1,350,000 on March 6. The stand of timber is estimated at 15,000,000 board feet. During the current year, 3,300,000 board feet of timber were cut and sold. (chart attached in screenshot) (Options in the drop down for Assets): Accounts receivable, accumulated depletion, accumulated depreciation, no effect + (Options in the drop down for Assets): Accounts receivable, accumulated depletion, cash, no effect = (Options in the drop down for Liabilities): Accounts payable, accumulated depletion, capital stock, no effect. + (Options in the drop down for Stockholders equity): Capital stock, depletion expenses, retained earnings, no effect ---------- (Options in the drop down for Statememt of cash flows): Financing, Investing, Operating, No effect. (Options in the drop down for income statement ): Depletion expenses, land, sales, no effect

Hello, please i need help with number 2 (a, b and c). Charts are in the screenshot

Amortization and Depletion Entries

Data related to the acquisition of timber rights and intangible assets of Gemini Company during the current year ended December 31 are as follows:

- On December 31, Gemini Company determined that $3,000,000 of

goodwill was impaired. - Governmental and legal costs of $920,000 were incurred by Gemini Company on June 30 in obtaining a patent with an estimated economic life of eight years. Amortization is to be for one-half year.

- Timber rights on a tract of land were purchased for $1,350,000 on March 6. The stand of timber is estimated at 15,000,000 board feet. During the current year, 3,300,000 board feet of timber were cut and sold.

Instructions:

1. Determine the amount of the amortization, depletion, or impairment for the current year for each of the foregoing items.

| Item | Amortization, Depletion, or Impairment |

| a. | $ (I answered 3000000) |

| b. | $ (I answered 5750) |

| c. | $ (I answered 297000) |

2. Illustrate the effects on the accounts and financial statements of recording the following transactions. For decreases in accounts or outflows of cash, enter your answers as negative numbers. If no account or activity is affected, select "No effect" from the dropdown and leave the corresponding number entry box blank.

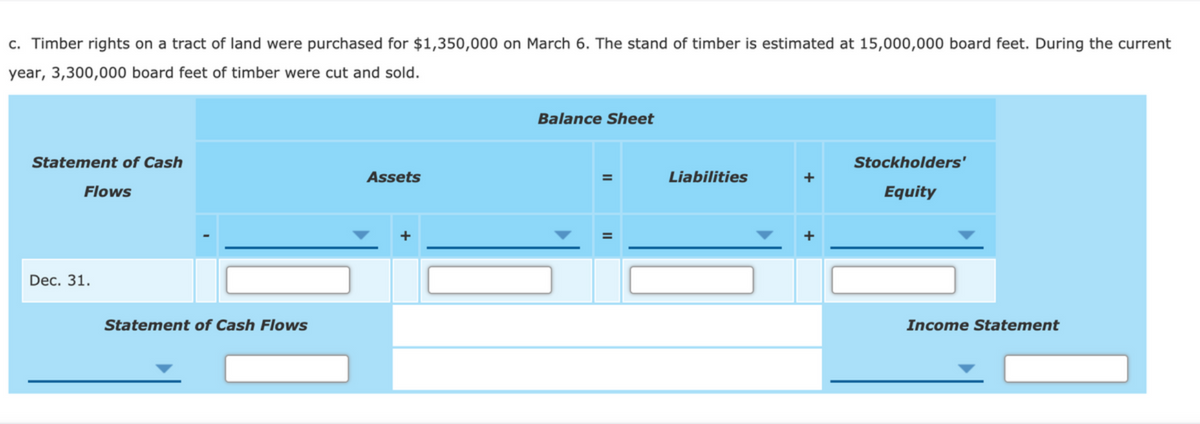

a. On December 31, Gemini Company determined that $3,000,000 of goodwill was impaired.

(chart attached in screenshot)

(Options in the drop down for Assets):

+

(Options in the drop down for Assets): Accounts payable, accumulated depreciation, cash, no effect.

=

(Options in the drop down for Liabilities): Accounts payable, capital stock, goodwill, no effect.

+

(Options in the drop down for Stock. equity): Capital stock, Loss from impaired goodwill,

----

(Options in the drop down for Statememt of cash flows): Financing, Investing, Operating, No effect.

(Options in the drop down for Income Statement): Goodwill, Loss from impaired goodwill, sales, no effect.

b. Governmental and legal costs of $920,000 were incurred by Gemini Company on June 30 in obtaining a patent with an estimated economic life of eight years. Amortization is to be for one-half year.

(chart attached in screenshot)

(Options in the drop down for Assets): Accounts receivable, accumulated depreciation, patents no effect

+

(Options in the drop down for Assets): Accounts payable, accumulated receivable, cash, no effect.

=

(Options in the drop down for Liabilities): Accounts payable, capital stock, patents, no effect.

+

(Options in the drop down for Stock. equity): Capital stock, patents, retained earnings, no effect

-------

(Options in the drop down for Statememt of cash flows): Financing, Investing, Operating, No effect.

(Options in the drop down for Income Statement): Amortization expense - patents, patents, sales, no effect

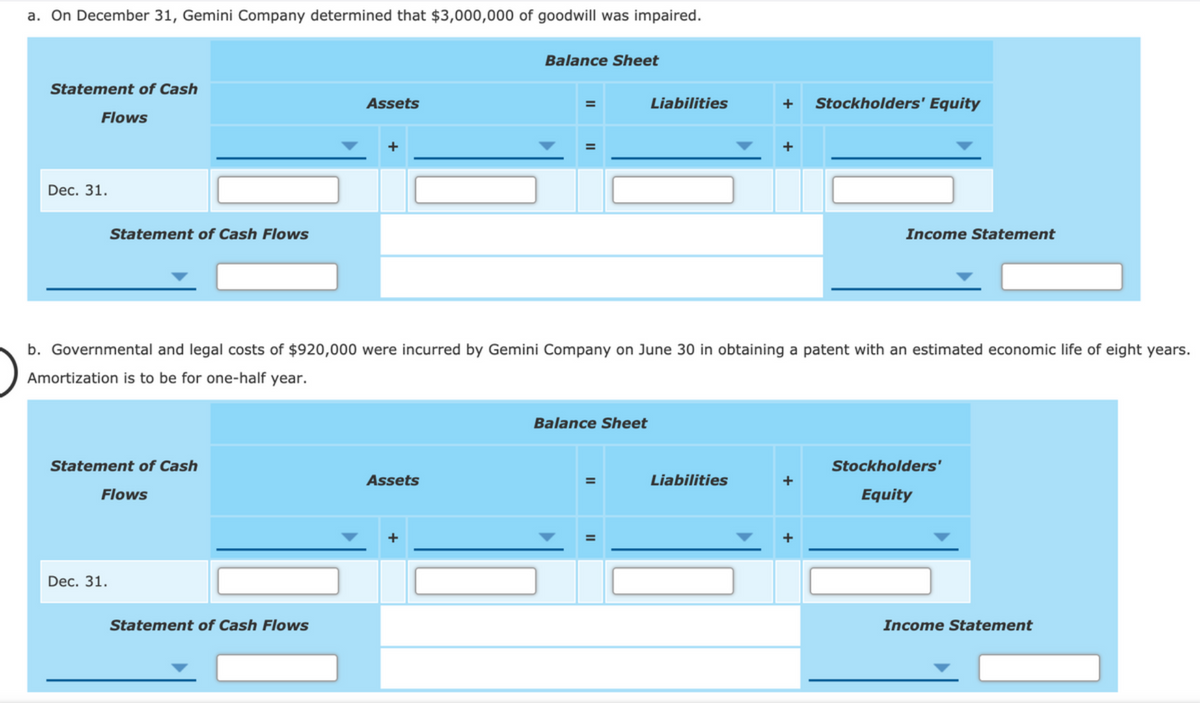

c. Timber rights on a tract of land were purchased for $1,350,000 on March 6. The stand of timber is estimated at 15,000,000 board feet. During the current year, 3,300,000 board feet of timber were cut and sold.

(chart attached in screenshot)

(Options in the drop down for Assets): Accounts receivable, accumulated depletion, accumulated depreciation, no effect

+

(Options in the drop down for Assets): Accounts receivable, accumulated depletion, cash, no effect

=

(Options in the drop down for Liabilities): Accounts payable, accumulated depletion, capital stock, no effect.

+

(Options in the drop down for

----------

(Options in the drop down for Statememt of cash flows): Financing, Investing, Operating, No effect.

(Options in the drop down for income statement ): Depletion expenses, land, sales, no effect

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images