An entity reported the following assets and liabilities at year end: Amount Property Inventory 7M Plant and Equipment 4M Liabilities 4M Tax base Accounts receivable 3M 5.5M Carrying 10M 5M 2.5M 2.4M 6M The entity had made a provision for inventory obsolescense of 1.5M. Further, an impairment loss against accounts receivable of 600,000 has been made. the tax is 30% What amount should be reported as deferred tax liability?

An entity reported the following assets and liabilities at year end: Amount Property Inventory 7M Plant and Equipment 4M Liabilities 4M Tax base Accounts receivable 3M 5.5M Carrying 10M 5M 2.5M 2.4M 6M The entity had made a provision for inventory obsolescense of 1.5M. Further, an impairment loss against accounts receivable of 600,000 has been made. the tax is 30% What amount should be reported as deferred tax liability?

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Fixed Assets And Intangible Assets

Section: Chapter Questions

Problem 10.26EX

Related questions

Question

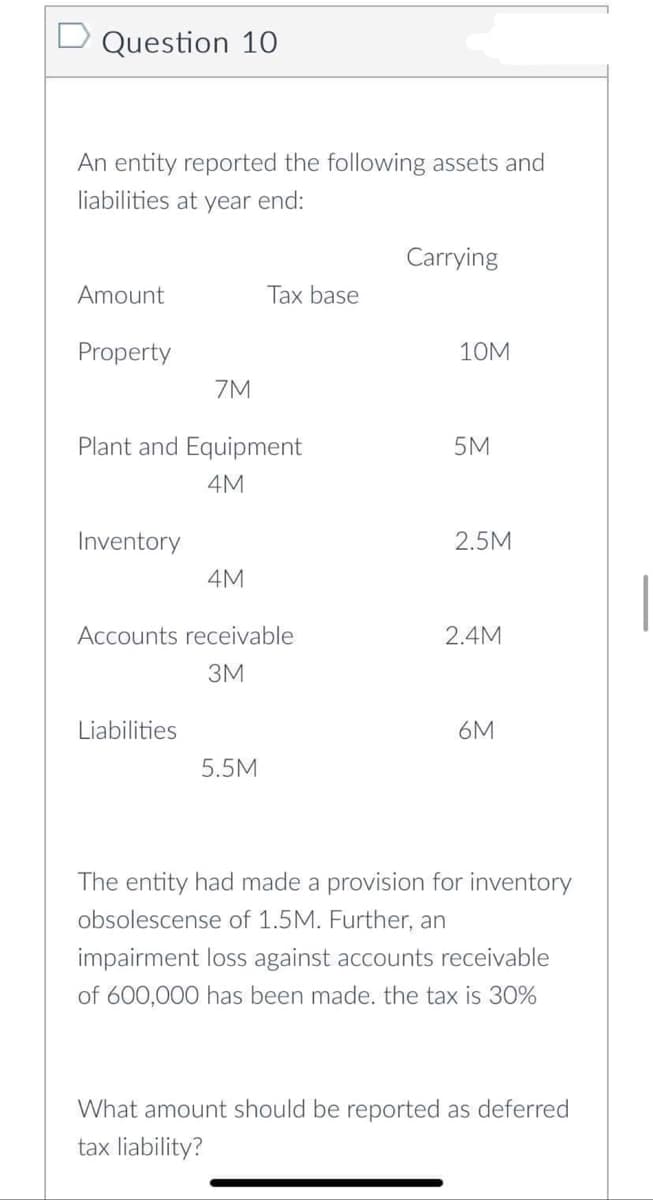

Transcribed Image Text:D Question 10

An entity reported the following assets and

liabilities at year end:

Amount

Property

Inventory

7M

Plant and Equipment

4M

Liabilities

4M

Tax base

Accounts receivable

3M

5.5M

Carrying

10M

5M

2.5M

2.4M

6M

The entity had made a provision for inventory

obsolescense of 1.5M. Further, an

impairment loss against accounts receivable

of 600,000 has been made. the tax is 30%

What amount should be reported as deferred

tax liability?

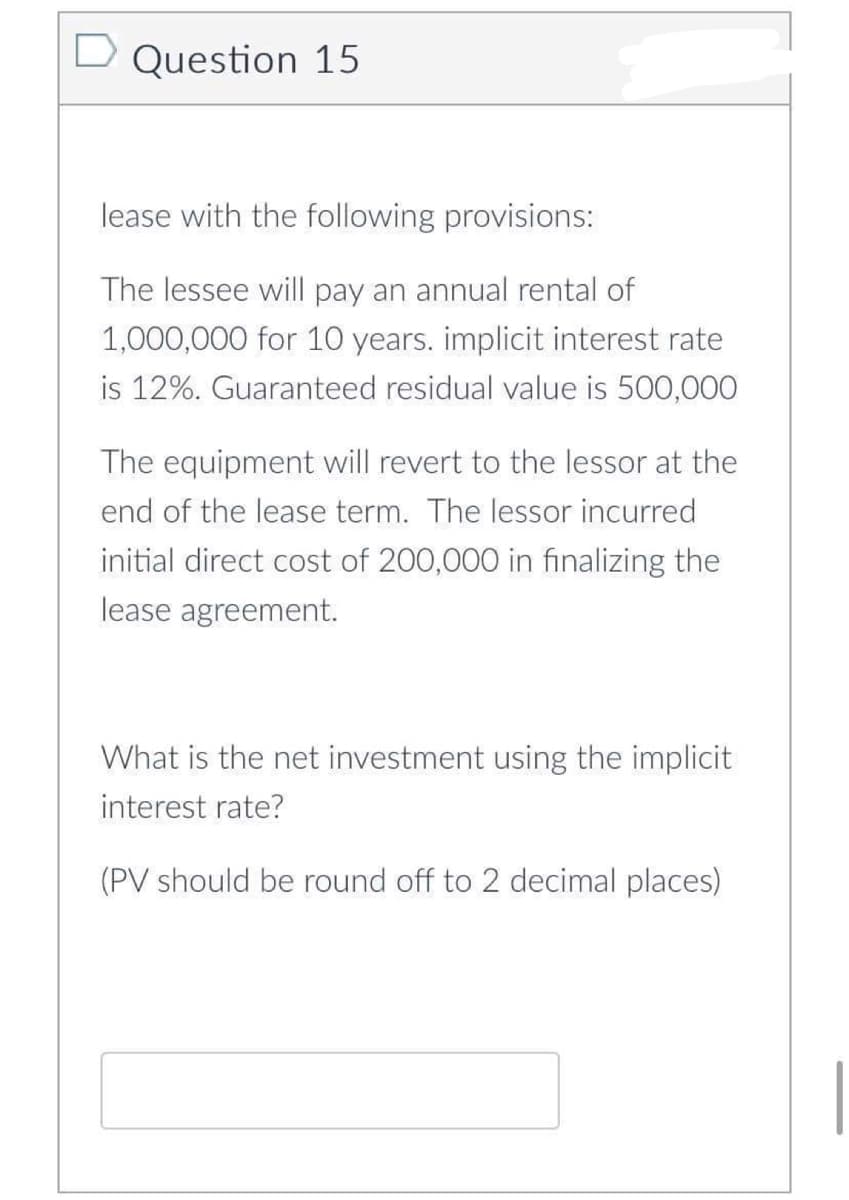

Transcribed Image Text:D Question 15

lease with the following provisions:

The lessee will pay an annual rental of

1,000,000 for 10 years. implicit interest rate

is 12%. Guaranteed residual value is 500,000

The equipment will revert to the lessor at the

end of the lease term. The lessor incurred

initial direct cost of 200,000 in finalizing the

lease agreement.

What is the net investment using the implicit

interest rate?

(PV should be round off to 2 decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College