Leonard should report Retained Earnings, 1/1/19, as adjusted at [ Select ] [ Select] $2,000,000 $2,555.000 None of these. Leonard should report Retained Earnings, 12/31/2019 at $1.785,000 $2,215,000 Leonard should report Accumulated Other Comprehensive Income, 12/31/2019 at [ Select ]

Leonard should report Retained Earnings, 1/1/19, as adjusted at [ Select ] [ Select] $2,000,000 $2,555.000 None of these. Leonard should report Retained Earnings, 12/31/2019 at $1.785,000 $2,215,000 Leonard should report Accumulated Other Comprehensive Income, 12/31/2019 at [ Select ]

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 5MCQ: Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense at...

Related questions

Topic Video

Question

![Leonard should report Retained Earnings, 1/1/19, as adjusted at

[ Select ]

[ Select]

$2,000,000

$2,555.000

None of these.

Leonard should report Retained Earnings, 12/31/2019 at

$1.785,000

$2.215.000

Leonard should report Accumulated Other Comprehensive Income, 12/31/2019 at

[ Select ]](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F038ea546-a4d6-4c49-bbd0-386e6724d029%2F115e4f3c-7eca-4299-83de-2a7a454ef839%2Fxkvuaqj_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Leonard should report Retained Earnings, 1/1/19, as adjusted at

[ Select ]

[ Select]

$2,000,000

$2,555.000

None of these.

Leonard should report Retained Earnings, 12/31/2019 at

$1.785,000

$2.215.000

Leonard should report Accumulated Other Comprehensive Income, 12/31/2019 at

[ Select ]

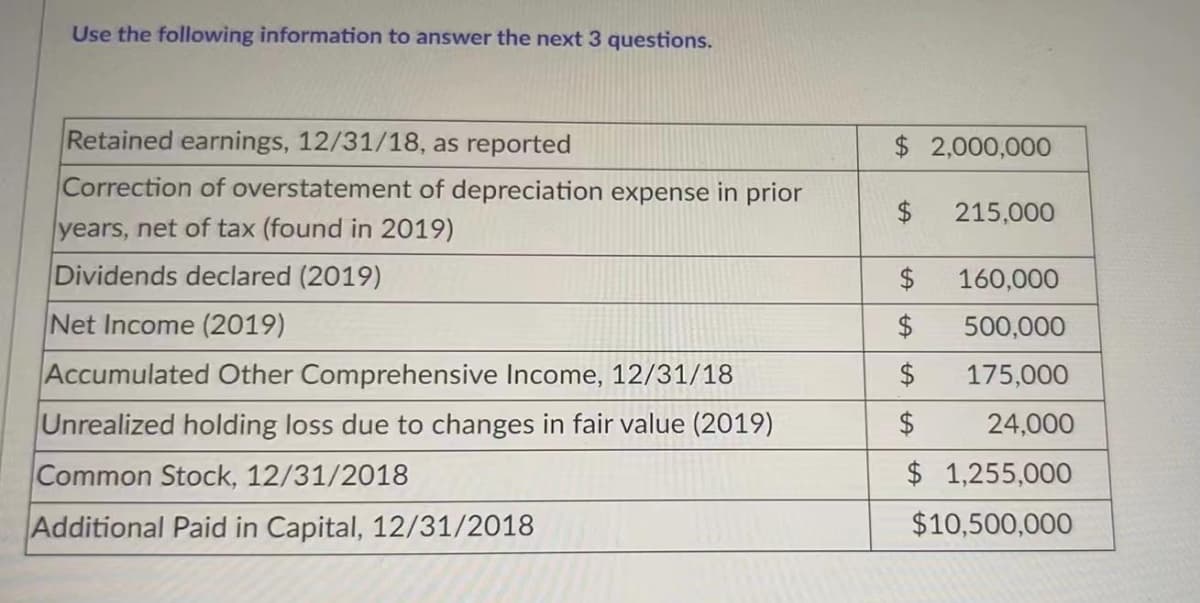

Transcribed Image Text:Use the following information to answer the next 3 questions.

Retained earnings, 12/31/18, as reported

$ 2,000,000

Correction of overstatement of depreciation expense in prior

$4

215,000

years, net of tax (found in 2019)

Dividends declared (2019)

$

160,000

Net Income (2019)

$

500,000

Accumulated Other Comprehensive Income, 12/31/18

175,000

Unrealized holding loss due to changes in fair value (2019)

$

24,000

Common Stock, 12/31/2018

$ 1,255,000

Additional Paid in Capital, 12/31/2018

$10,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning