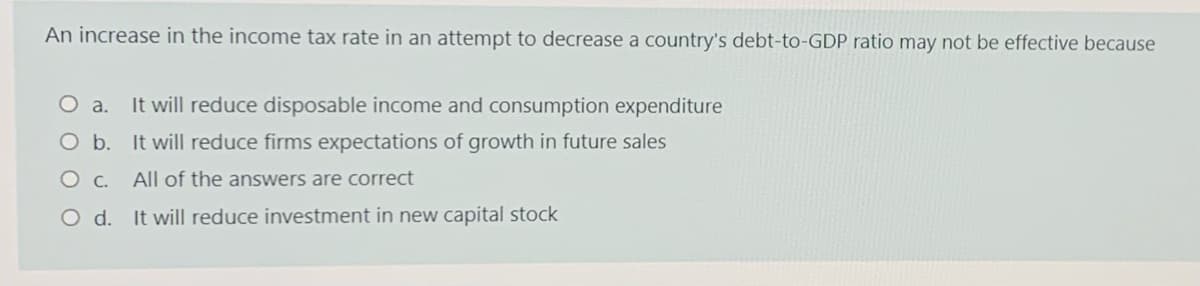

An increase in the income tax rate in an attempt to decrease a country's debt-to-GDP ratio may not be effective because O a. It will reduce disposable income and consumption expenditure Ob. It will reduce firms expectations of growth in future sales All of the answers are correct O d. It will reduce investment in new capital stock

Q: A price floor for commodity crops would always make farmers better off. True or false?

A: "A price floor is referred to as a limit on how low price can be charged for a commodity."

Q: Suppose that the University of Alabama and Clemson are making spending decisions for theupcoming yea...

A: Meaning of Decision Theory under Nash Equilibrium: The term decision theory refers to the situatio...

Q: Investors may view the euro area with suspicion because one of its member's public debt increases dr...

A: The outflow or the inflow of a currency depends upon its relative strength in the international mark...

Q: Suppose that a market is described by the following supply and demand equations: Qs = 2P, Qd = 300 P...

A:

Q: Which of the following is a producer good?

A: To find : Which is producer good

Q: A decrease in the German demand for American-made goods will Group of answer choices all...

A: Correct answer is "decrease the demand for dollars in the foreign exchange market."

Q: hat is a basket of goods? Explain how it is selected.

A: The "shopping baskets" of items utilized in aggregating the various measures of consumer price infla...

Q: 22. Suppose that Dent Carr's long-run total cost of repairing s cars per week is c(s):=3s2'+12. If t...

A: Long run total cost of repairing s cars per week is c(s) = 3s2 + 12 c(s) = 3s2 + 12 Differentiate c ...

Q: Distinguish the difference between nominal GDP and real GDP

A: GDP (gross domestic product) is the total value of goods & services manufactured in an economy d...

Q: The following graph represents the demand and supply for pinckneys (an imaginary product). The black...

A: Equilibrium in the market occurs at the intersection of demand and supply curves, where quantity dem...

Q: A manufacturing firm can sell x number of units of each product produced per month at a price of (24...

A: TR(TOTAL revenue) is the product of p(price) and x(quantity). TC(TOTAL cost) is the sum of fixed and...

Q: Ceteris Paribus means

A: To find : What is ceteris paribus

Q: Explain how our economies exist within the environment and how economies rely on ecosystem services

A: From climate change and biodiversity loss to changes in hydrological and nutrient cycles and natural...

Q: Engineering Economics A man deposits P58,454 each year into his savings account that pays 2% nomina...

A:

Q: Given the Input-output matrix Industry Oil Final Demand Industry Health 240 120 120 120 Housing 144 ...

A: Following are the demand and input-output combinations which are provided -

Q: Suppose that there is a large price increase for all types of salad dressing. What would you expect ...

A: Cross price elasticity measures the percentage change in quantity demanded of one good due to change...

Q: Note : please answer both the question. I will give instant upvote. For the "No, markets fail ...

A: Answer: (1). A negative demand shock leads to a decrease in the aggregate demand in the economy. As...

Q: Complete the sentence by choosing the correct response from the drop-down list. Suppose John deposit...

A: Bank in the economy receives cash deposits of 100. These are demand deposits of the people. The depo...

Q: irm's cost minimization problem is most similar to inding the consumer's final bundle, in the contex...

A: Cost minimization is an essential rule utilized by makers to figure out what blend of work and capit...

Q: Consider a firm that is indifferent between shutting down and continuing to operate in the short run...

A: Given that, Market price = $50 Total cost = $600 Average fixed cost = $10 We have to find revenue of...

Q: Each country has its own customs and traditions that determine business practices and influences how...

A: All societies have their own customs and restrictions. Advertisers really must find out about these ...

Q: he market demand for a product is Q = 2500 – 400P - 0.11, where P i ne price per unit of a product, ...

A: The marginal revenue refers to the change in the total revenue one additional unit of output is sold...

Q: Katherine advertises to sell cookies for $4 a dozen. She sells 50 dozen, and decides that she can ch...

A: Answer -

Q: What total payment made today would place the payee in the same financial position as the scheduled ...

A: Given, Interest rate = 4.25% Time = 9month Payment scheduled today = 870 Future value = 1160

Q: Describe aspects of environmental economics and ecological economics

A: Economics is a social It looks into how individuals, businesses, governments, and countries decide h...

Q: Unemployment of labour means that

A: To find : What is unemployment of labour

Q: Part A- You are a manager of an advertising company. The company is running short of funds, so you d...

A: The process of combining multiple material and immaterial inputs (plans, know-how) to generate a con...

Q: Circular flow of production process

A: Introduction Circular flow used to show how the economic activity works in an economy. There are two...

Q: The table above gives hypothetical figures for the U.S. balance of payments. The country’s current-...

A: Current account records transaction of import and export of goods and services, unilateral transfers...

Q: 1. The following model is a simplified version of the multiple regression model used by Biddle and H...

A:

Q: If a competitive firm finds that its average variable cost is decreasing at its current profit maxim...

A: There are many buyers and sellers in the perfectly competitive market. Single firm can not influence...

Q: CIBC Bank publishes the annual report every year on the 2nd of April. the Bank is at hearing to the ...

A: The company has to publish its annual financial reports every year as per regulatory requirements ...

Q: Imagine that you lease an apartment for $900 a month. The market price for that apartment has increa...

A: Equilibrium Price Equilibrium price refers to a price level at which market demand is equal to the m...

Q: Which of the following were effects of the consolidation of power in Japan under the Tokugawa dynast...

A: Basics:- Following were the effects of the consolidation of power in Japan under the Tokugawa dynast...

Q: MC MB 25 50 75 100 Trucks (per day) i. What is the marginal benefit and marginal cost of producing 2...

A: An optimal level of production occurs at MB = MC. MB decrease as output increases MC increases as ou...

Q: Question 2 Which of the following predictions is not made by the supply and demand model?' a) If the...

A: Note:- “Since you have asked multiple question, we will solve the first question for you. If you wan...

Q: Economic profit is

A: To find : What is economic profit

Q: Can you please explain step by step Practice problem #2 Tania has utility U = 20/Cī + c2 & income m1...

A: Above questions pertains to intertemporal choice problem in which a consumer optimizes its output be...

Q: Describe one type of negative market externality with a forest as it relates to climate change. Expl...

A: a) Environmental or forest related externalities, such as natural resources or public health, are ex...

Q: A household of a wife and husband get utility from hours spent watching HBO (Z). To produce one unit...

A: Given,

Q: Price £/unit E D3 D1 D2 Quantity Figure 4 Supply and demand curves for a normal good Figure 4 shows ...

A: A major natural disaster disrupts the production of goods leads to a decrease in the supply of goods...

Q: Question 39 Consider the table below. The addition of worker number when the firm first experiences ...

A: Change in the total product when one additional unit of input is used, is called the marginal produc...

Q: Small “Mom and Pop firms,” like inner city grocery stores, sometimes exist even though they do not e...

A: Economic profit is the difference between the total revenue received by the firm and its total impli...

Q: a) Compute the nominal GDP in 2018. b) Compute the real GDP in 2018? c) Compute the nominal GDP in...

A: Given 2018 as the base year Nominal GDP = Current Year price * Current year quantity Real GDP = Pri...

Q: Discuss some of the ethical issues that may arise in evaluation research.

A: The ethical issues that may arise in evaluation research include confidentiality, anonymity, involun...

Q: The low rate of inflation in the 1990s is probably due to Multiple Choice the fact that businesses h...

A: In an economy, when talking about low inflation rate, it is the situation when economy is having eno...

Q: In the ADT/ASI model, the equilibrium inflation rate is O a. The target inflation rate O b. The rate...

A: The ADπ/ASπ model refers to the representation of the goods market through mathematical and graphica...

Q: A. Consider that you're the manager of a competitive firm, KKL INC. with the following short run cos...

A:

Q: Over the years, you have accumulated a good amount of money in your 401k, traditional IRA and Roth I...

A: The correct ranking from best to worst is Roth IRA, Traditional IRA and 401k.

Q: Analytical problems 12 Faustian health economics. Consider Figure 11.10, which shows the locus of fe...

A: Dear Student, as you have posted multiple sub-parts in a question but according to our policies and ...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Aa3 a. Private saving is : $ ___Trillion b. Investment Spending is : $___Trillion c. Transfer Payments are: $___Trillion d. The government budget balance is : $ ___Trillion and as a result the government budget is in ___( deficit or surplus) Please show your work. (thumbs down for wrong answers)When the U.S government runs a Deficit, the savings curve in the market for loanable funds shifts to the____ ___ investment rates and _____domestic investment net capital outfiow.Multiple ChoiceO. right increasing; increasing O. left increasing; decreasing O. right decreasing; increasing O. left decreasing; increasingSuppose the government borrows $20 billion more next year than this year. a. Use a supply-and-demand diagram to analyse this policy. Does the interest rate rise or fall? b. What happens to investment? To private saving? To public saving? To national saving? Compare the size of the changes to the $20 billion of extra government borrowing. c. Suppose households believe that greater government borrowing today implies higher taxes to pay off the government debt in the future. What does this belief do to private saving and the supply of loanable funds today? Does it increase or decrease the effects that you discussed in parts (a) and (b)?

- Based on the table and graph, explain how the country's rate of GPD growth has compared to its debt growth over time and what the implication is for the debt/gdp rati(a) Assume that Gross Domestic Product (GDP)/Total output (Y) is 6,000. Consumption (C) is given by the equation C = 600 + 0.6(Y – T) where T is the tax. Investment (I) is given by the equation I = 2,000 – 100r, where r is the real rate of interest, in percent. Taxes (T) are 500, and government spending (G) is also 500. What are the equilibrium values of C, I, and r?a) Why can't the government run a budget deficit in a one- period macroeconomic model? b) Why are government transfer payments not included in (expenditure-based) GDP?

- National Income: Where It Comes From and Where It Goes — End of Chapter Problem If consumption depends on the interest rate, saving will also depend on it. In particular, the higher the interest rate, the greater will be the return to saving. Hence, the supply of loanable funds will be represented by an upward-sloping, rather than a vertical, curve. National saving is the sum of public saving and private saving. Investment in this analysis is private investment. It does not include public investment.Assume and economy is in recession and the government is considering using fiscal stimulus measures to boost spending , production and employment. a)Explain how "crowding out" can harm productivity growth b) explain how the crowding out problem associated with increase government spending can be avoided. identify any additional policy needed.Which of the following policy actions wouldunambiguously reduce the supply of loanable fundsand crowd out investment?a. an increase in taxes and a decrease ingovernment spendingb. a decrease in taxes together with an increase ingovernment spendingc. an increase in both taxes and governmentspendingd. a decrease in both taxes and government spending

- Is is possible for federal investment to have a negative rate of return? Yes, if the spending results in a strong crowding-out effect or if state and local governments substitute towards federal investment by reducing stateand local investment. Either would potentially reduce future productivity and output (GDP), resulting in a negative return. Yes, if the spending results in a weak crowding-out effect or if state and local investments complement the increase in federal investment by. Either would potentially reduce future productivity and output (GDP) and hence result in a negative return. No. At worst, federal investment can have no future return as the expenditure offered some form of service (ex. jobs training) or useful infrastructure (ex. highways). No. If in the future there were a negative return, the federal government would increase expenditures again to offset it.Assuming a tax rate of 40 percent, compute thebefore-tax real interest rate and the after-tax realinterest rate for each of the following cases.a. The nominal interest rate is 10 percent, and theinflation rate is 5 percent.b. The nominal interest rate is 6 percent, and theinflation rate is 2 percent.c. The nominal interest rate is 4 percent, and theinflation rate is 1 percent.Public saving is positive when: a. there is a government budget deficit b. after-tax income of households and businesses is greater than consumption expenditures c.there is a government budget surplus d. the government's budget is balanced