Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 4PA

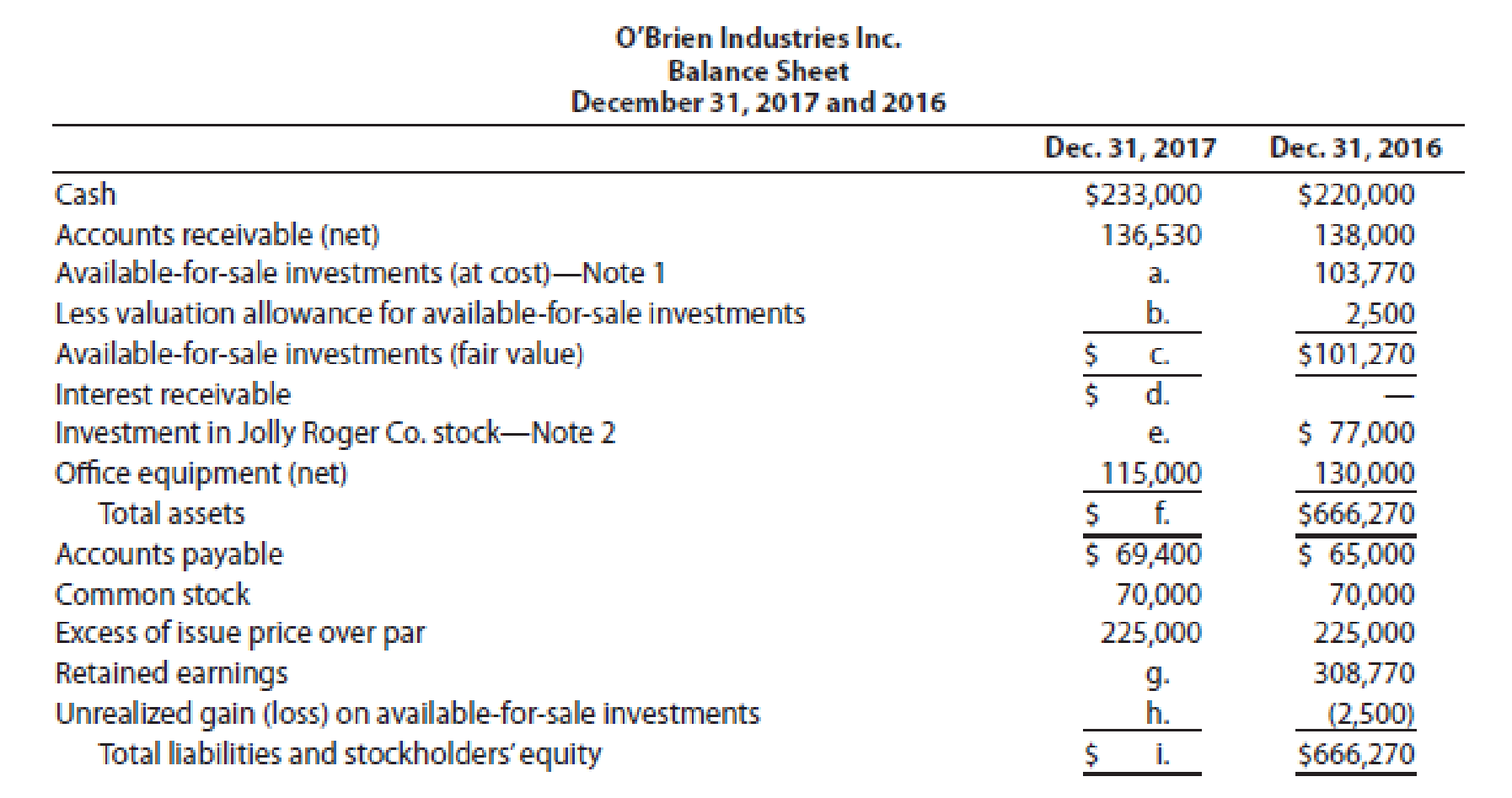

O’Brien Industries Inc. is a book publisher. The comparative unclassified balance sheets for December 31, 2017 and 2016 follow. Selected missing balances are shown by letters.

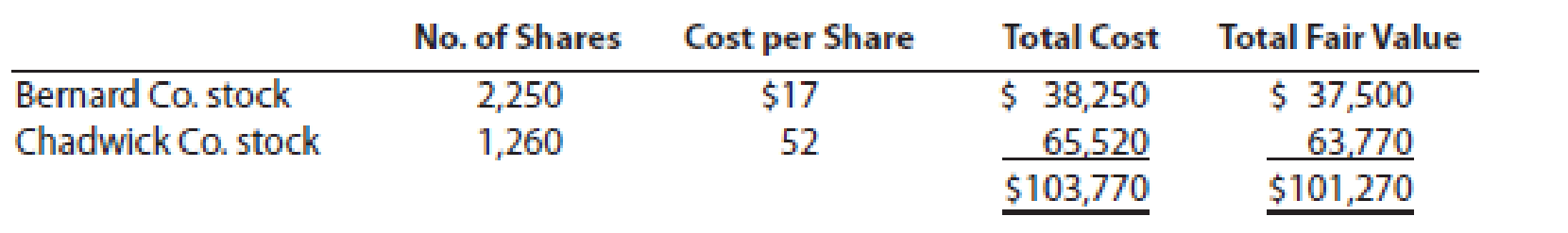

Note 1. Investments are classified as available for sale. The investments at cost and fair value on December 31, 2016, are as follows:

Note 2. The investment in Jolly Roger Co. stock is an equity method investment representing 30% of the outstanding shares of Jolly Roger Co. The following selected investment transactions occurred during 2017:

| May 5. | Purchased 3,080 shares of Gozar Inc. at $30 per share including brokerage commission. Gozar Inc. is classified as an available-for-sale security. |

| Oct. 1. | Purchased $40,000 of Nightline Co. 6%, 10-year bonds at 100. The bonds are classified as available for sale. The bonds pay interest on October 1 and April 1. |

| 9. | Dividends of $12,500 are received on the Jolly Roger Co. investment. |

| Dec. 31. | Jolly Roger Co. reported a total net income of $112,000 for 2017. O’Brien Industries Inc. recorded equity earnings for its share of Jolly Roger Co. net income. |

| 31. | Accrued three months of interest on the Nightline bonds. |

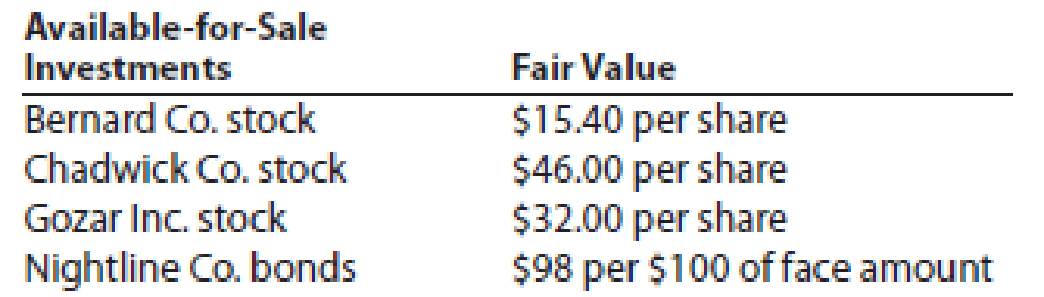

| 31. | Adjusted the available-for-sale investment portfolio to fair value, using the following fair value per-share amounts: |

| 31. | Closed the O’Brien Industries Inc. net income of $146,230. O’Brien Industries Inc. paid no dividends during the year. |

Instructions

Determine the missing letters in the unclassified balance sheet. Provide appropriate supporting calculations.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

At the beginning of 2016, Pioneer Products’ ownership interest in the common stock of LLB Co. increased to the point that it became appropriate to begin using the equity method of accounting for the investment. The balance in the investment account was $44 million at the time of the change but would have been $56 million if Pioneer had used the equity method and the account had been adjusted for investee net income and dividends. How should Pioneer report the change? Would your answer be the same if Pioneer is changing from the equity method rather than to the equity method?

The Trump Companies Inc. has ownership interests in several public companies. At the beginning of 2016, the company’s ownership interest in the common stock of Milken Properties increased to the point that it became appropriate to begin using the equity method of accounting for the investment. The balance in the investment account was $31 million at the time of the change. Accountants working with company records determined that the balance would have been $48 million if the account had been adjusted for investee net income and dividends as prescribed by the equity method. Required: 1. Prepare the journal entry to record the change in principle. 2. Briefly describe other steps Trump should take to report the change. 3. Suppose Trump is changing from the equity method rather than to the equity method. How would your answers to requirements 1 and 2 differ?

The Trump Companies, Inc., has ownership interests in several public companies. At the beginning of 2016, the company’s ownership interest in the common stock of Milken Properties increased to the point that it became appropriate to begin using the equity method of accounting for the investment. The balance in the investment account was $31 million at the time of the change. Accountants working with company records determined that the balance would have been $48 million if the account had been adjusted to reflect the equity method. Required: 1. Prepare the journal entry to record the change in accounting principle. (Ignore income taxes.) 2. Briefly describe other steps Trump should take to report the change. 3. Suppose Trump is changing from the equity method rather than to the equity method. How would your answers to requirements 1 and 2 differ?

Chapter 15 Solutions

Financial Accounting

Ch. 15.MJ - Prob. 1DQCh. 15.MJ - What is the difference between classifying an...Ch. 15.MJ - If a functional expense classification is used for...Ch. 15.MJ - Prob. 4DQCh. 15.MJ - What are two main differences in inventory...Ch. 15.MJ - Prob. 6DQCh. 15.MJ - Prob. 7DQCh. 15.MJ - Prob. 8DQCh. 15.MJ - Prob. 9DQCh. 15.MJ - How is treasury stock reported under IFRS? How...

Ch. 15.MJ - IFRS Activity 1

Unilever Group is a global company...Ch. 15.MJ - IFRS Activity 2 The following is a recent...Ch. 15.MJ - Prob. 3IFRSCh. 15 - Why might a business invest cash in temporary...Ch. 15 - What causes a gain or loss on the sale of a bond...Ch. 15 - When is the equity method the appropriate...Ch. 15 - Prob. 4DQCh. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQCh. 15 - Prob. 1PEACh. 15 - Prob. 1PEBCh. 15 - On February 10, 15,000 shares of Sting Company are...Ch. 15 - Prob. 2PEBCh. 15 - Prob. 3PEACh. 15 - Prob. 3PEBCh. 15 - Prob. 4PEACh. 15 - Prob. 4PEBCh. 15 - Prob. 5PEACh. 15 - On January 1, 2016, Valuation Allowance for...Ch. 15 - Prob. 6PEACh. 15 - Prob. 6PEBCh. 15 - Parilo Company acquired 170,000 of Makofske Co.,...Ch. 15 - Prob. 2ECh. 15 - Prob. 3ECh. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - On March 4, Breen Corporation acquired 7,500...Ch. 15 - Prob. 7ECh. 15 - Prob. 8ECh. 15 - Seamus Industries Inc. buys and sells investments...Ch. 15 - Prob. 10ECh. 15 - Prob. 11ECh. 15 - Prob. 12ECh. 15 - Prob. 13ECh. 15 - JED Capital Inc. makes investments in trading...Ch. 15 - Prob. 15ECh. 15 - Prob. 16ECh. 15 - Prob. 17ECh. 15 - Prob. 18ECh. 15 - Prob. 19ECh. 15 - The investments of Steelers Inc. include a single...Ch. 15 - Prob. 21ECh. 15 - Storm, Inc. purchased the following...Ch. 15 - Prob. 23ECh. 15 - Prob. 24ECh. 15 - Prob. 25ECh. 15 - Prob. 26ECh. 15 - Prob. 27ECh. 15 - Prob. 28ECh. 15 - Prob. 29ECh. 15 - Prob. 1PACh. 15 - Prob. 2PACh. 15 - Prob. 3PACh. 15 - OBrien Industries Inc. is a book publisher. The...Ch. 15 - Prob. 1PBCh. 15 - Prob. 2PBCh. 15 - Prob. 3PBCh. 15 - Prob. 4PBCh. 15 - Selected transactions completed by Equinox...Ch. 15 - On July 16, 1998, Wyatt Corp. purchased 40 acres...Ch. 15 - International Financial Reporting Standard No. 16...Ch. 15 - Prob. 3CPCh. 15 - Berkshire Hathaway, the investment holding company...Ch. 15 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Graham Railways Inc. is evaluating its operations and provides the following information: Required: For each of the years 2017 through 2019, calculate Graham Railwayss earnings per share and dividend yield ratio. The company has no preferred stock or other potentially dilutive securities outstanding.arrow_forwardAdams Industries holds 40,000 shares of FedEx common stock. On December 31, 2015, and December 31, 2016, the market value of the stock is $95 and $100 per share, respectively. What is the appropriate reporting category for this investment and at what amount will it be reported in the 2016 balance sheet?arrow_forward(Fair Value Measurement) Presented below is information related to the purchases of common stock by Lilly Company during 2017. Cost (at purchase date) Fair Value(at December 31) Investment in Arroyo Company stock $100,000 $ 80,000 Investment in Lee Corporation stock 250,000 300,000 Investment in Woods Inc. stock 180,000 190,000 Total $530,000 $570,000 Instructions(Assume a zero balance for any Fair Value Adjustment account.)(a) What entry would Lilly make at December 31, 2017, to record the investment in Arroyo Company stock if it chooses to report this security using the fair value option?(b) What entry(ies) would Lilly make at December 31, 2017, to record the investments in the Lee and Woods corporations, assuming that Lilly did not select the fair value option for these investments?arrow_forward

- Lexington Co. has the following securities outstanding on December 31, 2017 (its first year of operations). Cost Fair Value Greenspan Corp. stock $20,000 $19,000 Summerset Company stock 9,500 8,800 Tinkers Company stock 20,000 20,600 $49,500 $48,400 During 2018, Summerset Company stock was sold for $9,200, the difference between the $9,200 and the “fair value” of $8,800 being recorded as a “Gain on Sale of Investments.” The market price of the stock on December 31, 2018, was Greenspan Corp. stock $19,900; Tinkers Company stock $20,500.Instructions(a) What justification is there for valuing equity securities at fair value and reporting the unrealized gain or loss as part of net income?(b) How should Lexington Co. report this information in its financial statements at December 31, 2017? Explain.(c) Did Lexington Co. properly account for the sale of the Summerset Company stock? Explain.(d) Are there any additional entries necessary for Lexington Co. at December 31,…arrow_forwardPine Company makes an investment in Holt Company. Journalize the following transactions assuming that Pine Company uses (a) the fair value method and (b) the equity method for its investment in Holt Company: 1) On Jan. 1, 2017, Pine bought 30% of Holt’s common stock. Total book value of all Holt’s common stock was $800,000 on this date. 2) During 2017, Holt reported $40,000 of net income. 3) During 2017, Holt paid $20,000 of dividendsarrow_forwardPart AAl Salam Company began operations in 2016. Since then, it has reported the following gains andlosses for its investments in trading securities on the income statement:2016 2017 2018Gains (losses) from sale of trading investments $15,000 $(20,000) $14,000Unrealized holding gains (losses) on valuation of tradinginvestments(25,000) 10,000 (30,000)RequiredFor Al Salam Company:Calculate the balance in the Fair Value Adjustment account at December 31, 2018 (after theadjusting entry for 2018 is made).Part BThe following scenarios are independent from each other1. Al Faris Corp. issued €6,000,000 par value 10% convertible bonds at 98. The liabilitycomponent alone would have been valued at 95.2. Al Rassam Company issued €7,000,000 par value 10% bonds for €6,860,000. One sharewarrant was issued with each €100 par value bond. At the time of issuance, the warrantswere selling for €4. The net present value of the bonds without the warrants was €6,720,000.3. Mazaya, Inc. had an 11%, €5,000,000…arrow_forward

- On January 1, 2017, Vancouver Corporation paid $400,000 to purchase 40% of the outstanding voting stock of Montreal Corporation. The equity method is used to account for the investment. The following data relate to this investment.2017∙ Dividends received from Montreal Corporation amounted to $20,000.∙ Net income reported by Montreal Corporation was $200,000.∙ Current market value of Montreal Corporation investment on December 31, 2017, was $700,000.2018∙ Dividends received from Montreal Corporation amounted to $30,000.∙ Net income reported by Montreal Corporation was $300,000.∙ Current market value of English Court Corporation investment on December 31, 2018, was $860,000.∙ The investment was sold on December 31, 2017, for $830,000.Prepare all journal entries for 2017 and 2018 relating to Vancouver Corporation's investment in Montreal Corporation.arrow_forwardCardinal Company acquires an 80% interest in Huron Company common stock for $420,000 cash on January 1, 2015. At that time, Huron Company has the following balance sheet: (attached)Prepare a determination and distribution of excess schedule for the investment in Huron Company (a value analysis is not needed). Prepare journal entries that Cardinal Company would make on its books to record income earned and/or dividends received on its investment in Huron Company during 2015 and 2016 under the following methods: simple equity, sophisticated equity, and cost.arrow_forwardPorter Corporation purchased 80% of the common stock of Salem Company for $850,000 on January 1, 2013. During the next three years, Salem had the following income and Dividends paid: Year Income Dividends 2013 $100,000 $25,000 2014 $110,000 $35,000 2015 $170,000 $60,000 Prepare the journal entries made under both methods and then compute the ending balance in the "investment" account under both methods.arrow_forward

- Crane Corporation has the following accounts included in its December 31, 2017, trial balance: Equity Investments (trading) $21,000, Goodwill $150,000, Prepaid Insurance $12,000, Patents $220,000, and Franchises $130,000. Prepare the intangible assets section of the balance sheet.arrow_forwardO’Brien Industries Inc. is a book publisher. The partial balance sheets for December 31, 20Y4 and 20Y5 are as follows: The available-for-sale investments at cost and fair value on December 31, 20Y4, are as follows: The investment in Jolly Roger Co. stock represents 30% of the outstanding shares of Jolly Roger Co. The following selected transactions occurred during 20Y5: Jan. 2. Purchased $94,400 of Gozar Inc. 5%, 10-year bonds at 100. The bonds are classified as an available-for-sale investment. The bonds pay interest on June 30 and December 31. June 30. Received interest for 6 months on the Gozar Inc. bonds purchased on January 2. Oct. 1. Purchased $40,000 of Nightline Co. 6%, 10-year bonds at 100. The bonds are classified as an available-for-sale investment. The bonds pay interest on October 1 and April 1. 9. Dividends of $12,500 are received on the Jolly Roger Co. investment. Dec. 31. Jolly Roger Co. reported a total net income of $112,000 for…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License