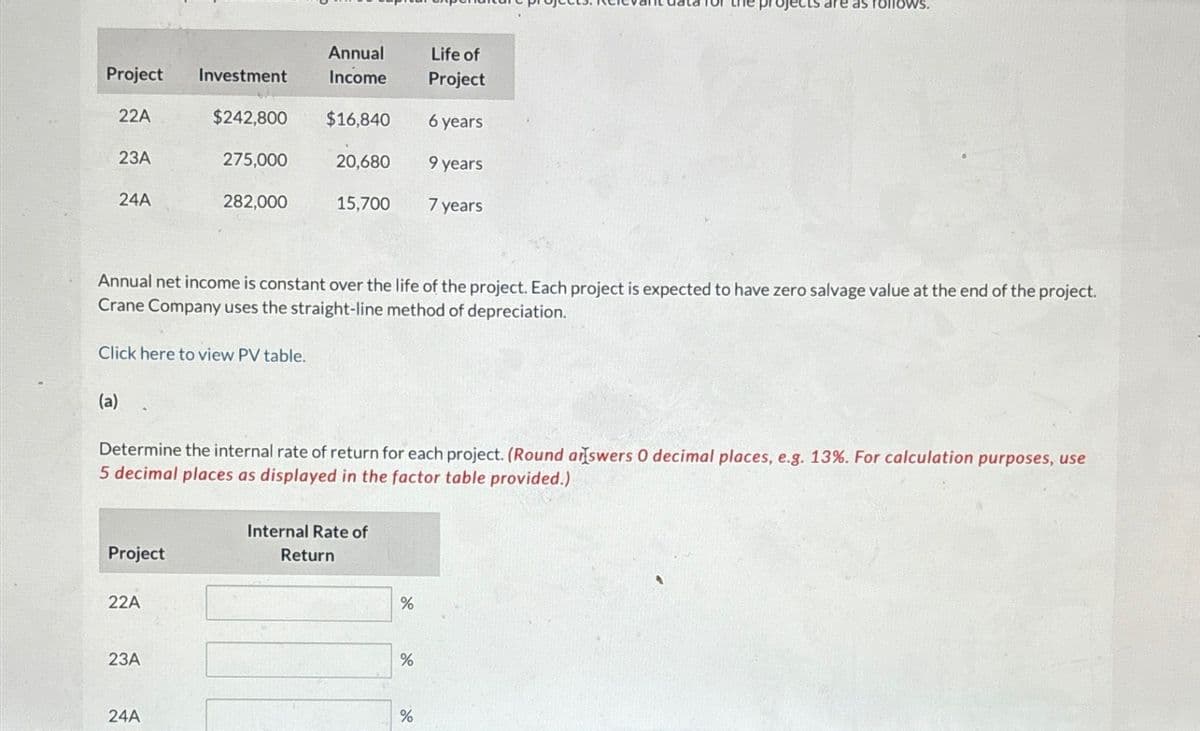

Annual Project Investment Income Life of Project 22A $242,800 $16,840 6 years 23A 275,000 20,680 9 years 24A 282,000 15,700 7 years are as follows. Annual net income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. Crane Company uses the straight-line method of depreciation. Click here to view PV table. (a) Determine the internal rate of return for each project. (Round answers O decimal places, e.g. 13%. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Internal Rate of Project 22A 23A Return % % 24A %

Annual Project Investment Income Life of Project 22A $242,800 $16,840 6 years 23A 275,000 20,680 9 years 24A 282,000 15,700 7 years are as follows. Annual net income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. Crane Company uses the straight-line method of depreciation. Click here to view PV table. (a) Determine the internal rate of return for each project. (Round answers O decimal places, e.g. 13%. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Internal Rate of Project 22A 23A Return % % 24A %

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 14E

Related questions

Question

Haresh

Transcribed Image Text:Annual

Project Investment

Income

Life of

Project

22A

$242,800

$16,840

6 years

23A

275,000

20,680

9 years

24A

282,000

15,700

7 years

are as follows.

Annual net income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project.

Crane Company uses the straight-line method of depreciation.

Click here to view PV table.

(a)

Determine the internal rate of return for each project. (Round answers O decimal places, e.g. 13%. For calculation purposes, use

5 decimal places as displayed in the factor table provided.)

Internal Rate of

Project

22A

23A

Return

%

%

24A

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning