+ Annotated B Class Specifi WileyPLL X WOMEN EM THE LIVED E En https://edugen.wileyplus.com/edugen/student/mainfr.uni Your answer is partially correct. Try again. The following information relates to Marin Co. for the year ended December 31, 2017: net income 1,138 million; unrealized holding loss of $11 million related to available-for-sale debt securities during the year; accumulated other comprehensive income of $61.1 million on December 31, 2016. Assuming no other changes in accumulated other comprehensive income. Determine (a) other comprehensive income for 2017, (b) comprehensive income for 2017, and (c) accumulated other comprehensive income at December 31, 2017. (Enter answers in millions to 1 decimal place, e.g. 25.5. Enter loss using either a negative sign preceding the number e.g. -45.2 or parentheses e.g. (45.2).) -9 -10 11.0 million (a) Other comprehensive income(loss) for 2017 (b) Comprehensive income for 2017 1,127 million by 50,1 million (c) Accumulated other comprehensive income SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Question Attempts: 2 of 3 used SAVE FOR LATER SUBMIT ANSWER reement Privacy Policy 2000-2019 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. Version 4.24.15.6 10:21 PM Type here to search 10/15/2019 Print Screen 2 F3 F7 F5 F6 F4 Insert F8 F9 F10 F11 F12 $ & ) 3 7 W T Y U F J K + II PP 4 LE

+ Annotated B Class Specifi WileyPLL X WOMEN EM THE LIVED E En https://edugen.wileyplus.com/edugen/student/mainfr.uni Your answer is partially correct. Try again. The following information relates to Marin Co. for the year ended December 31, 2017: net income 1,138 million; unrealized holding loss of $11 million related to available-for-sale debt securities during the year; accumulated other comprehensive income of $61.1 million on December 31, 2016. Assuming no other changes in accumulated other comprehensive income. Determine (a) other comprehensive income for 2017, (b) comprehensive income for 2017, and (c) accumulated other comprehensive income at December 31, 2017. (Enter answers in millions to 1 decimal place, e.g. 25.5. Enter loss using either a negative sign preceding the number e.g. -45.2 or parentheses e.g. (45.2).) -9 -10 11.0 million (a) Other comprehensive income(loss) for 2017 (b) Comprehensive income for 2017 1,127 million by 50,1 million (c) Accumulated other comprehensive income SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Question Attempts: 2 of 3 used SAVE FOR LATER SUBMIT ANSWER reement Privacy Policy 2000-2019 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. Version 4.24.15.6 10:21 PM Type here to search 10/15/2019 Print Screen 2 F3 F7 F5 F6 F4 Insert F8 F9 F10 F11 F12 $ & ) 3 7 W T Y U F J K + II PP 4 LE

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 23P

Related questions

Question

Transcribed Image Text:+

Annotated B

Class Specifi

WileyPLL X

WOMEN EM

THE LIVED E

En

https://edugen.wileyplus.com/edugen/student/mainfr.uni

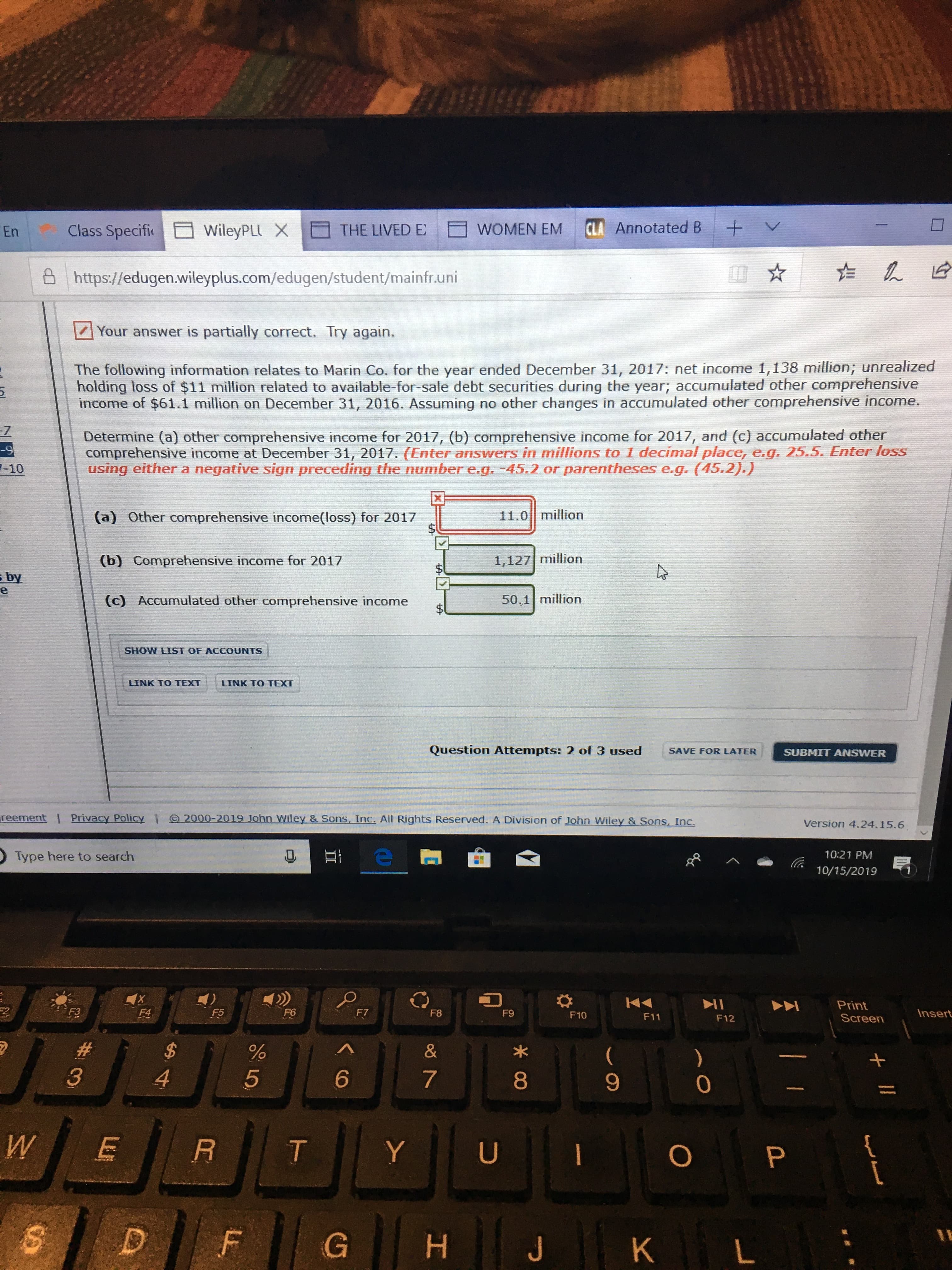

Your answer is partially correct. Try again.

The following information relates to Marin Co. for the year ended December 31, 2017: net income 1,138 million; unrealized

holding loss of $11 million related to available-for-sale debt securities during the year; accumulated other comprehensive

income of $61.1 million on December 31, 2016. Assuming no other changes in accumulated other comprehensive income.

Determine (a) other comprehensive income for 2017, (b) comprehensive income for 2017, and (c) accumulated other

comprehensive income at December 31, 2017. (Enter answers in millions to 1 decimal place, e.g. 25.5. Enter loss

using either a negative sign preceding the number e.g. -45.2 or parentheses e.g. (45.2).)

-9

-10

11.0 million

(a) Other comprehensive income(loss) for 2017

(b) Comprehensive income for 2017

1,127 million

by

50,1 million

(c) Accumulated other comprehensive income

SHOW LIST OF ACCOUNTS

LINK TO TEXT

LINK TO TEXT

Question Attempts: 2 of 3 used

SAVE FOR LATER

SUBMIT ANSWER

reement

Privacy Policy

2000-2019 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc.

Version 4.24.15.6

10:21 PM

Type here to search

10/15/2019

Print

Screen

2

F3

F7

F5

F6

F4

Insert

F8

F9

F10

F11

F12

$

&

)

3

7

W

T

Y

U

F

J

K

+ II

PP

4

LE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning