Anirudh Corporation has the following capital structure as at December 31, 20x3: Convertible bonds, 5% Preferred Shares - Series A, 4%, noncumulative Preferred Shares - Series B, $5, cumulative, 70,000 shares issued and outstanding Contributed Surplus - Convertible Bonds Contributed Surplus - Stock Options Common Shares, 1,700,000 shares issued and outstanding Additional Information - The convertible bonds were issued on December 31, 20x0. Bonds of similar risk yielded 4.4% at the time. The bonds mature on December 31, 20x15 and pay interest on Jun 30 and Dec 31. The face value of the bonds is $15,000,000. Each $1,000 bond is convertible into 30 common shares at the option of the holder. The net income for the year ended December 31, 20x4 is $2,800,000. No preferred share dividend had been declared since December 31, 20x2. On December 31, 20x4, Anirudh declared a total of $1,500,000 in dividends. a. The following common stock transactions took place in 20x4: April 30 - Repurchased 60,000 common shares August 31 - Issued 150,000 common shares b. $15,832,154 4,000,000 7,000,000 There are two stock option grants outstanding: Series B12: 50,000 options at an exercise price of $25 Series B13: 75,000 options at an exercise price of $18 225.000 110.000 22,400,000 The Series B preferred shares are convertible into 4 common shares at the option of the holder. Required - Calculate the Basic and Diluted EPS for the December 31, 20x4 year end. Please show your EPS calculations accurate to 3 decimal places. Assume now that the company declared a 2:1 stock split on June 30, 20x4. Calculate the weighted average number of common shares. On March 31, 20x3, Anirudh purchased a subsidiary. One of the conditions of the purchase was the issue of an additional 35,000 common shares on March 31, 20x5 if the cumulative net income of the subsidiary post-acquisition was $2,000,000. This was met on November 30, 20x4. As of December 31, 20x4, the cumulative net income of the subsidiary was $2,150,000 and management believes that there will be no decrease in the cumulative net income of the subsidiary between December 31, 20x4 and March 31, 20x5. The average stock price during the year was $22 The tax rate is 25%

Anirudh Corporation has the following capital structure as at December 31, 20x3: Convertible bonds, 5% Preferred Shares - Series A, 4%, noncumulative Preferred Shares - Series B, $5, cumulative, 70,000 shares issued and outstanding Contributed Surplus - Convertible Bonds Contributed Surplus - Stock Options Common Shares, 1,700,000 shares issued and outstanding Additional Information - The convertible bonds were issued on December 31, 20x0. Bonds of similar risk yielded 4.4% at the time. The bonds mature on December 31, 20x15 and pay interest on Jun 30 and Dec 31. The face value of the bonds is $15,000,000. Each $1,000 bond is convertible into 30 common shares at the option of the holder. The net income for the year ended December 31, 20x4 is $2,800,000. No preferred share dividend had been declared since December 31, 20x2. On December 31, 20x4, Anirudh declared a total of $1,500,000 in dividends. a. The following common stock transactions took place in 20x4: April 30 - Repurchased 60,000 common shares August 31 - Issued 150,000 common shares b. $15,832,154 4,000,000 7,000,000 There are two stock option grants outstanding: Series B12: 50,000 options at an exercise price of $25 Series B13: 75,000 options at an exercise price of $18 225.000 110.000 22,400,000 The Series B preferred shares are convertible into 4 common shares at the option of the holder. Required - Calculate the Basic and Diluted EPS for the December 31, 20x4 year end. Please show your EPS calculations accurate to 3 decimal places. Assume now that the company declared a 2:1 stock split on June 30, 20x4. Calculate the weighted average number of common shares. On March 31, 20x3, Anirudh purchased a subsidiary. One of the conditions of the purchase was the issue of an additional 35,000 common shares on March 31, 20x5 if the cumulative net income of the subsidiary post-acquisition was $2,000,000. This was met on November 30, 20x4. As of December 31, 20x4, the cumulative net income of the subsidiary was $2,150,000 and management believes that there will be no decrease in the cumulative net income of the subsidiary between December 31, 20x4 and March 31, 20x5. The average stock price during the year was $22 The tax rate is 25%

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 12RE: Given the following year-end information, compute Greenwood Corporations basic and diluted earnings...

Related questions

Question

Step by Step calculations

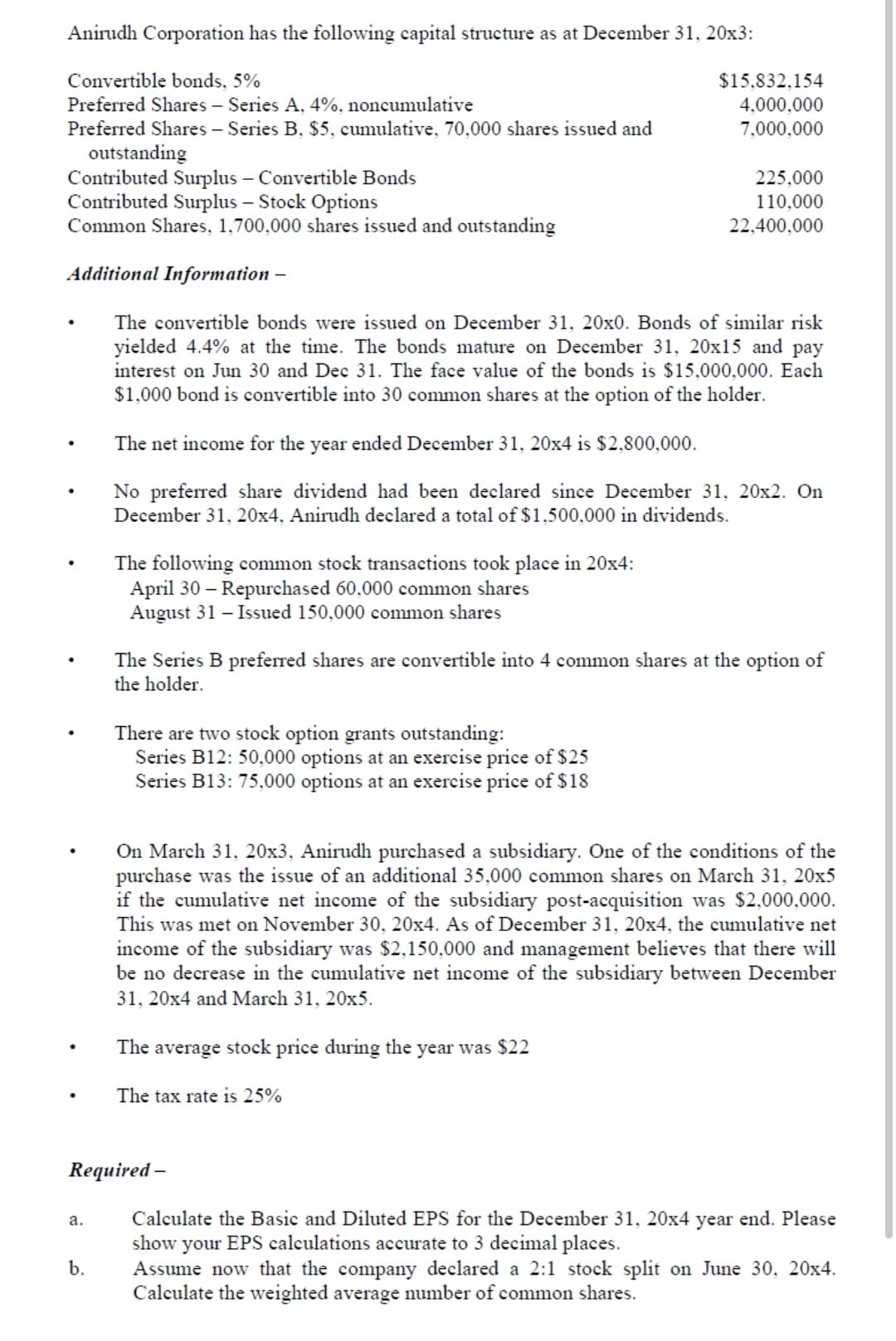

Transcribed Image Text:Anirudh Corporation has the following capital structure as at December 31, 20x3:

Convertible bonds, 5%

$15,832,154

Preferred Shares – Series A, 4%, noncumulative

4,000,000

Preferred Shares – Series B, $5, cumulative, 70,000 shares issued and

7,000,000

outstanding

Contributed Surplus – Convertible Bonds

Contributed Surplus – Stock Options

Common Shares, 1,700,000 shares issued and outstanding

225,000

110,000

22,400,000

Additional Information –

The convertible bonds were issued on December 31, 20x0. Bonds of similar risk

yielded 4.4% at the time. The bonds mature on December 31, 20x15 and pay

interest on Jun 30 and Dec 31. The face value of the bonds is $15,000,000. Each

$1,000 bond is convertible into 30 common shares at the option of the holder.

The net income for the year ended December 31, 20x4 is $2,800,000.

No preferred share dividend had been declared since December 31, 20x2. On

December 31, 20x4, Anirudh declared a total of $1,500,000 in dividends.

The following common stock transactions took place in 20x4:

April 30 – Repurchased 60,000 common shares

August 31 – Issued 150,000 common shares

The Series B preferred shares are convertible into 4 common shares at the option of

the holder.

There are two stock option grants outstanding:

Series B12: 50,000 options at an exercise price of $25

Series B13: 75,000 options at an exercise price of $18

On March 31, 20x3, Anirudh purchased a subsidiary. One of the conditions of the

purchase was the issue of an additional 35,000 common shares on March 31, 20x5

if the cumulative net income of the subsidiary post-acquisition was $2,000,000.

This was met on November 30, 20x4. As of December 31, 20x4, the cumulative net

income of the subsidiary was $2,150,000 and management believes that there will

be no decrease in the cumulative net income of the subsidiary between December

31, 20x4 and March 31, 20x5.

The average stock price during the year was $22

The tax rate is 25%

Required –

Calculate the Basic and Diluted EPS for the December 31, 20x4 year end. Please

show your EPS calculations accurate to 3 decimal places.

Assume now that the company declared a 2:1 stock split on June 30, 20x4.

Calculate the weighted average number of common shares.

а.

b.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 6 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning