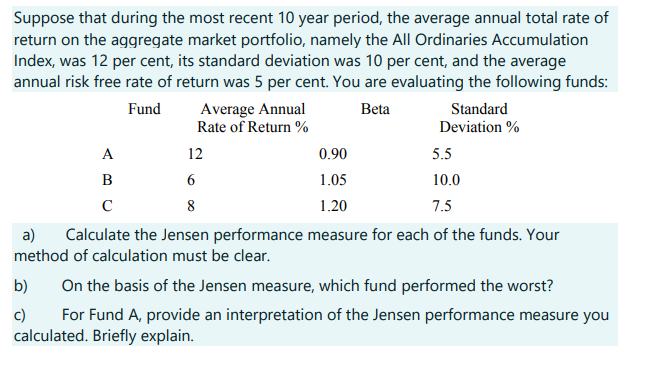

Suppose that during the most recent 10 year period, the average annual total rate of return on the aggregate market portfolio, namely the All Ordinaries Accumulation Index, was 12 per cent, its standard deviation was 10 per cent, and the average annual risk free rate of return was 5 per cent. You are evaluating the following funds: Fund Beta A B C b) c) Average Annual Rate of Return% 12 6 8 0.90 1.05 1.20 Standard Deviation % 5.5 10.0 7.5 a) Calculate the Jensen performance measure for each of the funds. Your method of calculation must be clear. On the basis of the Jensen measure, which fund performed the worst? For Fund A, provide an interpretation of the Jensen performance measure you calculated. Briefly explain.

Suppose that during the most recent 10 year period, the average annual total rate of return on the aggregate market portfolio, namely the All Ordinaries Accumulation Index, was 12 per cent, its standard deviation was 10 per cent, and the average annual risk free rate of return was 5 per cent. You are evaluating the following funds: Fund Beta A B C b) c) Average Annual Rate of Return% 12 6 8 0.90 1.05 1.20 Standard Deviation % 5.5 10.0 7.5 a) Calculate the Jensen performance measure for each of the funds. Your method of calculation must be clear. On the basis of the Jensen measure, which fund performed the worst? For Fund A, provide an interpretation of the Jensen performance measure you calculated. Briefly explain.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:Suppose that during the most recent 10 year period, the average annual total rate of

return on the aggregate market portfolio, namely the All Ordinaries Accumulation

Index, was 12 per cent, its standard deviation was 10 per cent, and the average

annual risk free rate of return was 5 per cent. You are evaluating the following funds:

Fund

Beta

A

B

с

Average Annual

Rate of Return%

12

6

8

b)

c)

0.90

1.05

1.20

Standard

Deviation %

5.5

10.0

7.5

a) Calculate the Jensen performance measure for each of the funds. Your

method of calculation must be clear.

On the basis of the Jensen measure, which fund performed the worst?

For Fund A, provide an interpretation of the Jensen performance measure you

calculated. Briefly explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning