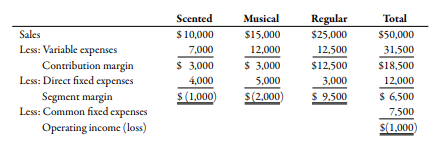

Scented Musical Regular Total Sales $10,000 $15,000 $25,000 $50,000 Less: Variable expenses 7,000 12,500 12,000 31,500 Contribution margin $ 3,000 $ 3,000 $12,500 $18,500 Less: Direct fixed expenses 4,000 3,000 $ 9,500 5,000 12,000 $ (1,000) $ 6,500 Segment margin Less: Common fixed expenses S(2,000) 7,500 Operating income (loss) S(1,000)

FunTime Company produces three lines of greeting cards: scented, musical, and regular.

Segmented income statements for the past year are as follows:

Kathy Bunker, president of FunTime, is concerned about the financial performance of her firm

and is seriously considering dropping both the scented and musical product lines. However,

before making a final decision, she consults Jim Dorn, FunTime’s vice president of marketing.

Required:

1. CONCEPTUAL CONNECTION Jim believes that by increasing advertising by $1,000

($250 for the scented line and $750 for the musical line), sales of those two lines would

increase by 30%. If you were Kathy, how would you react to this information?

2. CONCEPTUAL CONNECTION Jim warns Kathy that eliminating the scented and musical

lines would lower the sales of the regular line by 20%. Given this information, would it be

profitable to eliminate the scented and musical lines?

3. CONCEPTUAL CONNECTION Suppose that eliminating either line reduces sales of the

regular cards by 10%. Would a combination of increased advertising (the option described

in Requirement 1) and eliminating one of the lines be beneficial? Identify the best

combination for the firm.

Step by step

Solved in 2 steps