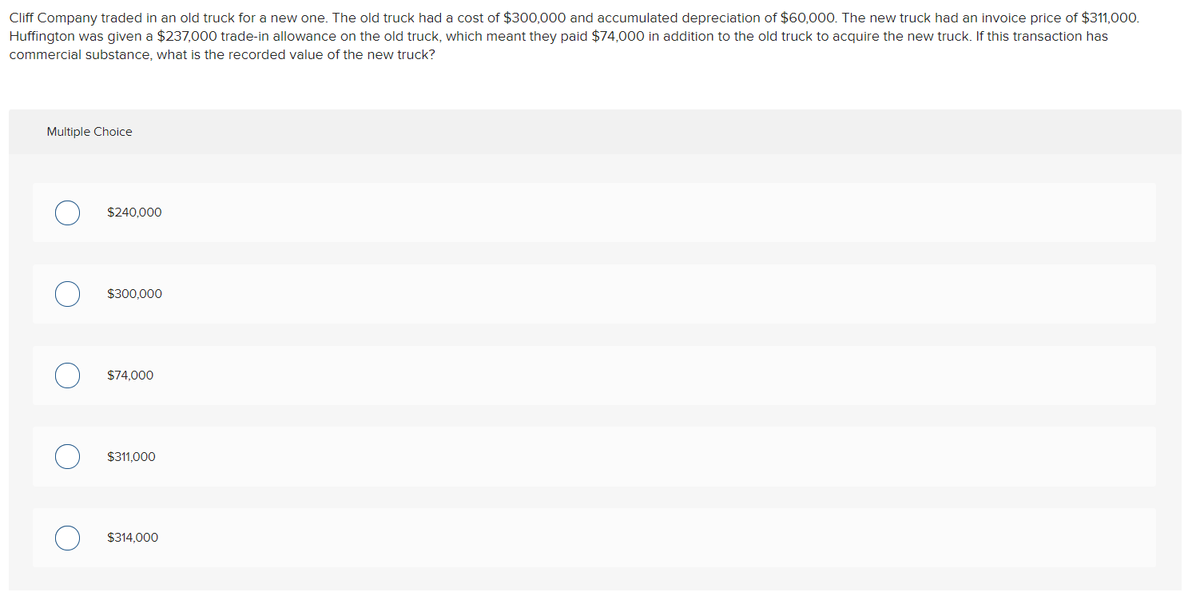

Cliff Company traded in an old truck for a new one. The old truck had a cost of $300,000 and accumulated depreciation of $60,000. The new truck had an invoice price of $311,000. Huffington was given a $237,000 trade-in allowance on the old truck, which meant they paid $74,000 in addition to the old truck to acquire the new truck. If this transaction has commercial substance, what is the recorded value of the new truck? Multiple Choice $240,000 $300,000 $74,000 $311,000 $314,000

Cliff Company traded in an old truck for a new one. The old truck had a cost of $300,000 and accumulated depreciation of $60,000. The new truck had an invoice price of $311,000. Huffington was given a $237,000 trade-in allowance on the old truck, which meant they paid $74,000 in addition to the old truck to acquire the new truck. If this transaction has commercial substance, what is the recorded value of the new truck? Multiple Choice $240,000 $300,000 $74,000 $311,000 $314,000

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 14PB: Garcia Co. owns equipment that costs $150,000, with accumulated depreciation of $65,000. Garcia...

Related questions

Question

Transcribed Image Text:Cliff Company traded in an old truck for a new one. The old truck had a cost of $300,000 and accumulated depreciation of $60,000. The new truck had an invoice price of $311,000.

Huffington was given a $237,000 trade-in allowance on the old truck, which meant they paid $74,000 in addition to the old truck to acquire the new truck. If this transaction has

commercial substance, what is the recorded value of the new truck?

Multiple Choice

$240,000

$300,000

$74,000

$311,000

$314,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT