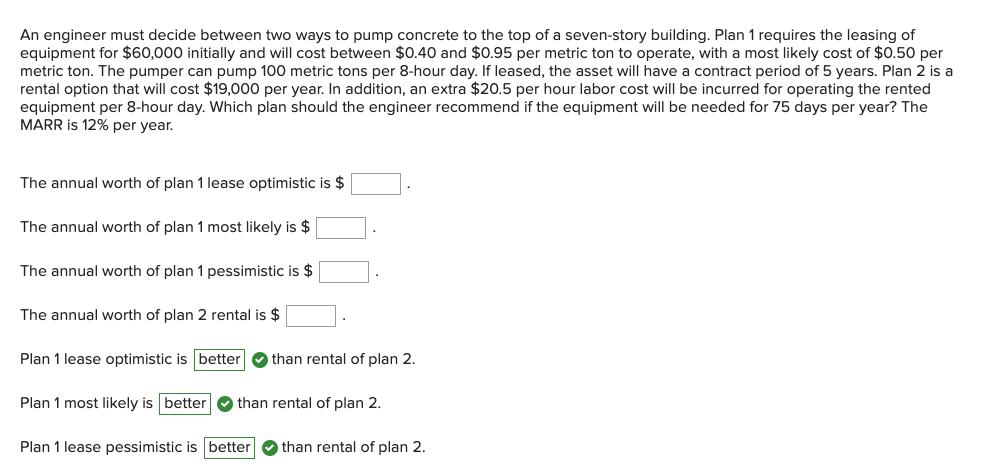

An engineer must decide between two ways to pump concrete to the top of a seven-story building. Plan 1 requires the leasing of equipment for $60,000 initially and will cost between $0.40 and $0.95 per metric ton to operate, with a most likely cost of $0.50 per metric ton. The pumper can pump 100 metric tons per 8-hour day. If leased, the asset will have a contract period of 5 years. Plan 2 is a rental option that will cost $19,000 per year. In addition, an extra $20.5 per hour labor cost will be incurred for operating the rented equipment per 8-hour day. Which plan should the engineer recommend if the equipment will be needed for 75 days per year? The MARR is 12% per year. The annual worth of plan 1 lease optimistic is $ The annual worth of plan 1 most likely is $ The annual worth of plan 1 pessimistic is $ The annual worth of plan 2 rental is $ Plan 1 lease optimistic is better than rental of plan 2. Plan 1 most likely is better than rental of plan 2. Plan 1 lease pessimistic is better than rental of plan 2.

An engineer must decide between two ways to pump concrete to the top of a seven-story building. Plan 1 requires the leasing of equipment for $60,000 initially and will cost between $0.40 and $0.95 per metric ton to operate, with a most likely cost of $0.50 per metric ton. The pumper can pump 100 metric tons per 8-hour day. If leased, the asset will have a contract period of 5 years. Plan 2 is a rental option that will cost $19,000 per year. In addition, an extra $20.5 per hour labor cost will be incurred for operating the rented equipment per 8-hour day. Which plan should the engineer recommend if the equipment will be needed for 75 days per year? The MARR is 12% per year. The annual worth of plan 1 lease optimistic is $ The annual worth of plan 1 most likely is $ The annual worth of plan 1 pessimistic is $ The annual worth of plan 2 rental is $ Plan 1 lease optimistic is better than rental of plan 2. Plan 1 most likely is better than rental of plan 2. Plan 1 lease pessimistic is better than rental of plan 2.

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:An engineer must decide between two ways to pump concrete to the top of a seven-story building. Plan 1 requires the leasing of

equipment for $60,000 initially and will cost between $0.40 and $0.95 per metric ton to operate, with a most likely cost of $0.50 per

metric ton. The pumper can pump 100 metric tons per 8-hour day. If leased, the asset will have a contract period of 5 years. Plan 2 is a

rental option that will cost $19,000 per year. In addition, an extra $20.5 per hour labor cost will be incurred for operating the rented

equipment per 8-hour day. Which plan should the engineer recommend if the equipment will be needed for 75 days per year? The

MARR is 12% per year.

The annual worth of plan 1 lease optimistic is $

The annual worth of plan 1 most likely is $

The annual worth of plan 1 pessimistic is $

The annual worth of plan 2 rental is $

Plan 1 lease optimistic is better than rental of plan 2.

Plan 1 most likely is better than rental of plan 2.

Plan 1 lease pessimistic is better than rental of plan 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning