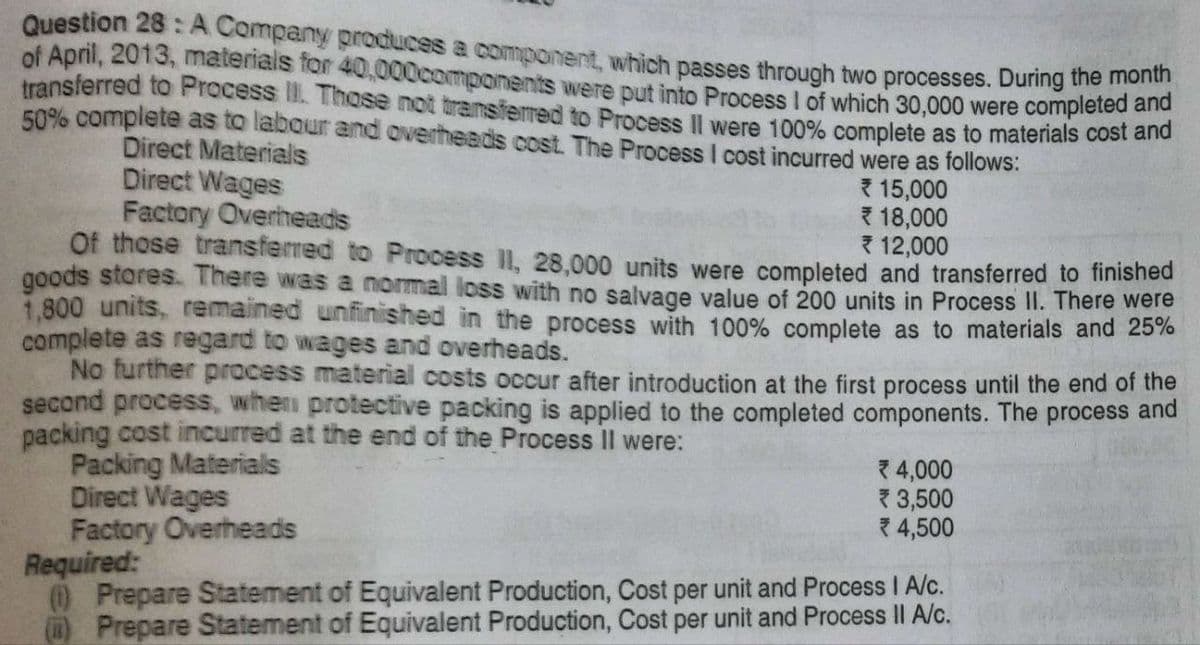

Question 28: A Company produces a component, which passes through two processes. During the mon of April, 2013, materials for 40,000components were put into Process I of which 30,000 were completed and transferred to Process II. Those not transferred to Process Il were 100% complete as to materials cost and 50% complete as to labour and overheads cost. The Process I cost incurred were as follows: Direct Materials 15,000 Direct Wages Factory Overheads *18,000 12,000 Of those transferred to Process II, 28,000 units were completed and transferred to finished goods stores. There was a normal loss with no salvage value of 200 units in Process II. There were 1,800 units, remained unfinished in the process with 100% complete as to materials and 25% complete as regard to wages and overheads. No further process material costs occur after introduction at the first process until the end of the second process, when protective packing is applied to the completed components. The process and packing cost incurred at the end of the Process II were: Packing Materials Direct Wages Factory Overheads 4,000 3,500 4,500 Required: (1) Prepare Statement of Equivalent Production, Cost per unit and Process I A/c. Prepare Statement of Equivalent Production, Cost per unit and Process II A/c.

Question 28: A Company produces a component, which passes through two processes. During the mon of April, 2013, materials for 40,000components were put into Process I of which 30,000 were completed and transferred to Process II. Those not transferred to Process Il were 100% complete as to materials cost and 50% complete as to labour and overheads cost. The Process I cost incurred were as follows: Direct Materials 15,000 Direct Wages Factory Overheads *18,000 12,000 Of those transferred to Process II, 28,000 units were completed and transferred to finished goods stores. There was a normal loss with no salvage value of 200 units in Process II. There were 1,800 units, remained unfinished in the process with 100% complete as to materials and 25% complete as regard to wages and overheads. No further process material costs occur after introduction at the first process until the end of the second process, when protective packing is applied to the completed components. The process and packing cost incurred at the end of the Process II were: Packing Materials Direct Wages Factory Overheads 4,000 3,500 4,500 Required: (1) Prepare Statement of Equivalent Production, Cost per unit and Process I A/c. Prepare Statement of Equivalent Production, Cost per unit and Process II A/c.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter6: Process Cost Accounting—additional Procedures; Accounting For Joint Products And By-products

Section: Chapter Questions

Problem 9P: Clearwater Candy Co. had a cost per equivalent pound for the month of 4.56 for materials, 1.75 for...

Related questions

Question

100%

Transcribed Image Text:Question 28: A Company produces a component, which passes through two processes. During the month

of April, 2013, materials for 40,000components were put into Process I of which 30,000 were completed and

transferred to Process II. Those not transferred to Process Il were 100% complete as to materials cost and

50% complete as to labour and overheads cost. The Process I cost incurred were as follows:

Direct Materials

Direct Wages

15,000

18,000

Factory Overheads

12,000

Of those transferred to Process II, 28,000 units were completed and transferred to finished

goods stores. There was a normal loss with no salvage value of 200 units in Process II. There were

1,800 units, remained unfinished in the process with 100% complete as to materials and 25%

complete as regard to wages and overheads.

No further process material costs occur after introduction at the first process until the end of the

second process, when protective packing is applied to the completed components. The process and

packing cost incurred at the end of the Process II were:

Packing Materials

Direct Wages

Factory Overheads

4,000

3,500

*4,500

Required:

(1) Prepare Statement of Equivalent Production, Cost per unit and Process I A/c.

() Prepare Statement of Equivalent Production, Cost per unit and Process II A/c.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,