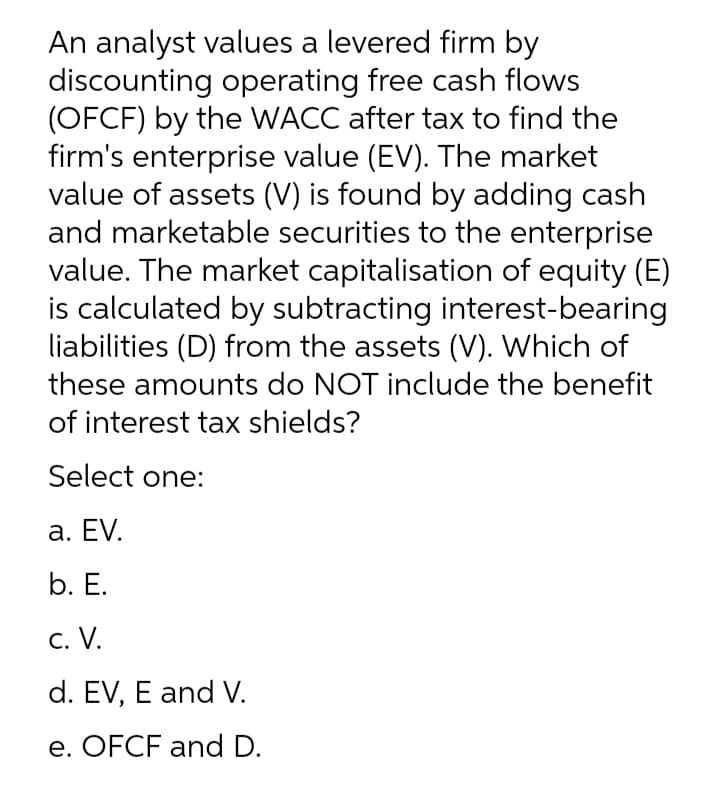

An analyst values a levered firm by discounting operating free cash flows (OFCF) by the WACC after tax to find the firm's enterprise value (EV). The market value of assets (V) is found by adding cash and marketable securities to the enterprise value. The market capitalisation of equity (E) is calculated by subtracting interest-bearing liabilities (D) from the assets (V). Which of

An analyst values a levered firm by discounting operating free cash flows (OFCF) by the WACC after tax to find the firm's enterprise value (EV). The market value of assets (V) is found by adding cash and marketable securities to the enterprise value. The market capitalisation of equity (E) is calculated by subtracting interest-bearing liabilities (D) from the assets (V). Which of

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter5: Risk Analysis

Section: Chapter Questions

Problem 2QE

Related questions

Question

2

Transcribed Image Text:An analyst values a levered firm by

discounting operating free cash flows

(OFCF) by the WACC after tax to find the

firm's enterprise value (EV). The market

value of assets (V) is found by adding cash

and marketable securities to the enterprise

value. The market capitalisation of equity (E)

is calculated by subtracting interest-bearing

liabilities (D) from the assets (V). Which of

these amounts do NOT include the benefit

of interest tax shields?

Select one:

a. EV.

b. Е.

с. V.

d. EV, E and V.

e. OFCF and D.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT