Answer is not complete. Total Company West Central East Amount Amount Amount Amount % 100.0 100.0 Sales 100.0 100.0 1,813,000 699,000 311,000 803,000 Variable expenses 30.5 243,000 30.3 317,000 36.1 45.4 Cost of goods sold 655,000 95,000 80,000 3.9 3.6 39,000 5.6 Shipping expense 4.4 12,000 29,000 Total variable expenses Contribution margin 1,078,000 65.6 531,000 66.1 343,000 59.5 49.1 204,000 Traceable fixed expenses: 52,000 16.7 6.4 107,000 Salaries 210,000 11.6 51,000 15.3 8,800 2.8 1.9 14,400 2.1 Utilities 38,800 2.1 15,600 32.1 103,000 33.1 244.000 30.4 235,000 582,000 33.6 Advertising (Traceable) Depreciation 83,000 4.6 31,000 3.9 27,000 3.9 25,000 8.0 Total traceable fixed expenses 50.4 188,800 42.5 383,400 60.7 913,800 341,600 54.8 9.1 15,200 164,200 4.9 23.6 Regional segment margin (5.8) (40,400) 189,400 Common fixed expenses: Advertising (general) 90,000 5.0 General Administrative expense 63,000 3.5 Total common fixed expense 153,000 8.4 $ Net operating income (loss) 11,200 0.6

I am resubmitting this question as I am getting flagged that there is information missing.

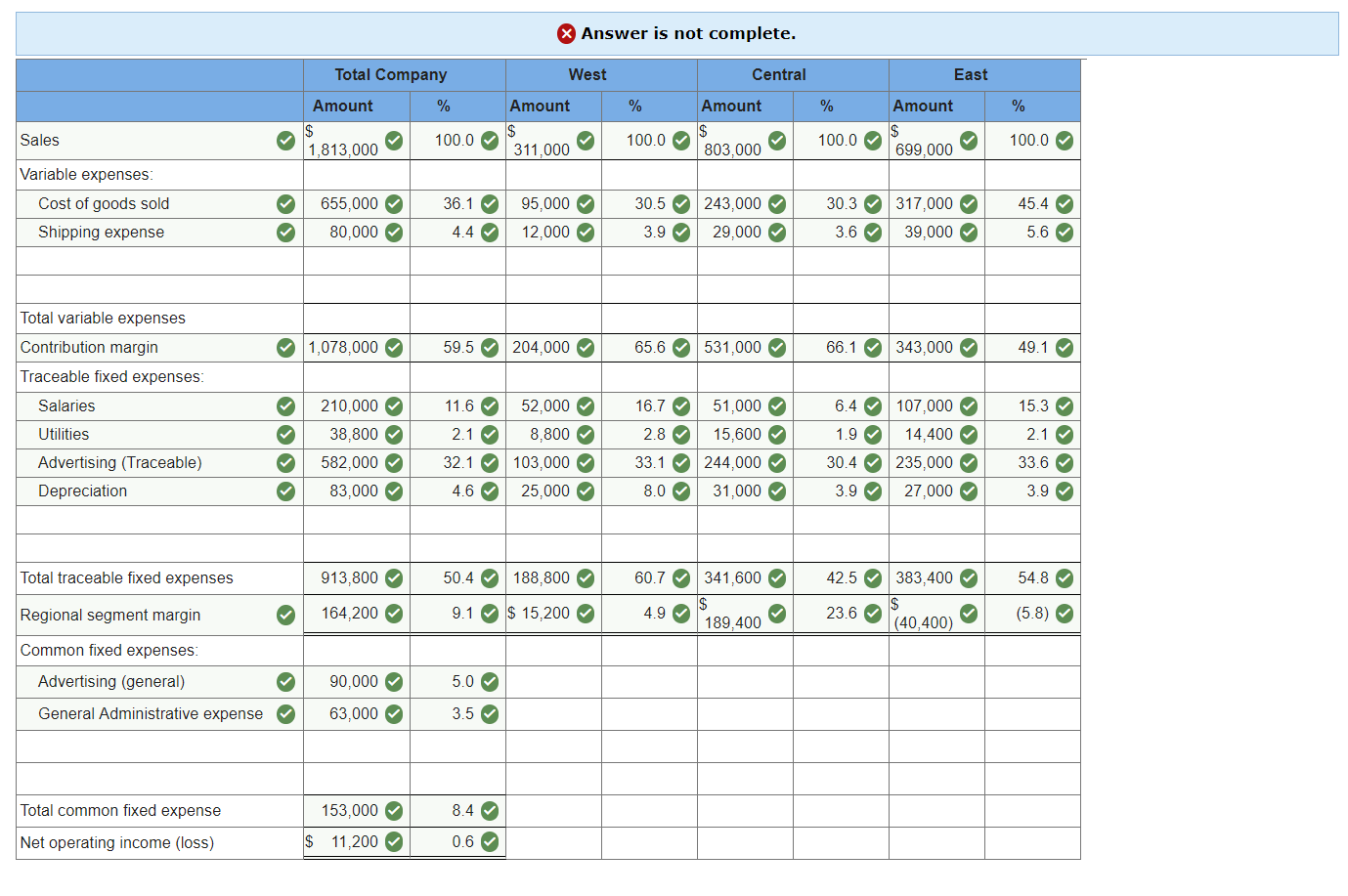

Losses have been incurred at Millard Corporation for some time. In an effort to isolate the problem and improve the company’s performance, management has requested that the monthly income statement be segmented by sales region. The company’s first effort at preparing a segmented statement is given below. This statement is for May, the most recent month of activity.

|

Sales Region |

|||||||||||

| West | Central | East | |||||||||

| Sales | $ | 311,000 | $ | 803,000 | $ | 699,000 | |||||

| Regional expenses (traceable): | |||||||||||

| Cost of goods sold | 95,000 | 243,000 | 317,000 | ||||||||

| Advertising | 103,000 | 244,000 | 235,000 | ||||||||

| Salaries | 52,000 | 51,000 | 107,000 | ||||||||

| Utilities | 8,800 | 15,600 | 14,400 | ||||||||

| 25,000 | 31,000 | 27,000 | |||||||||

| Shipping expense | 12,000 | 29,000 | 39,000 | ||||||||

| Total regional expenses | 295,800 | 613,600 | 739,400 | ||||||||

| Regional income (loss) before corporate expenses | 15,200 | 189,400 | (40,400 | ) | |||||||

| Corporate expenses: | |||||||||||

| Advertising (general) | 16,000 | 39,000 | 35,000 | ||||||||

| General administrative expense | 21,000 | 21,000 | 21,000 | ||||||||

| Total corporate expenses | 37,000 | 60,000 | 56,000 | ||||||||

| Net operating income (loss) | $ | (21,800 | ) | $ | 129,400 | $ | (96,400 | ) | |||

|

|

Cost of goods sold and shipping expense are both variable; other costs are all fixed. Millard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the three regions given above. The three regions are about the same size, and each has its own manager and sales staff. The products that the company distributes vary widely in profitability.

Required:

3. Prepare a new contribution format segmented income statement for May. Show a Total column as well as data for each region. In addition, for the company as a whole and for each sales region, show each item on the segmented income statement as a percent of sales. (Note: % columns may not total due to rounding.) Round percentage answers to 1 decimal place (i.e .1234 should be entered as 12.3).

|

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images