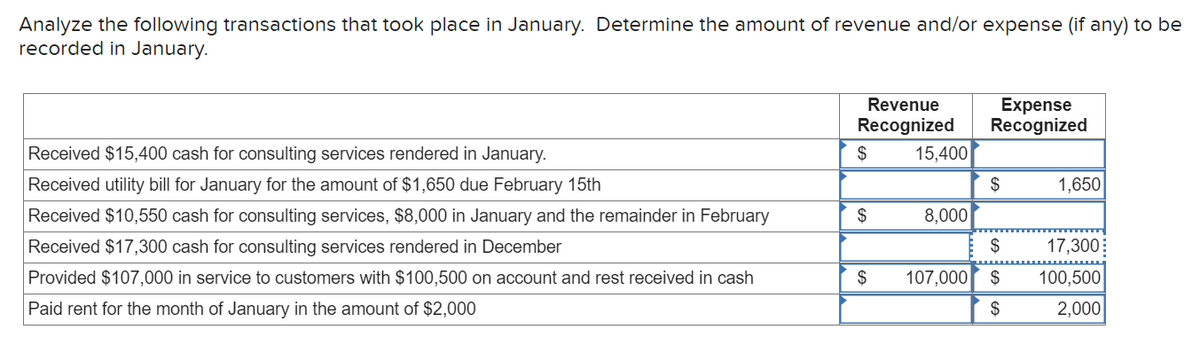

Analyze the following transactions that took place in January. Determine the amount of revenue and/or expense (if any) to be recorded in January. Revenue Expense Recognized Recognized Received $15,400 cash for consulting services rendered in January. $ 15,400 Received utility bill for January for the amount of $1,650 due February 15th $ 1,650 Received $10,550 cash for consulting services, $8,000 in January and the remainder in February $ 8,000 Received $17,300 cash for consulting services rendered in December $ 17,300: Provided $107,000 in service to customers with $100,500 on account and rest received in cash $ 107,000 $ 100,500 Paid rent for the month of January in the amount of $2,000 $ 2,000

Q: During December, Camp McDavid Inc. purchased $5,000 of supplies for use in its business. At the end…

A: Accrual accounting is one of an accounting method in which all transactions it may be revenue or…

Q: The assets and liabilities of Bennett Designs at December 31, the end of the current year, and its…

A: Those resources that are owned by the company and have economic value are term as assets.

Q: Holmes Cleaning Service began operation on January 1, Year 1. The company experienced the following…

A: T Accounts: A T-account is a graphical depiction of a general ledger, which is used to record the…

Q: ABC Co. received $1,000 in December for services it will perform in the following month. ABC uses…

A: Introduction: Journal: Recording of a business transactions in a chronological order. First step in…

Q: Bearcat Construction begins operations in March and has the following transactions. March 1 Issue…

A: Journal entry: Journal is the book of original entry whereby all the financial transactions are…

Q: Daube Industries’ operations for the month of October are summarized as follows: Provided $2,500…

A: Introduction: A journal entry is often used to record a business recorded in the accounting records…

Q: The trial balance of Pacilio Security Services, Inc. as of January 1, Year 5, had the following…

A: Note: Since there are multiple parts, I am solving the first 3 subparts. A trial balance includes a…

Q: Daube Industries’ operations for the month of October are summarized as follows: Provided $6,200…

A: To record service revenue for current period on account, Accounts Receivable account should be…

Q: Following is a February transaction for a company. Calculate the amount of revenue to recognize in…

A: Under accrual basis, revenue is recognized only if the services are performed irrespective of…

Q: Holmes Cleaning Service began operation on January 1, Year 1. The company experienced the following…

A: SOLUTION- The accounting equation shows on a company's balance that a company's total assets are…

Q: [The following information applies to the questions displayed below.] Carmen Camry operates a…

A: Net income = Total revenue - Total assets

Q: The following is the Trial Balance of ABC Services for the MONTH OF DECEMBER, 2022 Debit Credit Cash…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Journalizing transactions Harper Sales Consultants completed the following transactions during the…

A: Date Account Titles and Explanation Debit Credit Jan. 22 Accounts receivable $7,500…

Q: The following transactions were completed by the company. a. The company completed consulting work…

A: Accounting Equation: It is based on the double-entry-bookkeeping-system, All assets = All…

Q: The company completed consulting work for a client and immediately collected $7,200 cash earned b.…

A: Accounting Equation shows the relationship among Assets, Liabilities and Capital.Its also called as…

Q: Listed below are several transactions that took place during the second and third years of…

A: The accrual net income states that the expenses and revenues are to be considered when they are…

Q: The accountant for Scott Industries prepared the following list of account balances from the…

A: Net Income: It's necessary to deduct costs like taxes and interest from gross revenue before…

Q: For each transaction below, calculate the amount of revenue to be recognized in the current period…

A: Accrual accounting: The method of accounting which recognizes revenues when it is earned though not…

Q: Holmes Cleaning Service began operation on January 1, Year 1. The company experienced the following…

A: a. Cash + Account Receivable - Allowance = Retained earnings Account title 1 150,000…

Q: Carmen Camry operates a consulting firm called Help Today, which began operations on December 1. On…

A: Balance sheet is a component of financial statements that shows the exact position of assets and…

Q: The following selected transactions were completed by Next Day Delivery Services during October:…

A: Accounting Equation: It is a fundamental equation used in accounting to establish the relationship…

Q: The accountant for Scott Industries prepared the following list of account balances from the…

A: Income: This is theamount earned from operations of a business. The operating activities are sale of…

Q: In its first month of business, Brewed Awakenings, Inc., collected $34,000 from customers in advance…

A: Deferred Revenue account is a Liability account which represents company's liabilities as company…

Q: The following is the Trial Balance of ABC Services for the MONTH OF DECEMBER, 2022. Debit Credit…

A: Adjusting entries are made to provide a more accurate view of business performance at the end of the…

Q: Listed below are several transactions that took place during the second and third years of…

A: In order to determine 'Accruals net income,' we have to subtract 'expenses incurred' from the…

Q: The accountant for Scott Industries prepared the following list of accounting equation element…

A: Calculate total assets:

Q: Waterway recorded the following transactions during the month of April. April 3 Cash 2,500…

A: A T-account is an informal term for a set of financial records using double-entry bookkeeping. It is…

Q: Listed below are several transactions that took place during the second and third years of…

A: The accrual basis accounting records the revenue and expenses as and when they are incurred.

Q: Holmes Cleaning Service began operation on January 1, Year 1. The company experienced the following…

A: The question is based on the concept of Financial Accounting.

Q: On December 1, Oren Marketing Company received $4,500 from a customer for a 2-month marketing plan…

A: Adjusting entries are the journal entries passed at the end of the accounting period to give effect…

Q: The following transactions occurred during April: Received $900 cash for services provided to a…

A: Revenue represents the sales earning of the company. It is presented in the income statement of the…

Q: During March, the activities of Evergreen Landscaping included the following transactions andevents,…

A:

Q: The following selected transactions were completed by Cota Delivery Service during July: Received…

A: Definition: Accounting equation: Accounting equation is an accounting tool expressed in the form of…

Q: 13. The following transactions occurred during April: Received $900 cash for services provided to…

A: According to the accrual concept of accounting, revenues and expenses are recorded in the period to…

Q: The accountant for Scott Industries prepared the following list of account balances from the…

A: Assets represent the economic benefit of the company arose in the future period.

Q: On April 1, Margaret Moore established Moore’s Travel Agency. The following transactions were…

A: Note: It is assumed that the requirement of the question is to prepare the accounting equation:…

Q: The following account balances were taken from the books of ABC Company for the month of March.…

A: Income statement: The income statement shows the company's revenues and expenses earned during the…

Q: On January 1, Entity A invested cash of P 50,000. On January 5, the business performed services…

A: Formula: Service revenue = Total revenue x cash collection %

Q: For each transaction below, calculate the amount of revenue to be recognized in the current period…

A: Here in this question we are require to calculate the revenue that needs to be recorded under…

Q: Under accrual basis accounting, expenses are recognized when incurred. The following transactions…

A: According to this principle, the expense should be recognized when it is actually incurred, doesn't…

Q: Maynard Services was organized on August 1, 20Y5. A summary of the revenue and expense transactions…

A: Income statement : It is also known as "Statement of Income" in which the income/loss for the…

Q: The following transactions were completed by the company: The company completed consulting work…

A: With the given question, the journal entries of the transactions are as follows:

Q: Imaging Services was organized on March 1, 20Y5. A summary of the revenue and expense transactions…

A: Income statement: The financial statement which reports revenues and expenses from business…

Q: Holmes Cleaning Service began operation on January 1, Year 1. The company experienced the following…

A: Journal Entry is the initial step in the accounting cycle. Within any business, some or the other…

Q: On January 1, Entity A invested cash of P 50,000. On January 5, the business performed services…

A: Formula: Cash collection amount = Total sales x cash collection %

Q: August, the entity completed the following transactions: Aug.2 Paid rent for August, P6,500 3…

A: The ledgers are prepared by posting transactions from journal.

Q: he following transactions occurred during the month of July 2021. July 1 Paid employee salaries,…

A: The ledger accounts are prepared to post the transactions to the specific accounts and further trial…

Q: For each of the transactions, if an expense is to be recognized in January, indicate the amount.…

A: Accrual basis implies that the expenses and revenues are recognized as and when it's due…

Q: For each transaction below, calculate the amount of expense to be recognized in March using…

A: The revenue and expenses are recognised as and when are incurred without considering cash…

I want to verify I'm doing this correctly. If not, please expalin why.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Analyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.Prepare journal entries to record the following transactions for the month of November: A. on first day of the month, issued common stock for cash, $20,000 B. on third day of month, purchased equipment for cash, $10,500 C. on tenth day of month, received cash for accounting services, $14,250 D. on fifteenth day of month, paid miscellaneous expenses, $3,200 E. on last day of month, paid employee salaries, $8,600On January 24, 20Y8, Niche Consulting collected $5,700 it had hilled its clients for services rendered on December 31, 20Y7. How would you record the January 24 transaction, using the accrual basis? A. Increase Cash, $5,700; decrease Fees Earned, $5,700 B. Increase Accounts Receivable, $5,700; increase Fees Earned, $5,700 C. Increase Cash, $5,700; decrease Accounts Receivable, $5,700 D. Increase Cash, $5,700; increase Fees Earned, $5,700

- Considering the following events, determine which month the revenue or expenses would be recorded using the accounting method specified. a. Gerber Company uses the cash basis of accounting. Gerber prepays cash in May for insurance that only covers the following month, (June). b. Matthews and Dudley Attorneys uses the accrual basis of accounting. Matthews and Dudley Attorneys receives cash from customers in June for services to be performed in July. c. Eckstein Company uses the accrual basis of accounting. Eckstein prepays cash in October for rent that covers the following month, (October). d. Gerbino Company uses the cash basis of accounting. Gerbino makes a sale to a customer in February but does not expect payment until March.Determining an Ending Account Balance Jessies Accounting Services was organized on June 1. The company received a contribution of $1,000 from each of the two principal owners. During the month, Jessies Accounting Services provided services for cash of $1,400 and services on account for $450, received $250 from customers in payment of their accounts, purchased supplies on account for $600 and equipment on account for $1,350, received a utility bill for $250 that will not be paid until July, and paid the full amount due on the equipment. Use a T account to determine the companys Cash balance on June 30.Determine the amount of cash expended for Salaries during the month, based on the entries in the following accounts (assume 0 beginning balances).

- Prepare journal entries to record the following transactions that occurred in March: A. on first day of the month, purchased building for cash, $75,000 B. on fourth day of month, purchased inventory, on account, $6,875 C. on eleventh day of month, billed customer for services provided, $8,390 D. on nineteenth day of month, paid current month utility bill, $2,000 E. on last day of month, paid suppliers for previous purchases, $2,850The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.Journal Entries Overnight Delivery Inc. is incorporated on February 1 and enters into the following transactions during its first month of operations: February 15: Received $8,000 cash from customer accounts. February 26: Provided $16,800 of services on account during the month. February 27: Received a $3,400 bill from the local service station for gas and oil used during February. February 28: Paid $400 for wages earned by employees for the month. February 28: Paid $3,230 for February advertising. February 28: Declared and paid $2,000 cash dividends to stockholders. Required Prepare journal entries on the books of Overnight to record the transactions entered into during February. Explain why you agree or disagree with the following: The transactions on February 28 all represent expenses for the month of February because cash was paid. The transaction on February 27 does not represent an expense in February because cash has not yet been paid.Journal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.