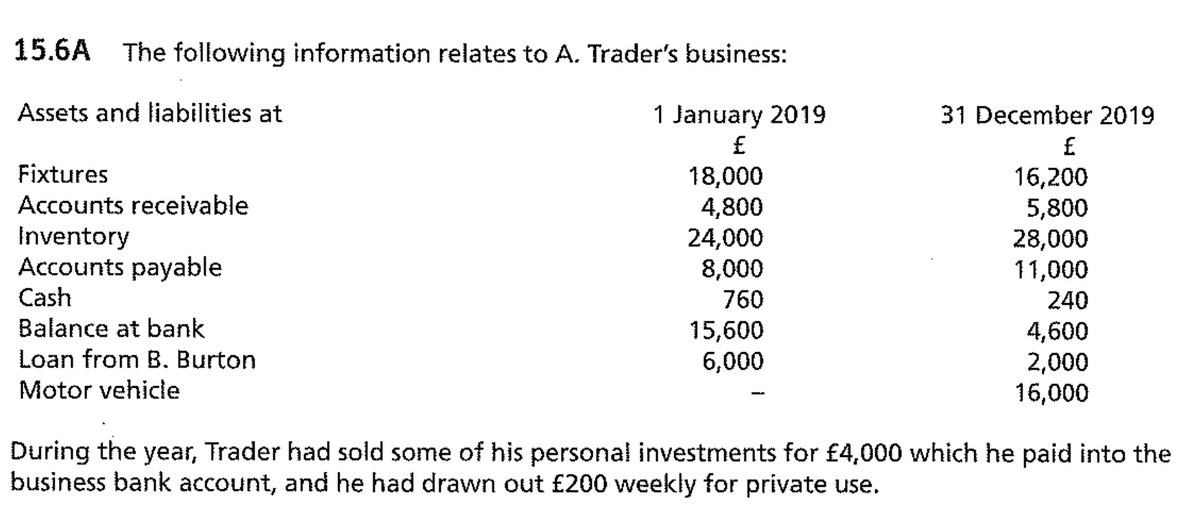

18,000 4,800 24,000 8,000 eivable vable 760 ank 15,600

Q: The auto repalr shop of Quality Motor Company uses standards to control the labor time and labor cos...

A: The variance is the difference between the actual data and standard output of the production.

Q: the audit of loans payable, which of the following audit procedure would be most likely performed to...

A: Assertion is representation made by the management . it ensure that the financial records are accu...

Q: Jellicent Corporation is an 80% owned subsidiary of Frilish Corporation. During 2018, Jellicent sold...

A: solution given % holding in Jellicent 80% unrealized profit at December 31, 2018 on sales ...

Q: Stew and Peed entered into a partnership on March 1, 2017 investing P 2,000,000 and P 1,000,000 resp...

A: Two or more person can start partnership firm. They usually contribute capital at the start of partn...

Q: Merville is a dealer in real properties. Merville requires 20% downpayment, and the balance is payab...

A: Answer: We have Gross profit = 40% of Selling price Selling price of lot 1 in 2019= P 1,350,000 Sel...

Q: Entity A had 200,000 ordinary shares outstanding all throughout 20x1. In 20x2, share issuances occur...

A: Earning per Share: It indicates a company's profitability and is calculated by dividing a company's ...

Q: answer true or false: 1. Revenue collected in advance of being earned represents a liability until i...

A: Accounting principles are those rules and guidelines which are used for the purpose of accounting, r...

Q: Corporation resells one product to a small isolated community. It sells an average of 60 sacks, but ...

A:

Q: An analysis of the cash book and other records of Bye Corporation shows the following data: Accounts...

A: The income statement is one of the financial statements of the business which represents the profita...

Q: Age in days Receivable balances 0- 15 180,000 16 - 30 108,000 31 - 60 95,000 61 90 72,000 91 - 120 5...

A: Doubtful accounts are those accounts to whom business has made credit sales on account and it is dou...

Q: What are the three primary reasons an organization holds cash or cash equivalents?

A: Cash and cash equivalents are those liquid assets which are either in cash or can be converted into ...

Q: Miranda Company reported the following amounts on its 2018 income statement: Purchases, P100,000; Be...

A: Cost of goods available for sale means how much cost of goods are being made available for sale to t...

Q: Corporate Estimated Tax. F Corporation, a calendar year corporation, reported the following informat...

A: There is requirement to pay the estimated tax on quarterly basis, however the actual tax liability m...

Q: procedures for expenses and its related payable. In testing the completeness/cut-off assertion, what...

A: cut off procedures and procedures which are applied at the end of accounting period this is done t...

Q: ACCOUNTING CYCLE: Complete the illustration Problem: On January 1 of the current year Josef Cacdac o...

A: A journal entry is the first step in accounting. It records all business transactions in the account...

Q: Statement 1: The cash basis is appropriate for some smaller entities

A: Cash basis is one of the methods of accounting. Under this method revenue is recognized when cash is...

Q: XYZ Corporation has a lower and an upper limit for its savings account at P40,000 and P70,000 respec...

A: Solution Concept Miller-Orr Model As per this model -when cash balan...

Q: Shamrock Corporation manufactures drones. On December 31, 2019, it leased to Althaus Company a drone...

A: The question is based on the concept of Lease accounting. Financial Lease: A financial lease is a ty...

Q: Statement 1: In single entry, Payables ( accounts and notes) could be determined from sales invoices...

A: The answer for the multiple choice question and relevant explanation are presented hereunder : There...

Q: The following transactions (in summary) affecting the accounts receivable of Seraphine company occur...

A: Allowance Method - Under allowance method company make provision of uncollectible accounts at the en...

Q: y created a standard cost system to help control costs and has established the following standards f...

A: Material price variance = (Standard price - Actual price)*Actual quantity purchased Material quantit...

Q: A company annually consumes 10,000 units of Part C. The carrying cost of this part is P2 per year an...

A: Economic order quantity in costing States the order quantity at which the ordering and carrying cost...

Q: The following details are found in the incomplete bank reconciliation statement of Phillip Company f...

A: Bank reconciliation statement is prepared to reconcile cash balance as per cashbook and bank balance...

Q: Prepare the following: • Statement of Financial Position • Trial balance

A: Financial statements are the set of records of the financial transactions and position of a business...

Q: LeBron James (LBJ) Corporation agrees on January 1, 2020, to lease equipment from Cullumber, Inc. fo...

A: Lease is an agreement or arrangement between two parties, in which one party provides its asset for ...

Q: Required information Problem 6-9B Record transactions and prepare a partial income statement using a...

A: Under periodic inventory system, the cost of goods sold is not recorded with every sale transaction ...

Q: LL Corporation will need a minimum of P1,500,000 cash for six months. It has the following options a...

A:

Q: Requirements: Compute for the basic and diluted EPS.

A: Earnings per share are the earnings of shareholders after all the payments towards expenses includin...

Q: The amount of assets consumed during the performance of business operations in a period while delive...

A: Assets can be defined as any resource which has its own intrinsic economic value, owned and controll...

Q: Declan's Designs Balance Sheet Declan's Designs Income Statement ASSETS Current Assets For the Year ...

A: The dividend is declared to the shareholders from the retained earnings of the business.

Q: The generally accepted accounting principle that supports recording the value of a property at the p...

A: Monetary principle says that a business should only record transaction if it is measured in monetary...

Q: Sage Hill, Inc. leases a piece of equipment to Bucks Company on January 1, 2020. The contract stipul...

A: Lease: When one party lets out its assets to another party for some time or specific time mentioned ...

Q: Which of the following statements is correct regarding working paper entries to facilitate the prepa...

A: The given questions answer is given in the following steps.

Q: Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution form...

A: Operating leverage is used to measure the degree to which the firm can increase its operating income...

Q: Which of the following expenses is usually listed last on the income statement? a. Advertising expe...

A: The income statement is one of the financial statements of the business. It tells about the profitab...

Q: 1. How much is the total expense? 2. How much is the net income? 3. What is the balance of the endin...

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: On December 31, 2021, The Essence Finance Company had P5,000,000 note receivable from Galena Company...

A: The correct calculation of the solution is given in the following steps.

Q: Ms. QWE began a business on April 1, 2021, contributing to the business the following assets: Cash 3...

A: The transactions in the business effects two or more accounts. The accounting equation states that ...

Q: Among the account balance of Jeffrey Corporation at December 31, 2009 are the following: Patent Inst...

A: A patent is the granting of a property right to the inventor by a sovereign authority. This grant pr...

Q: ZETA Company reported revenue of P6,000,000 under the cash basis for the year ended 2020. Additional...

A: Under the accrual basis, the revenue will be total of cash sales & credit sales. Under the accru...

Q: For the year ended December 31, a company has revenues of $324,000 and expenses of $199,500. The own...

A: The closing entries are prepared to close the temporary accounts of the business including revenue, ...

Q: Lloyd’s Auto Specialist Ltd. journal entry for August 2021 Date Details DR CR 1-Aug Cash 150,000 ...

A: An income statement is a financial report that indicates the revenue and expenses of a business. It ...

Q: At the beginning of September, Helen Rojas started Rojas Wealth Management Consulting, a firm that o...

A: The income statement is prepared to record the revenues and expenses of the current period. It tell...

Q: Problem 6-2B Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for fou...

A: Cost of Goods sold Under LIFO method using periodic inventory system, cost of goods sold is calculat...

Q: Grouper Corporation leases equipment from Falls Company on January 1, 2020. The lease agreement does...

A: The present value of the lease payments is used to establish both a lease liability and a Right-of-U...

Q: Entity A operates in a hyperinflationary economy. Entity A has the following assets before restateme...

A: Investment in Bonds: It is a debt instruments in which bond holders receive interest periodical...

Q: antiago, Inc. has the following receipts during 2018: From service billings to client P400,000 Ad...

A: Solution Accrual basis of accounting Under accrual basis , the income is recorded when s...

Q: Statement 1: Under the single entry method, the owner maintains a cash book and separate list of rec...

A: Single entry system: the single entry system is an accounting system used by small companies to reco...

Q: FIFO and LIFO costs under perpetual inventory system The following units of an item were available ...

A: Total cost = number of units * cost per unit In LIFO method , the last purchase is sold first. So ,...

Q: Perpetual inventory using LIFO The following units of a particular item were available for sale d...

A: Last-in, first-out (LIFO) cost flow assumption - Under LIFO Method, Inventory purchased last is sold...

Step by step

Solved in 3 steps with 3 images

- Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000Errors During the course of your examination of the financial statements of Burnett Co., a new client, for the year ended December 31, 2019, you discover the following: Inventory at January 1, 2019, was understated by 6,000. Inventory at December 31, 2019, was overstated by 5,000. During 2019, the company received a 1,000 cash advance from a customer for merchandise to be manufactured and shipped during 2020. It had credited the 1,000 to sales revenue. The companys gross profit on sales is 50%. Net income reported on the 2019 income statement (before reflecting any adjustments for the above items) is 20,000. Required: Next Level What is the correct net income for 2019?Investment in Trading Securities The following information relates to Sanders Companys investment in trading securities for 2019: Required: 1. Prepare journal entries to record the previous information for 2019. Use the effective interest method and round all amounts to the nearest dollar. Assume that Sanders prepares semiannual financial statement. 2. Show the items of income or loss from investment transactions that Sanders reports for each 2019 semiannual income statement. 3. Show how the investment items are reported on each of the 2019 semiannual balance sheets, assuming that management expects to dispose of all investments within one year of purchase.

- 7.Lanson Corporation Co.'s trial balance included the following account balances at December 31, 2021: Accounts payable $26,800Bonds payable, due 2030 24,900Salaries payable 16,900Notes payable, due 2022 22,000Notes payable, due 2026 40,800 What amount should be included in the current liabilities section of Lanson's December 31, 2021, balance sheet? Group of answer choices $65,700 $43,700 $106,500 $68,60010 Ji Lui’s statement of financial position was prepared on 31 December 2018. It showed the followingassets and liabilities:$Machinery 7200Trade receivables 800Inventory 1300Other payables 830Creditors 510Cash 180Bank (debit balance) 250a Calculate Ji Lui’s owner’s equity on 31 December 2018. [2 marks]........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................On 1 January 2019, the following transactions took place:i) Ji Lui paid salaries for December 2018 in cash $319.ii) Ji Lui took cash $89 for her own personal…Godo At May 31, 2019, FOR Deliveries reported the following amounts (in millions) in its financial statements:20192018Total Assets$ 70,000$ 68,000Total Liabilities46,20042,160Interest Expense736750Income Tax Expense155260Net Income7806,275 Required: 1. Compute the debt-to-assets ratio and times interest earned ratio for 2019 and 2018. 2-a. In 2019, were creditors providing a greater (or lesser) proportion of financing for FOR’s assets? 2-b. In 2019, was FOR more (or less) successful at covering its interest costs, as compared to 2018?

- Then balance off the accounts and extracted a trial balance for sole trader Airman Co. as at 30September 2020:DR CR£ £Capital £306,070Drawings 26,500Cash at bank 20,000Cash in hand 8500Accounts receivable (Debtors) 70,000Accounts payable (Creditors) 16,000Inventory (Stock): 30 September 2019 36,000Van 16,000Fixtures and Fittings 32,000Sales 80,000Purchases 150,000Return inwards (Sales Returns) 2,000Carriage inwards 720Returns outwards (Purchase Returns) 600Carriage outwards 400Motor expenses 1200Rent 5,000Telephone charges 620Wages and salaries 32,000Insurance 830Office expenses 600Sundry expenses 300437,600 437,600Inventory as at 30 September 2020was £120,000.Requireda. Draft an Income Statement for S. Keyes for the year ending 30th September 201921. Mahal Mo Co. reported revenue of P3,100,000 in its accrual basis income statement for the year ended December 31, 2020. Additional information are as follows: Accounts receivable, December 31, 2019, P700,000 and Accounts receivable, December 31, 2020, P1,100,000. Under the cash basis, how much should Mahal Mo Co. report as revenue for 2020? Choices: P3,500,000 P2,000,000 P2,700,000 P2,400,00010. Comparative balance sheet accounts of Sage Inc. are presented below. SAGE INC.COMPARATIVE BALANCE SHEET ACCOUNTSAS OF DECEMBER 31, 2020 AND 2019 December 31 Debit Accounts 2020 2019 Cash $42,400 $33,800 Accounts Receivable 70,500 59,700 Inventory 30,300 24,200 Equity investments 22,100 38,300 Machinery 30,200 18,500 Buildings 67,500 55,800 Land 7,400 7,400 $270,400 $237,700 Credit Accounts Allowance for Doubtful Accounts $2,300 $1,500 Accumulated Depreciation—Machinery 5,500 2,300 Accumulated Depreciation—Buildings 13,500 8,900 Accounts Payable 34,700 24,700 Accrued Payables 3,300 2,700 Long-Term Notes Payable 20,800 31,000 Common Stock, no-par 150,000 125,000 Retained Earnings 40,300 41,600 $270,400 $237,700 Additional data (ignoring taxes): 1. Net income…

- 59 . A company’s accounts payable dated December 31, 2021, totaled P1,000,000 before any necessary year-end adjustments relating to the following transactions and information: On December 27, 2021, the company wrote and issued checks to creditors totaling P350,000. The issuance of the checks was recorded on January 3, 2022. On December 28, 2021, the company purchased and received goods for P150,000, terms 2/10, n/30. The company records purchases and accounts payable at net amounts. The invoice was recorded and paid on January 3, 2022 Goods shipped FOB Destination on December 20, 2021, from a vendor to the company were received on January 2, 2022. The invoice cost was P65,000. The purchase was recorded on January 2, 2022. Goods costing P120,000 were purchased from supplier with terms FOB shipping point on December 28, 2021. The company received the goods and the invoice on January 4, 2022. The P1,000,000 ledger balance of accounts payable is net of P80,000 debit balance in one…The following are extracts from the financial records of ABC Ltd for the year ended31 August 2021.ABC LtdExtract from the Statement of financial statement as at 31 August 2021 31 August 2021 - R 30 August 2020 - R Bank Inventories - Trade Goods Trade Recievables Trade payables Prepaid Expenses Prepaid Expenses Accrued Expenses; interest Accrued Expenses; other SARS - income tax payable Dividens payable 50000 22000 77000 44000 1800 1000 5700 8000 1500 20000 30000 69000 46000 1200 2400 4400 3000 2700 ABC LtdExtract from the Statement of profit or loss and other comprehensive incomefor the year ended 31 August 2021 Sales 592000 Cost of sales (301000 Gross profit 291000 Profit on sale of Equipment 9000 Depreciation 41000 Interest Expense 2600 Income tax expense 15200 Profit for the year 110300 Additional information: 1. The dividends declared for the current year is R2 400 Required:Prepare only the “Cash flows from operating activities” section…1. PGold Company provided the following trial balance on December 2020: Total credits amounting to P3,000,000 as follows; Bank overdraft P100,000, Accounts Payable P200,000, Accrued expenses P150,000, Ordinary share capital P1,500,000, Share premium P250,000, Retained earnings P800,000. Total debits of P3,000,000 composed the following; Accounts receivable P350,000, Inventory P600,000, Prepaid expenses P100,000, Land held for sale P1,000,000, Property, plant & equipment P950,000. Additional information: Checks amounting to 300,000 were written to vendors and recorded on December 29, 2020 resulting in a cash overdraft of P100,000. The checks were mailed on January 15, 2021. Land held for resale was sold for cash on January 31, 2021. The entity issued the financial statements on March 31, 2021. What is the total shareholders equity?