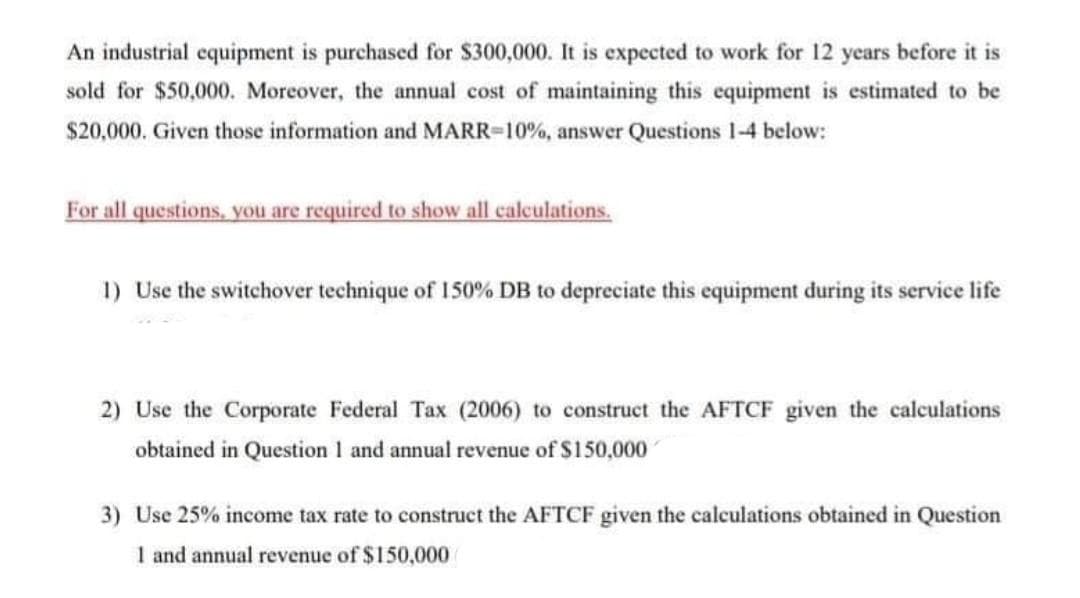

An industrial equipment is purchased for $300,000. It is expected to work for 12 years before it is sold for $50,000. Moreover, the annual cost of maintaining this equipment is estimated to be $20,000. Given those information and MARR-10%, answer Questions 1-4 below:

Q: A company is considering purchasing a new piece of machinery at a cost $50,000. It is expected to…

A: Economic Value Added Economic value added is referred to as the economic profit which is calculated…

Q: A company is planning to purchase a machine that will cost $54,000 with a six-year life and no…

A: Payback period refers to the time period that is required to recover the initial cost. With the help…

Q: a computer is purchased for P35,000, it is expected to be used for six years and will be sold for…

A: Purchase cost = P 35000 Annual cost = P 10,000 Salvage value = P 5000 Period = 6 Years Rate of…

Q: A manufacturing company leases a building for $100,000 per year for its manufacturing facilities. In…

A: Annual profit: It can be defined as the amount of profit earned by a company during an accounting…

Q: A company is considering the purchase of a capital asset for $100,000. Installation charges needed…

A: a) workings:'

Q: Adams Company paid $92.000 to purchase a machine on January 1, Year 1. During Year 3, a…

A: An avoidable cost is one that will not be spent if a specific activity is not carried out. Unlike…

Q: Majestic Aircraft Company (MAC) is considering purchasing new equipment with a purchase price of…

A: First cost = Initial outlay = all cash costs to make the asset up and running First cost =…

Q: A machine cost ₱100,000 with salvage value of ₱10,000 after 10 years. If the annual maintenance and…

A: A machine will be profitable if Net Present value (NPV) of machine is positive. NPV = Present value…

Q: A printing machine is bought at P 1.3 million and is estimated to have a salvage value of P100,000…

A:

Q: A company expects the cost of equipment maintenance to be $5,000 in year one, $5,500 in year two,…

A: Cost in year 1 = $ 5000 Cost in year 2 = $ 5500 Annual increase in cost = $ 500 Period = 10 Years…

Q: A Construction Company has just purchased a fleet of five truck to be used for delivery in a…

A: The present value is the present worth of the amount that will be paid or received at future.

Q: An equipment has a first cost of 500,000 PHP and the cost of installation is 30,000 PHP. At the end…

A: Depreciation means the loss in value of assets because of usage of assets , passage of time or…

Q: meter, with both components assumed to be paid at year-end. Actual use is expected to be 1,500 hours…

A: The net advantage lost by rejecting a different course of action is known as opportunity cost. Its…

Q: An injection molding machine can be purchased and installed for $90,000. It is in the seven-year GDS…

A: Hello. Since your question has multiple sub-parts, we will solve the first three sub-parts for you.…

Q: A hydraulic lift is purchased for a warehouse for $60,000. This lift is expected to generate $7000…

A: Rate of Return on Investment = Net income/Total Investment Depreciation Expense = Cost of the…

Q: Dairy queen corporation has been awarded a contract to supply a key replacement part for its ice…

A: Required Return = 16% N = 8 years Initial Investment = Equipment Cost + Working Capital Needed…

Q: company is considering the purchase of a capital asset for $120,000. Installation charges needed to…

A: Cost of capital assets =120000 Salvage value =25000 Life of assets =6 Straight line depreciation…

Q: A construction company has purchased a motor for P20,000 and a generator for P8,000 to produce its…

A: Depreciation is charged on fixed tangible asset to show the asset on true and accurate value. It is…

Q: At i = 15% per year, a machine has a first cost of $15,000 and estimated operating costs and…

A:

Q: Coast-to-Coast Inc. is considering the purchase of an additional delivery vehicle for $30,000 on…

A: Net present value=Present value of annual net cash flows-Investment

Q: A firm can purchase a centrifugal separator (5-year MACRS property) for$17,000. The estimated…

A: Given Data: Investment ($) 17000 Useful life 6 Salvage value($) 3000 Tax rate 23% MARR 12%…

Q: Coast-to-Coast Inc. is considering the purchase of an additional delivery vehicle for $70,000…

A: The evaluations of different projects are done by the company. Before adding any investment, the…

Q: Equipment is purchased for P600,000 and is expected to be sold after ten years for P100,000. The…

A: According to the time value concept, a specific sum of money is worth more than the same sum of…

Q: The Rosco company is purchasing a new machine that will increase revenue for 8 years. The purchase…

A: NPV(Net Present Value) = Present Value of Cash Inflow - Present Value of Cash Outlows

Q: A contracting company purchased a new equipment at a cost of $200,000. The delivery and installation…

A: A non-current asset is a fixed asset that is expected to be in use for a long-term period, i.e.,…

Q: An injection molding system has a first cost of $175,000 and an annual operating cost of $95,000 in…

A: ESL means maximum life of the machinery up to which machine can provides positive cashflows. ESL is…

Q: The project to convert the infrastructure into an office complex that will generate annual revenues…

A: Cash flow considers only the cash dealt items. Since depreciation is a non-cash item, so the impact…

Q: To maintain its newly acquired equipment, the company needs 40,000.00 per year for the first 5 years…

A: Annual cost for first 5 years = 40,000 Annual cost for next 5 years = 60,000 Additional cot at the…

Q: The Rosco company is purchasing a new machine that will increase revenue for 8 years. The purchase…

A: Solution- Given that Purchase price=$2,45,900 Working capital=$55,000 Service in 3rd and 6th year…

Q: A construction company has purchased a motor for P20,000 and a generator for P8,000 to produce its…

A: Annual cost of operation = Depreciation expense + maintenance cost + operation costs

Q: A company purchased a quality control system for $46,004 which requires $8,221 per year maintenance…

A: The present value is the value of the sum received at time 0 or the current period. It is the value…

Q: An injection molding machine can be purchased and installed for $90,000. It is in the seven-year GDS…

A: Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: A piece of research equipment is expected to require an investment of $18,000, with $6,000 committed…

A: Capital recovery means recovery of initial investment amount put into any project. It is in a way…

Q: Consider a machine that costs $1000 to purchase. The machine creates an annual operating expense of…

A: Correct answer is option (d) 9 years.

Q: A 2-ton hydraulic press is needed to add to production. This equipment has an initial purchase and…

A: Initial Purchase and Installation Cost 190000 Yearly Operation Cost 1000…

Q: A Funiture Factory is considering buying a new automated planing machine for a cost of $80,250. This…

A: Time cashflows 0(now) = -$80250-$2800= -$83050 1 0 2 0 3 -$1000 4 -$3000

Q: The Highway Department expects the cost of maintenance for a piece of heavy construction equipment…

A: The formula used as follows: Present worth=FV1+rn

Q: The management of XYZ Beverage Company is considering to purchase a new equipment to increase the…

A: Payback period means the period when we get back our investment amount. Formula for payback period…

Q: The table given below lists the relevant cost items for a specific system purchase. The operating…

A: Answer a) Basic cost =$160000+$15000+$15000=$190000Salvage value =$160000 x 25%=$40000Depreciation…

Q: A company expects the cost of equipment maintenance to be $5,000 in year one, $5,500 in year two,…

A: Maintenance cost in year 1 = $ 5000 Maintenance cost in year 2 = $ 5500 Annual increase in cost = $…

Q: Gentry Machines. Inc .. has just received a special job order from one of itsclients. The following…

A: The question is based on the concept of calculation of cash flows from a new project with…

Q: A manufacturing plant manager has purchased a new bologna slicing machine for $24,500. The new…

A: Present value of annuity is the current value of the future payments that are calculated using the…

Q: An injection molding machine can be purchased and installed for $90,000. It is in the seven-year GDS…

A: Purchase and installment cost=$90000 MARR= 15%/year Income tax rate= 40% Amount=$15000

Q: ny expects the cost of equipment maintenance to be $5,000 in year one, $5,500 in year two, and…

A: The given problem can be solved using NPV function in excel.

Q: The initial cost of an evaporative crystallizer including its installation is Php 930,000. The…

A: solution given Initial cost 930000 Cost of dismantling 22000 Salvage value 66000…

Q: An injection molding system has a first cost of $200,000 and an annual operating cost of $85,000 in…

A: The question is based on the calculation of economic service life and annual worth of a machine.…

Q: The Libby & Lacy Company is considering a new construction project for the new manufacturing plant…

A: Net Present Value - It is a difference between the present value of cash inflow to the present value…

Solve question 3

Step by step

Solved in 2 steps

- Dunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. With DEPREC5 still on the screen, click the Chart sheet tab. This chart shows the accumulated depreciation under all three depreciation methods. Identify below the depreciation method that each represents. Series 1 _____________________ Series 2 _____________________ Series 3 _____________________ When the assignment is complete, close the file without saving it again. Worksheet. The problem thus far has assumed that assets are depreciated a full year in the year acquired. Normally, depreciation begins in the month acquired. For example, an asset acquired at the beginning of April is depreciated for only nine months in the year of acquisition. Modify the DEPREC2 worksheet to include the month of acquisition as an additional item of input. To demonstrate proper handling of this factor on the depreciation schedule, modify the formulas for the first two years. Some of the formulas may not actually need to be revised. Do not modify the formulas for Years 3 through 8 and ignore the numbers shown in those years. Some will be incorrect as will be some of the totals. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as DEPRECT. Hint: Insert the month in row 6 of the Data Section specifying the month by a number (e.g., April is the fourth month of the year). Redo the formulas for Years 1 and 2. For the units of production method, assume no change in the estimated hours for both years. Chart. Using the DEPREC5 file, prepare a line chart or XY chart that plots annual depreciation expense under all three depreciation methods. No Chart Data Table is needed; use the range B29 to E36 on the worksheet as a basis for preparing the chart if you prepare an XY chart. Use C29 to E36 if you prepare a line chart. Enter your name somewhere on the chart. Save the file again as DEPREC5. Print the chart.Urquhart Global purchases a building to house its administrative offices for $500,000. The best estimate of the salvage value at the time of purchase was $45,000, and it is expected to be used for forty years. Urquhart uses the straight-line depreciation method for all buildings. After ten years of recording depreciation, Urquhart determines that the building will be useful for a total of fifty years instead of forty. Calculate annual depreciation expense for the first ten years. Determine the depreciation expense for the final forty years of the assets life, and create the journal entry for year eleven.Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one the company expects the truck to be driven for 26,000 miles; in year two, 30,000 miles; and in year three, 40,000 miles. Consider how the purchase of the truck will impact Montellos depreciation expense each year and what the trucks book value will be each year after depreciation expense is recorded.

- Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the assets life, and create the journal entry for year five.A machine costing 350,000 has a salvage value of 15,000 and an estimated life of three years. Prepare depreciation schedules reporting the depreciation expense, accumulated depreciation, and book value of the machine for each year under the double-declining-balance and sum-of-the-years-digits methods. For the double-declining-balance method, round the depreciation rate to two decimal places.Montezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montezuma uses the straight-line depreciation method. Calculate the annual depreciation expense. After three years of recording depreciation, Montezuma determines that the delivery truck will only be useful for another three years and that the salvage value will increase to $4,000. Determine the depreciation expense for the final three years of the assets life, and create the journal entry for year four.

- Dunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. Dunedin buys equipment frequently and wants to print a depreciation schedule for each assets life. Review the worksheet called DEPREC that follows these requirements. Since some assets acquired are depreciated by straight-line, others by units of production, and others by double-declining balance, DEPREC shows all three methods. You are to use this worksheet to prepare depreciation schedules for the new machine.A truck was recently purchased for 75,000 with a salvage value of 5,000 and an estimated useful life of eight years or 150,000 miles (24,000 miles per year for the first five years and 10,000 miles per year after that). Enter the new information in the Data Section of the worksheet. Again, make sure the totals for all three methods are in agreement. Print the worksheet. Save this new data as DEPREC5.Montezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $8,000 and is expected to be driven for ten years. Montezuma uses the straight-line depreciation method. Calculate the annual depreciation expense. After five years of recording depreciation, Montezuma determines that the delivery truck will be useful for another five years (ten years in total, as originally expected) and that the salvage value will increase to $10,000. Determine the depreciation expense for the final five years of the assets life, and create the journal entry for years 6–10 (the entry will be the same for each of the five years).

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for ten years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.To test your formulas, assume the machine purchased had an estimated useful life of three years (20,000, 30,000, and 50,000 hours, respectively). Enter the new information in the Data Section of the worksheet. Does your depreciation total 320,000 under all three methods? There are three common errors made by students completing this worksheet. Lets clear up two of them. One, an asset that has a three-year life should have no depreciation claimed in Year 4. This can be corrected using an =IF statement in Year 4. For example, the correct formula in cell C32 is =IF(B32D9,0,(D7D8)/D9) or =IF(B32D9, 0, SLN(D7, D8, D9)). You may wish to edit what you have already entered rather than retype it. Two, as mentioned in requirement 2, the double-declining-balance calculation needs to be modified in the last year of the assets life. Assuming you have already modified the formula for Year 4 (per instructions in step 2), alter the formula for Year 3 also. If you corrected any formulas, test their correctness by trying different estimated useful lives (between 3 and 8) in cell E9. Then reset the Data Section to the original values, save the revised file as DEPREC2, and reprint the worksheet to show the correct formulas. The third common error doesnt need to be corrected in this problem. The general form of the double-declining-balance formula needs to be modified to check the net book value of the asset each year to make sure it does not go below salvage value. =DDB does this automatically, but if you are writing your own formulas, this gets very complicated and is beyond the scope of the problem.