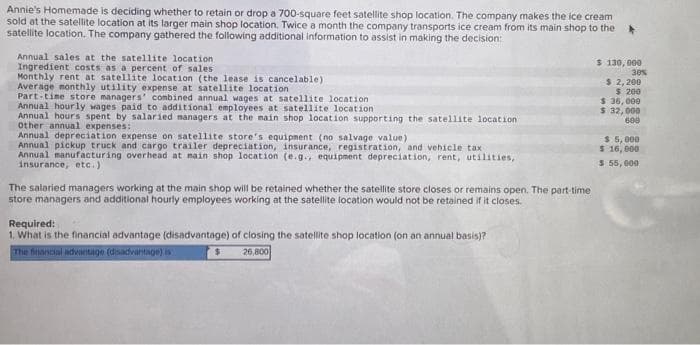

Annie's Homemade is deciding whether to retain or drop a 700-square feet satellite shop location. The company makes the ice cream sold at the satellite location at its larger main shop location. Twice a month the company transports ice cream from its main shop to the satellite location. The company gathered the following additional information to assist in making the decision: Annual sales at the satellite location Ingredient costs as a percent of sales Monthly rent at satellite location (the lease is cancelable). Average monthly utility expense at satellite location. Part-time store managers' combined annual wages at satellite location Annual hourly wages paid to additional employees at satellite location. Annual hours spent by salaried managers at the main shop location supporting the satellite location i Other annual expenses: Annual depreciation expense on satellite store's equipment (no salvage value) Annual pickup truck and cargo trailer depreciation, insurance, registration, and vehicle taxi Annual manufacturing overhead at main shop location (e.g., equipment depreciation, rent, utilities, insurance, etc.) The salaried managers working at the main shop will be retained whether the satellite store closes or remains open. The part-time store managers and additional hourly employees working at the satellite location would not be retained if it closes. Required: 1. What is the financial advantage (disadvantage) of closing the satellite shop location (on an annual basis)? The financial advantage (disadvantage) is 26,800 $ $ 130,000 $ 2,200 $ 200 $ 35,000 $ 32,000 600 30% $ 5,000 $ 16,000 $ 55,000

Annie's Homemade is deciding whether to retain or drop a 700-square feet satellite shop location. The company makes the ice cream sold at the satellite location at its larger main shop location. Twice a month the company transports ice cream from its main shop to the satellite location. The company gathered the following additional information to assist in making the decision: Annual sales at the satellite location Ingredient costs as a percent of sales Monthly rent at satellite location (the lease is cancelable). Average monthly utility expense at satellite location. Part-time store managers' combined annual wages at satellite location Annual hourly wages paid to additional employees at satellite location. Annual hours spent by salaried managers at the main shop location supporting the satellite location i Other annual expenses: Annual depreciation expense on satellite store's equipment (no salvage value) Annual pickup truck and cargo trailer depreciation, insurance, registration, and vehicle taxi Annual manufacturing overhead at main shop location (e.g., equipment depreciation, rent, utilities, insurance, etc.) The salaried managers working at the main shop will be retained whether the satellite store closes or remains open. The part-time store managers and additional hourly employees working at the satellite location would not be retained if it closes. Required: 1. What is the financial advantage (disadvantage) of closing the satellite shop location (on an annual basis)? The financial advantage (disadvantage) is 26,800 $ $ 130,000 $ 2,200 $ 200 $ 35,000 $ 32,000 600 30% $ 5,000 $ 16,000 $ 55,000

Essentials Of Business Analytics

1st Edition

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Camm, Jeff.

Chapter11: Monte Carlo Simulation

Section: Chapter Questions

Problem 10P

Related questions

Question

Transcribed Image Text:Annie's Homemade is deciding whether to retain or drop a 700-square feet satellite shop location. The company makes the ice cream

sold at the satellite location at its larger main shop location. Twice a month the company transports ice cream from its main shop to the

satellite location. The company gathered the following additional information to assist in making the decision:

Annual sales at the satellite location i

Ingredient costs as a percent of sales

Monthly rent at satellite location (the lease is cancelable).

Average monthly utility expense at satellite location.

Part-time store managers' combined annual wages at satellite location

Annual hourly wages paid to additional employees at satellite location

Annual hours spent by salaried managers at the main shop location supporting the satellite location i

Other annual expenses:

Annual depreciation expense on satellite store's equipment (no salvage value)

Annual pickup truck and cargo trailer depreciation, insurance, registration, and vehicle tax

Annual manufacturing overhead at main shop location (e.g., equipment depreciation, rent, utilities,

insurance, etc.)

The salaried managers working at the main shop will be retained whether the satellite store closes or remains open. The part-time

store managers and additional hourly employees working at the satellite location would not be retained if it closes.

Required:

1. What is the financial advantage (disadvantage) of closing the satellite shop location (on an annual basis)?

The financial advantage (disadvantage) is

26,800

$

$ 130,000

30%

$ 2,200

$ 200

$ 36,000

$ 32,000

600

$5,000

$ 16,000

$ 55,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College