an investment broker for Fernanda and Tigstu, what would If you were you advise them to do about the following two investments: A) DeVries Oil Exploration: 20% chance of 50% return; 80% chance of 08 return. B) Dolma Bond Fund: 60% chance of 6% return; 40% chance of 12% return. a) Tell both off them t o buy Devries.

an investment broker for Fernanda and Tigstu, what would If you were you advise them to do about the following two investments: A) DeVries Oil Exploration: 20% chance of 50% return; 80% chance of 08 return. B) Dolma Bond Fund: 60% chance of 6% return; 40% chance of 12% return. a) Tell both off them t o buy Devries.

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 55P

Related questions

Question

3

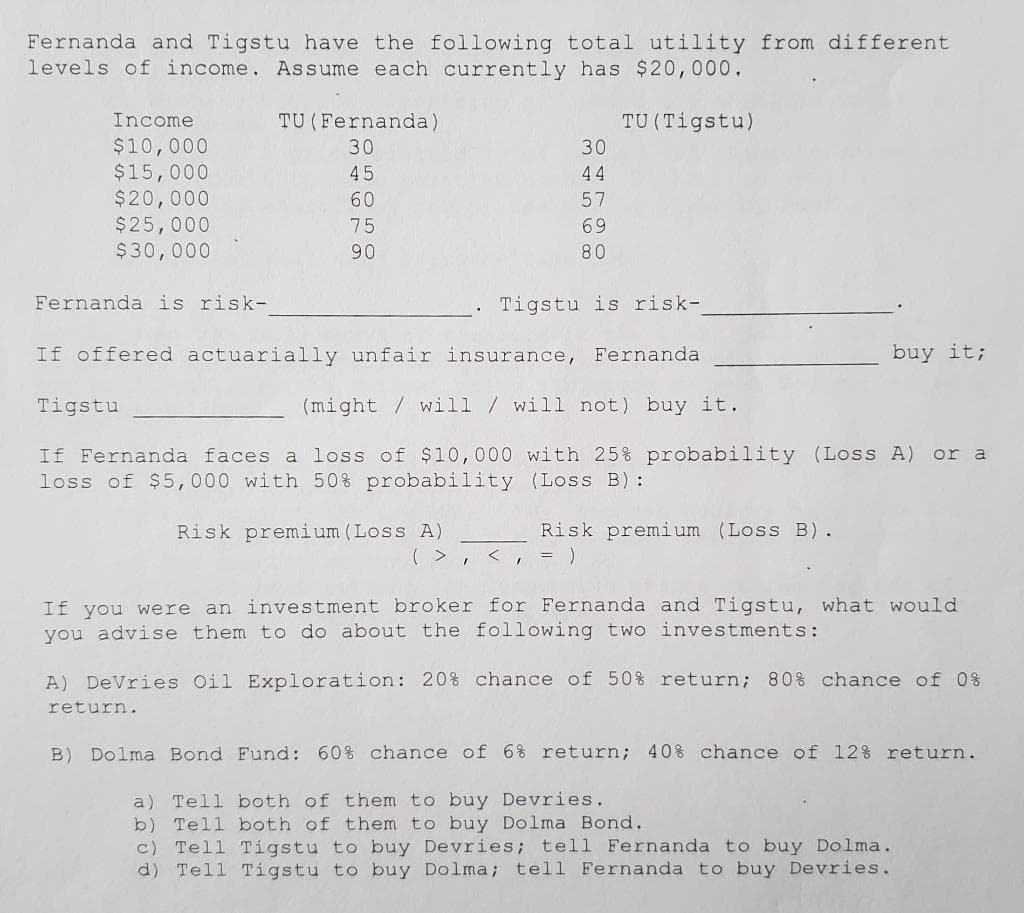

Transcribed Image Text:Fernanda and Tigstu have the following total utility from different

levels of income. Assume each currently has $20,000.

Income

TU (Fernanda)

TU (Tigstu)

$10,000

$15,000

$20,000

$25,000

$30,000

30

30

45

44

60

57

75

69

90

80

Fernanda is risk-

Tigstu is risk-

If offered actuarially unfair insurance, Fernanda

buy it;

Tigstu

(might / will / will not) buy it.

If Fernanda faces a loss of $10,000 with 25% probability (Loss A) or a

loss of $5,000 with 50% probability (Loss B) :

Risk premium (Loss A)

Risk premi um (Loss B).

( >, <, = )

If you were an investment broker for Fernanda and Tigstu, what would

you advise them to do about the following two investments:

A) DeVries Oil Exploration: 20% chance of 50% return; 80% chance of 08

return.

B) Dolma Bond Fund: 60% chance of 6% return; 40% chance of 12% return.

a) Tell both of them to buy Devries.

b) Tell both of them to buy Dolma Bond.

Tell Tigstu to buy Devries; tell Fernanda to buy Dolma.

d) Tell Tigstu to buy Dolma; tell Fernanda to buy Devries.

c)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT