held firm, you do not have access to the necessary data. If you want to estimate a beta for DUC, will have to work with some comparable firm data. Calculate the unlevered betas for each of you the four basic comparable firms shown below. (Hint: Be sure to adjust for the respective tax rates given.) Comparable Firms Sales Levered Total Тах ($ Mill) Beta Debt Ratio Rate

held firm, you do not have access to the necessary data. If you want to estimate a beta for DUC, will have to work with some comparable firm data. Calculate the unlevered betas for each of you the four basic comparable firms shown below. (Hint: Be sure to adjust for the respective tax rates given.) Comparable Firms Sales Levered Total Тах ($ Mill) Beta Debt Ratio Rate

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter15: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 2Q: How would each of the following changes tend to affect aggregate payout ratios (that is, the average...

Related questions

Question

What is the unlevered beta for each of the four comparable firms? Additionally, estimate an equally-weighted and sales-weighted average unlevered beta.

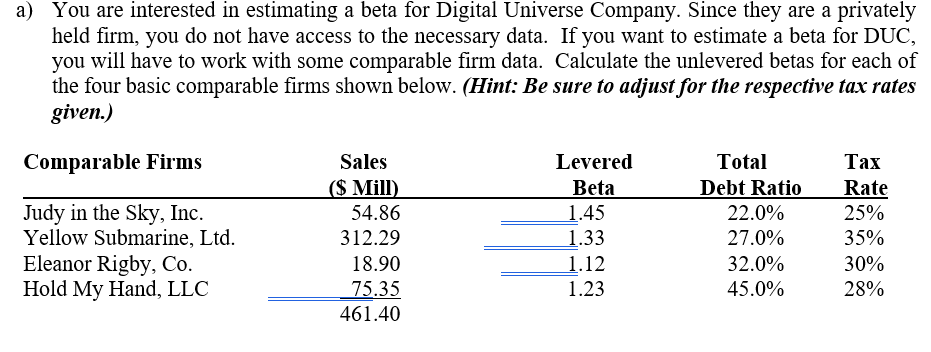

Transcribed Image Text:a) You are interested in estimating a beta for Digital Universe Company. Since they are a privately

held firm, you do not have access to the necessary data. If you want to estimate a beta for DUC,

you will have to work with some comparable firm data. Calculate the unlevered betas for each of

the four basic comparable firms shown below. (Hint: Be sure to adjust for the respective tax rates

given.)

Comparable Firms

Sales

Levered

Total

Таx

($ Mill)

Debt Ratio

Beta

1.45

1.33

Rate

Judy in the Sky, Inc.

Yellow Submarine, Ltd.

Eleanor Rigby, Co.

Hold My Hand, LLC

54.86

22.0%

25%

312.29

27.0%

35%

18.90

1.12

1.23

32.0%

30%

75.35

461.40

45.0%

28%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College