An online streaming company, Netflicks, has invested $100,000 in servers. The resale value of those servers is $70,000 if they never operate, and $0 if they operate. The marginal cost is $0. If they operate, the profit-maximizing price is $10, corresponding to a lifetime quantity of 6,000. O Netflicks should operate, because the marginal revenue is equal to the marginal cost. O Netflicks should operate, because the marginal cost is zero. Netflicks should not operate, because they would be better off by selling their servers. ONetflicks should not operate, because their sunk cost is $100,000. Netflicks should not operate, because the variable profits are less than $100,000.

An online streaming company, Netflicks, has invested $100,000 in servers. The resale value of those servers is $70,000 if they never operate, and $0 if they operate. The marginal cost is $0. If they operate, the profit-maximizing price is $10, corresponding to a lifetime quantity of 6,000. O Netflicks should operate, because the marginal revenue is equal to the marginal cost. O Netflicks should operate, because the marginal cost is zero. Netflicks should not operate, because they would be better off by selling their servers. ONetflicks should not operate, because their sunk cost is $100,000. Netflicks should not operate, because the variable profits are less than $100,000.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter10: Prices, Output, And Strategy: Pure And Monopolistic Competition

Section: Chapter Questions

Problem 8E

Related questions

Question

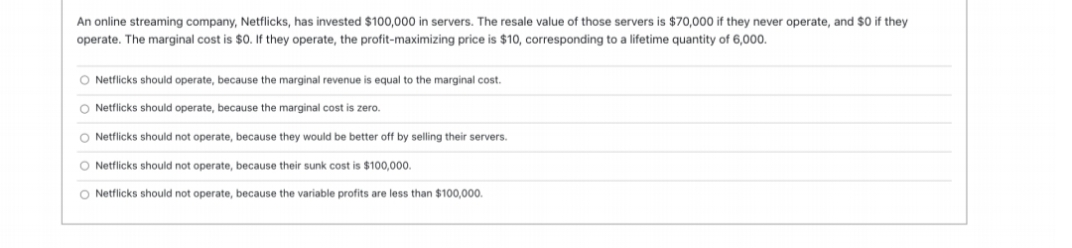

Transcribed Image Text:An online streaming company, Netflicks, has invested $100,000 in servers. The resale value of those servers is $70,000 if they never operate, and $0 if they

operate. The marginal cost is $0. If they operate, the profit-maximizing price is $10, corresponding to a lifetime quantity of 6,000.

O Netflicks should operate, because the marginal revenue is equal to the marginal cost.

O Netflicks should operate, because the marginal cost is zero.

O Netflicks should not operate, because they would be better off by selling their servers.

O Netflicks should not operate, because their sunk cost is $100,000.

O Netflicks should not operate, because the variable profits are less than $100,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning