An Australian firm asks the bank for an AS/SFr quote because it received SFr and wants to change it to AS. A bank is quoting the following exchange rates against the US dollar for the Swiss franc and the Australian dollar SFr/USS = 1.4950--60 AS/USS = 1.5245-50 Calculate the cross ask rate for the AS/SFR by identifying the correct formula in the attached formula sheet. One of the following answers will be correct: a. 1.0201 b. 1.0213 c. 0.9813 d. 0.9803

An Australian firm asks the bank for an AS/SFr quote because it received SFr and wants to change it to AS. A bank is quoting the following exchange rates against the US dollar for the Swiss franc and the Australian dollar SFr/USS = 1.4950--60 AS/USS = 1.5245-50 Calculate the cross ask rate for the AS/SFR by identifying the correct formula in the attached formula sheet. One of the following answers will be correct: a. 1.0201 b. 1.0213 c. 0.9813 d. 0.9803

Chapter3: International Financial Markets

Section: Chapter Questions

Problem 2IEE

Related questions

Question

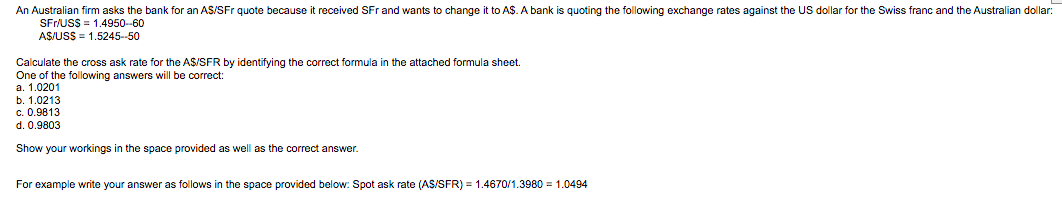

Transcribed Image Text:An Australian firm asks the bank for an AS/SFr quote because it received SFr and wants to change it to A$. A bank is quoting the following exchange rates against the US dollar for the Swiss franc and the Australian dollar:

SFr/US$ = 1.4950-60

AS/USS = 1.5245-50

Calculate the cross ask rate for the A$/SFR by identifying the correct formula in the attached formula sheet.

One of the following answers will be correct:

a. 1.0201

b. 1.0213

c. 0.9813

d. 0.9803

Show your workings in the space provided as well as the correct answer.

For example write your answer as follows in the space provided below: Spot ask rate (AS/SFR) = 1.4670/1.3980 = 1.0494

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage