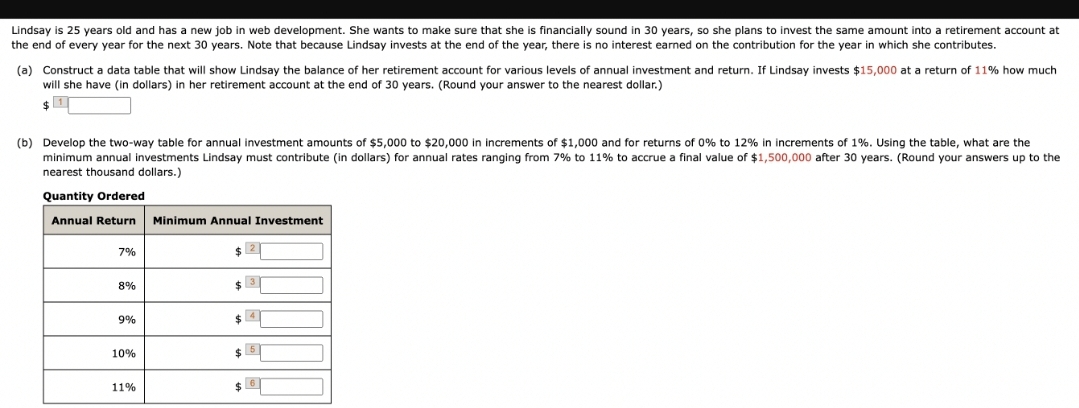

Lindsay is 25 years old and has a new job in web development. She wants to make sure that she is financially sound in 30 years, so she plans to invest the same amount into a retirement account at the end of every year for the next 30 years. Note that because Lindsay invests at the end of the year, there is no interest earned on the contribution for the year in which she contributes. (a) Construct a data table that will show Lindsay the balance of her retirement account for various levels of annual investment and return. If Lindsay invests $15,000 at a return of 11% how much will she have (in dollars) in her retirement account at the end of 30 years. (Round your answer to the nearest dollar.) $ (b) Develop the two-way table for annual investment amounts of $5,000 to $20,000 in increments of $1,000 and for returns of 0% to 12% in increments of 1%. Using the table, what are the minimum annual investments Lindsay must contribute (in dollars) for annual rates ranging from 7% to 11% to accrue a final value of $1,500,000 after 30 years. (Round your answers up to the nearest thousand dollars.) Quantity Ordered Annual Return Minimum Annual Investment 7% 8% 9% 10% 11% $2 $ 5

Lindsay is 25 years old and has a new job in web development. She wants to make sure that she is financially sound in 30 years, so she plans to invest the same amount into a retirement account at the end of every year for the next 30 years. Note that because Lindsay invests at the end of the year, there is no interest earned on the contribution for the year in which she contributes. (a) Construct a data table that will show Lindsay the balance of her retirement account for various levels of annual investment and return. If Lindsay invests $15,000 at a return of 11% how much will she have (in dollars) in her retirement account at the end of 30 years. (Round your answer to the nearest dollar.) $ (b) Develop the two-way table for annual investment amounts of $5,000 to $20,000 in increments of $1,000 and for returns of 0% to 12% in increments of 1%. Using the table, what are the minimum annual investments Lindsay must contribute (in dollars) for annual rates ranging from 7% to 11% to accrue a final value of $1,500,000 after 30 years. (Round your answers up to the nearest thousand dollars.) Quantity Ordered Annual Return Minimum Annual Investment 7% 8% 9% 10% 11% $2 $ 5

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 2FPE

Related questions

Question

Bb.6.

Transcribed Image Text:Lindsay is 25 years old and has a new job in web development. She wants to make sure that she is financially sound in 30 years, so she plans to invest the same amount into a retirement account at

the end of every year for the next 30 years. Note that because Lindsay invests at the end of the year, there is no interest earned on the contribution for the year in which she contributes.

(a) Construct a data table that will show Lindsay the balance of her retirement account for various levels of annual investment and return. If Lindsay invests $15,000 at a return of 11% how much.

will she have (in dollars) in her retirement account at the end of 30 years. (Round your answer to the nearest dollar.)

$

(b) Develop the two-way table for annual investment amounts of $5,000 to $20,000 in increments of $1,000 and for returns of 0% to 12% in increments of 1%. Using the table, what are the

minimum annual investments Lindsay must contribute (in dollars) for annual rates ranging from 7% to 11% to accrue a final value of $1,500,000 after 30 years. (Round your answers up to the

nearest thousand dollars.)

Quantity Ordered

Annual Return Minimum Annual Investment

7%

8%

9%

10%

11%

$2

$3

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning