Balance Sheet as of December 31, 2020 Assets Liabilities and Owners' Equity ent assets Current liabilities sh counts receivable $ 21,940 44,880 Accounts payable Notes payable $ 56,100 15,300 entory 104,960 Total $ 71,400 otal $ 171,780 Long-term debt $ 143,000 d assets t plant and Owners' equity Common stock and paid-in $436,000 $ 121,000 oment

Balance Sheet as of December 31, 2020 Assets Liabilities and Owners' Equity ent assets Current liabilities sh counts receivable $ 21,940 44,880 Accounts payable Notes payable $ 56,100 15,300 entory 104,960 Total $ 71,400 otal $ 171,780 Long-term debt $ 143,000 d assets t plant and Owners' equity Common stock and paid-in $436,000 $ 121,000 oment

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter16: Financial Planning And Forecasting

Section: Chapter Questions

Problem 8P: LONG-TERM FINANCING NEEDED At year-end 2019, total assets for Arrington Inc. were 1.8 million and...

Related questions

Question

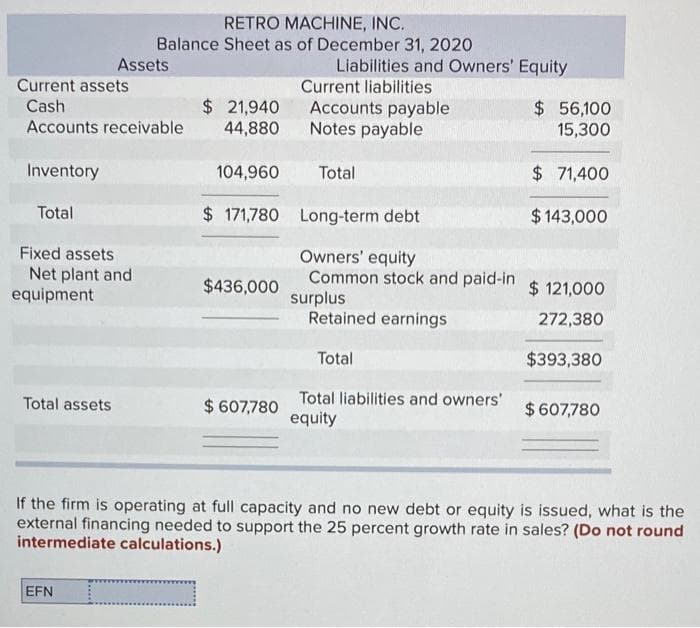

Transcribed Image Text:RETRO MACHINE, INC.

Balance Sheet as of December 31, 2020

Assets

Liabilities and Owners' Equity

Current assets

Current liabilities

$ 21,940

44,880

Cash

Accounts payable

Notes payable

$56,100

15,300

Accounts receivable

Inventory

104,960

Total

$ 71,400

Total

$ 171,780 Long-term debt

$ 143,000

Fixed assets

Owners' equity

Common stock and paid-in

surplus

Retained earnings

Net plant and

equipment

$436,000

$ 121,000

272,380

Total

$393,380

Total liabilities and owners'

equity

Total assets

$ 607,780

$ 607,780

If the firm is operating at full capacity and no new debt or equity is issued, what is the

external financing needed to support the 25 percent growth rate in sales? (Do not round

intermediate calculations.)

EFN

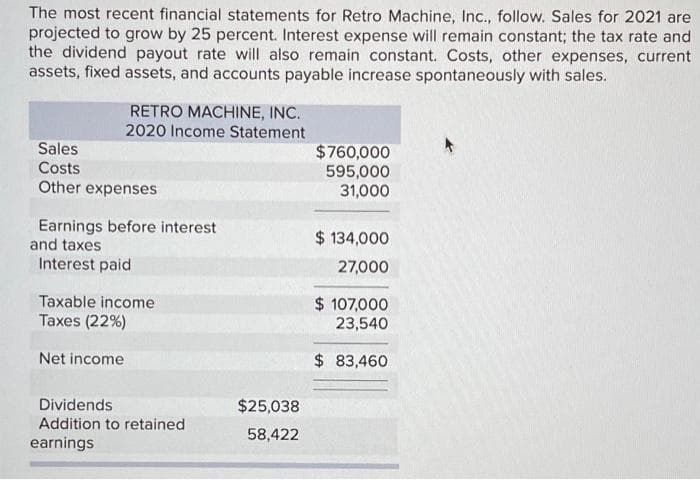

Transcribed Image Text:The most recent financial statements for Retro Machine, Inc., follow. Sales for 2021 are

projected to grow by 25 percent. Interest expense will remain constant; the tax rate and

the dividend payout rate will also remain constant. Costs, other expenses, current

assets, fixed assets, and accounts payable increase spontaneously with sales.

RETRO MACHINE, INC.

2020 Income Statement

Sales

Costs

$760,000

595,000

31,000

Other expenses

Earnings before interest

and taxes

Interest paid

$ 134,000

27,000

Taxable income

$ 107,000

23,540

Taxes (22%)

Net income

$ 83,460

Dividends

$25,038

Addition to retained

58,422

earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT