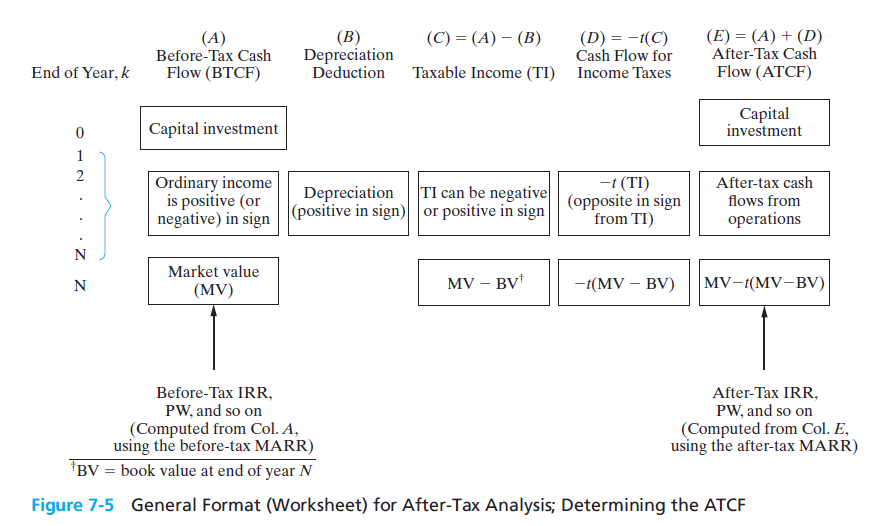

(A) Before-Tax Cash Flow (BTCF) (B) Depreciation Deduction (D) = -t(C) Cash Flow for (E) = (A) + (D) After-Tax Cash Flow (ATCF) (C) = (A) – (B) End of Year, k Taxable Income (TI) Income Taxes Сapital investment Capital investment 1 2 Ordinary income is positive (or negative) in sign positive in sign) or positive in sign -t (TI) (opposite in sign from TI) After-tax cash Depreciation TI can be negative flows from operations N Market value N MV – BV* -t(MV – BV) MV-t(MV-BV) (MV) Before-Tax IRR, PW, and so on (Computed from Col. A, using the before-tax MARR) *BV = book value at end of year N After-Tax IRR, PW, and so on (Computed from Col. E, using the after-tax MARR) Figure 7-5 General Format (Worksheet) for After-Tax Analysis; Determining the ATCF

A company is considering the purchase of a capital asset for $100,000. Installation charges needed to make the asset serviceable will total $30,000. The asset will be

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images