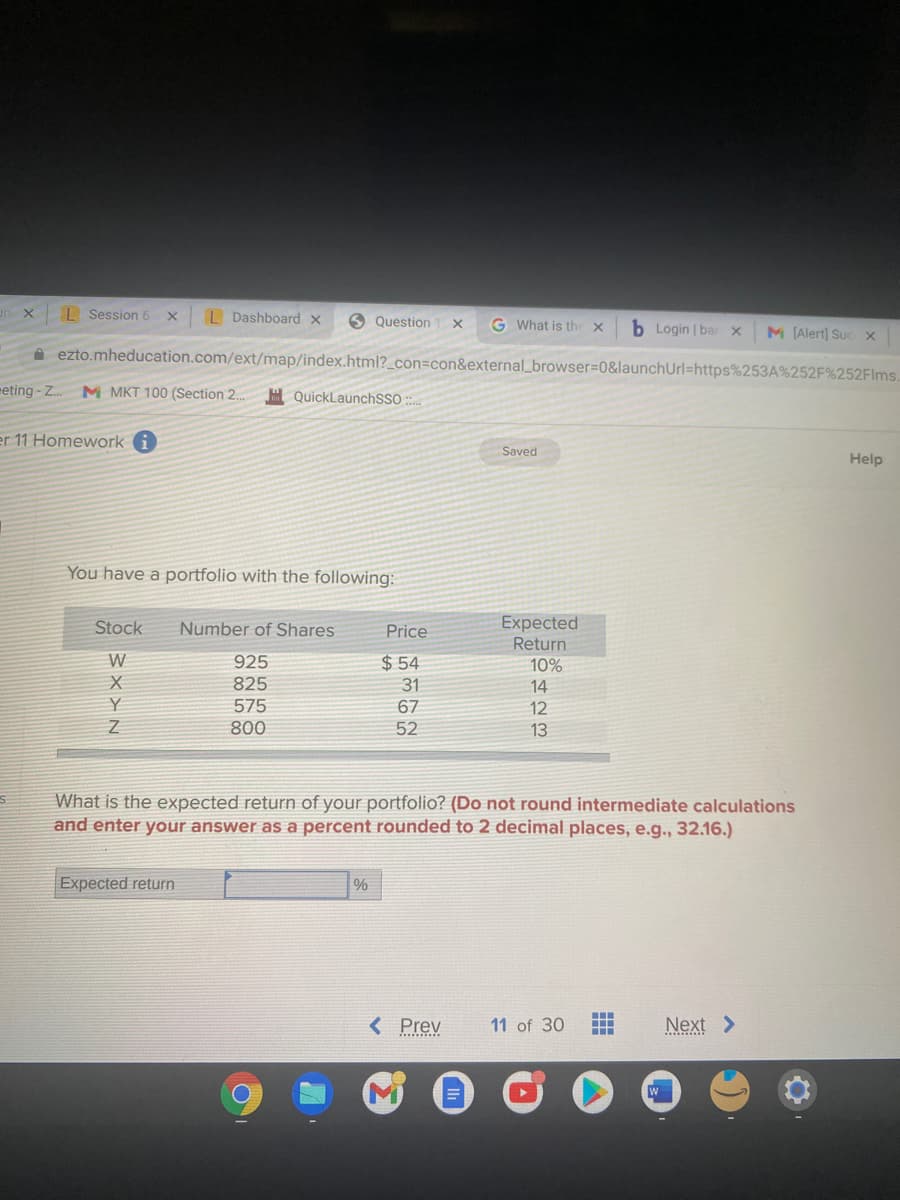

You have a portfolio with the following: Expected Return 10% Stock Number of Shares Price W $ 54 31 925 825 14 575 67 12 800 52 13 What is the expected return of your portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return %

You have a portfolio with the following: Expected Return 10% Stock Number of Shares Price W $ 54 31 925 825 14 575 67 12 800 52 13 What is the expected return of your portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Expected return %

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 3.4C

Related questions

Question

Transcribed Image Text:L Session 6 Xx

L Dashboard x

6 Question

G What is the x

b Login | bar x

M (Alert) Suc x

A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A%252F%252Flms.

eting - Z.

M MKT 100 (Section 2.

H QuickLaunchSSO :

er 11 Homework

Saved

Help

You have a portfolio with the following:

Expected

Return

10%

Stock

Number of Shares

Price

$ 54

925

825

31

14

575

67

12

800

52

13

What is the expected return of your portfolio? (Do not round intermediate calculations

and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

Expected return

%

< Prev

11 of 30

Next >

N< X {

Expert Solution

Step 1

Portfolio return is the weighted average expected return of all the securities in the portfolio. This is calculated by taking weights of all the assets along with expected returns.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning