ampbell med January February March Cash receipts $104,000 $110,000 $130,000 Cash payments For inventory 92,000 purchases For S&A expenses 33,000 34,000 wing Campbell Medical had a cash balance of $10,000 on January 1. The company desires to maintain a cash cushion of $9,000. Funds are assumed to be borrowed, in increments of $1,000, and repaid on the last day of each month; the nterest rate is 2 percent per month. Repayments may be made in any amount available. Campbell pays its vendors on he last day of the month also. The company had a monthly $40,000 beginning balance in its line of credit liability ccount from this year's quarterly results. Cash Budget Section 1: Cash Receipts 74,000 87,000 29,000 Cequired Prepare a cash budget. (Round intermediate and final answers to the nearest whole dollar amounts. Any epayments/shortage should be indicated with a minus sign.) January February Total cash available Section 2: Cash Payments Total budgeted disbursements Section 3: Financing Activities March

ampbell med January February March Cash receipts $104,000 $110,000 $130,000 Cash payments For inventory 92,000 purchases For S&A expenses 33,000 34,000 wing Campbell Medical had a cash balance of $10,000 on January 1. The company desires to maintain a cash cushion of $9,000. Funds are assumed to be borrowed, in increments of $1,000, and repaid on the last day of each month; the nterest rate is 2 percent per month. Repayments may be made in any amount available. Campbell pays its vendors on he last day of the month also. The company had a monthly $40,000 beginning balance in its line of credit liability ccount from this year's quarterly results. Cash Budget Section 1: Cash Receipts 74,000 87,000 29,000 Cequired Prepare a cash budget. (Round intermediate and final answers to the nearest whole dollar amounts. Any epayments/shortage should be indicated with a minus sign.) January February Total cash available Section 2: Cash Payments Total budgeted disbursements Section 3: Financing Activities March

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 6PA: Budgeted income statement and balance sheet As a preliminary to requesting budget estimates of...

Related questions

Question

Transcribed Image Text:11

Skipped

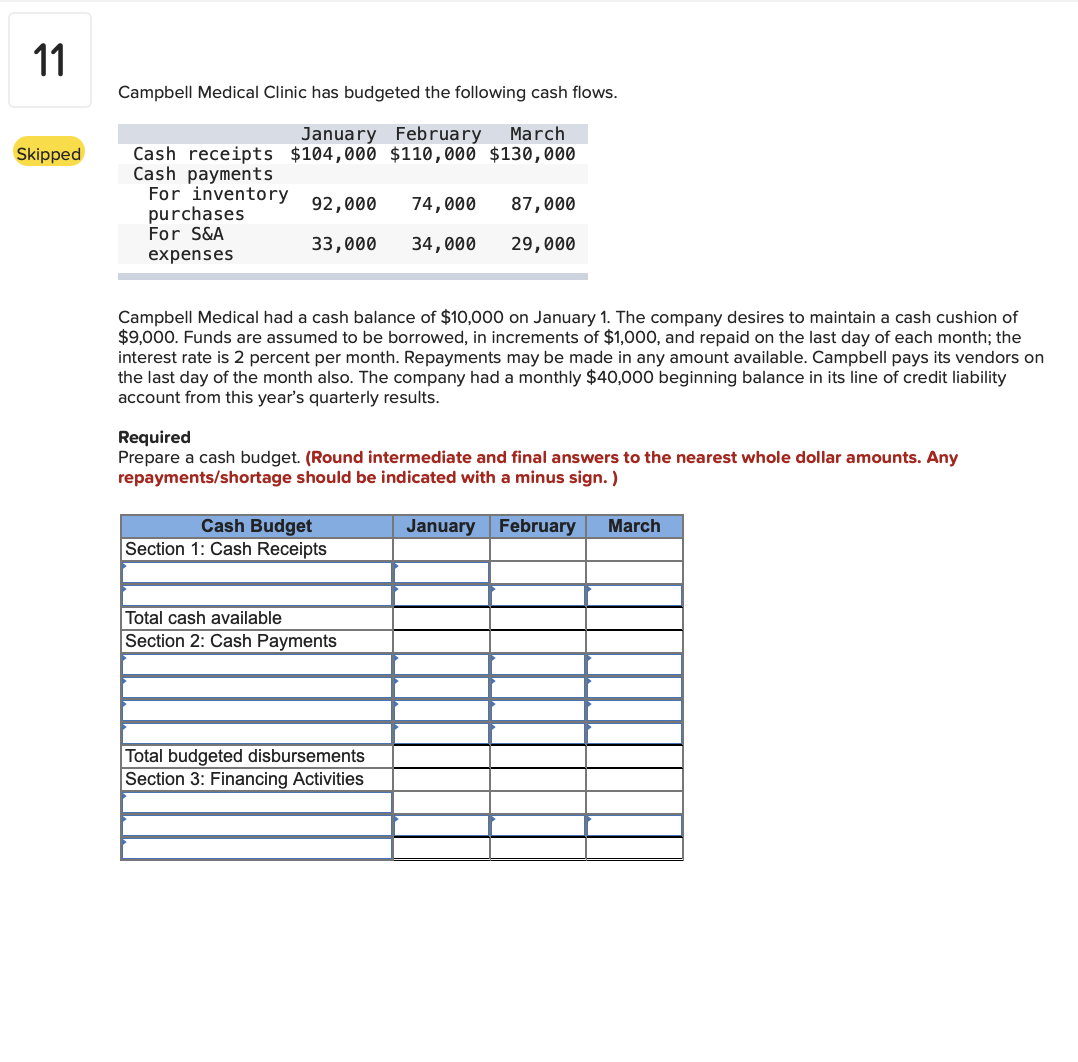

Campbell Medical Clinic has budgeted the following cash flows.

January February March

Cash receipts $104,000 $110,000 $130,000

Cash payments

For inventory

purchases

For S&A

expenses

92,000 74,000

33,000 34,000

Campbell Medical had a cash balance of $10,000 on January 1. The company desires to maintain a cash cushion of

$9,000. Funds are assumed to be borrowed, in increments of $1,000, and repaid on the last day of each month; the

interest rate is 2 percent per month. Repayments may be made in any amount available. Campbell pays its vendors on

the last day of the month also. The company had a monthly $40,000 beginning balance in its line of credit liability

account from this year's quarterly results.

Required

Prepare a cash budget. (Round intermediate and final answers to the nearest whole dollar amounts. Any

repayments/shortage should be indicated with a minus sign.)

January February

Cash Budget

Section 1: Cash Receipts

87,000

29,000

Total cash available

Section 2: Cash Payments

Total budgeted disbursements

Section 3: Financing Activities

March

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning