For each of the transactions, if an expense is to be recognized in January, indicate the amount. (Enter answers in dollars but not in millions.) Activity Amount a. AMZ Wealth Management paid its salespersons $6,100 in commissions related to December sales of financial advisory services. Answer from AMZ Wealth Management's standpoint. b. On January 31, AMZ Wealth Management determined that it will pay its salespersons $5,650 in commissions related to January sales. The payment will be made in early February. Answer from AMZ Wealth Management's standpoint. 5,650 c. The city of Omaha hired RM, Ic., to provide trash collection services beginning January 1. The city paid $9.6 million for the entire year. Answer from the city's standpoint. $ 115,200,000

For each of the transactions, if an expense is to be recognized in January, indicate the amount. (Enter answers in dollars but not in millions.) Activity Amount a. AMZ Wealth Management paid its salespersons $6,100 in commissions related to December sales of financial advisory services. Answer from AMZ Wealth Management's standpoint. b. On January 31, AMZ Wealth Management determined that it will pay its salespersons $5,650 in commissions related to January sales. The payment will be made in early February. Answer from AMZ Wealth Management's standpoint. 5,650 c. The city of Omaha hired RM, Ic., to provide trash collection services beginning January 1. The city paid $9.6 million for the entire year. Answer from the city's standpoint. $ 115,200,000

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 5PB: Review the following transactions and prepare any necessary journal entries. A. On January 5, Bunnet...

Related questions

Question

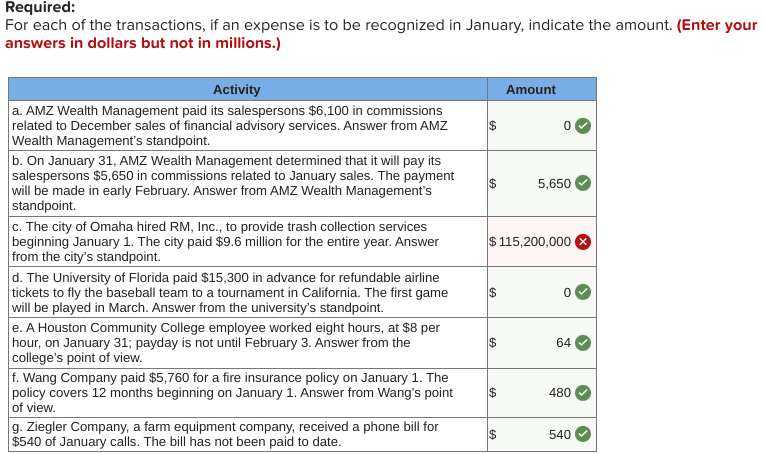

E3-7 (Algo) Identifying Accrual Basis Expenses [LO 3-1, LO 3-2]

Under accrual basis accounting, expenses are recognized when incurred. The following transactions occurred in January:

Transcribed Image Text:Required:

For each of the transactions, if an expense is to be recognized in January, indicate the amount. (Enter your

answers in dollars but not in millions.)

Activity

Amount

a. AMZ Wealth Management paid its salespersons $6,100 in commissions

related to December sales of financial advisory services. Answer from AMZ

Wealth Management's standpoint.

b. On January 31, AMZ Wealth Management determined that it will pay its

salespersons $5,650 in commissions related to January sales. The payment

will be made in early February. Answer from AMZ Wealth Management's

standpoint.

24

24

5,650

c. The city of Omaha hired RM, Inc., to provide trash collection services

beginning January 1. The city paid $9.6 million for the entire year. Answer

from the city's standpoint.

d. The University of Florida paid $15,300 in advance for refundable airline

tickets to fly the baseball team to a tournament in California. The first game

will be played in March. Answer from the university's standpoint.

e. A Houston Community College employee worked eight hours, at $8 per

hour, on January 31; payday is not until February 3. Answer from the

college's point of view.

f. Wang Company paid $5,760 for a fire insurance policy on January 1. The

policy covers 12 months beginning on January 1. Answer from Wang's point

of view.

g. Ziegler Company, a farm equipment company, received a phone bill for

$540 of January calls. The bill has not been paid to date.

$115,200,000

64

24

480

24

540

%24

%24

Expert Solution

Step 1

Accrual basis implies that the expenses and revenues are recognized as and when it's due irrespective or the timing of expenditure or receipt relating to the same.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning