Answer ANY 2 from the following Questions Q.1. You are an investment analyst domiciled in Country Z doing a cross-country comparison of the financial performance of two manufacturing companies in the pharmaceuticals industry. Both companies, X and Y (located in Countries X and Y), have similar expected sales of $600 million. Country X has a corporate income tax. Country Y has no income tax but relies on indirect taxes. Selected data for companies X and Y are as follows: Соmpany X $120 million Сompany Y $72 million Pretax income Return on sales 12.0% 12.0% Required: Determine which company promises to have the better financial performance? What tax considerations might affect your conclusions?

Answer ANY 2 from the following Questions Q.1. You are an investment analyst domiciled in Country Z doing a cross-country comparison of the financial performance of two manufacturing companies in the pharmaceuticals industry. Both companies, X and Y (located in Countries X and Y), have similar expected sales of $600 million. Country X has a corporate income tax. Country Y has no income tax but relies on indirect taxes. Selected data for companies X and Y are as follows: Соmpany X $120 million Сompany Y $72 million Pretax income Return on sales 12.0% 12.0% Required: Determine which company promises to have the better financial performance? What tax considerations might affect your conclusions?

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

Transcribed Image Text:Ass gnment2 -IntACCT403 - Mcrosoft Word

عرض

أبجد هوز أبجد هوز أيجد هوز . هور

أبجد هوز

南 ,三,三 |,Aa

A

1 olgic

-加一、三■==

- A - ay - A

العنوان

2 ülgic

scli , 1

blasi

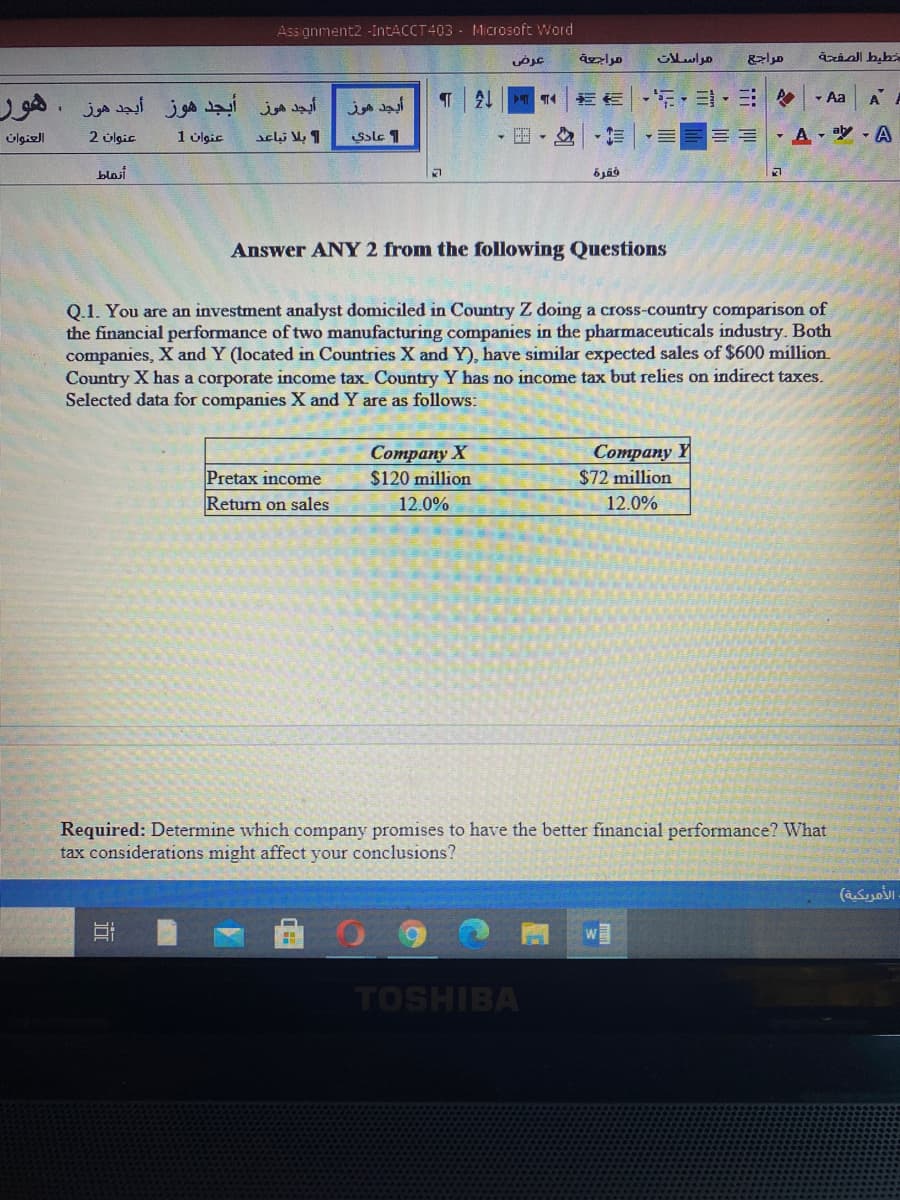

Answer ANY 2 from the following Questions

Q.1. You are an investment analyst domiciled in Country Z doing a cross-country comparison of

the financial performance of two manufacturing companies in the pharmaceuticals industry. Both

companies, X and Y (located in Countries X and Y), have similar expected sales of $600 million.

Country X has a corporate income tax. Country Y has no income tax but relies on indirect taxes.

Selected data for companies X and Y are as follows:

Соmpany X

$120 million

Сompany Y

$72 million

Pretax income

Return on sales

12.0%

12.0%

Required: Determine which company promises to have the better financial performance? What

tax considerations might affect your conclusions?

الأمريكية(

TOSHIBA

近

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you