Answer only the 44-45

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 46E: Lotts Company produces and sells one product. The selling price is 10, and the unit variable cost is...

Related questions

Question

Answer only the 44-45

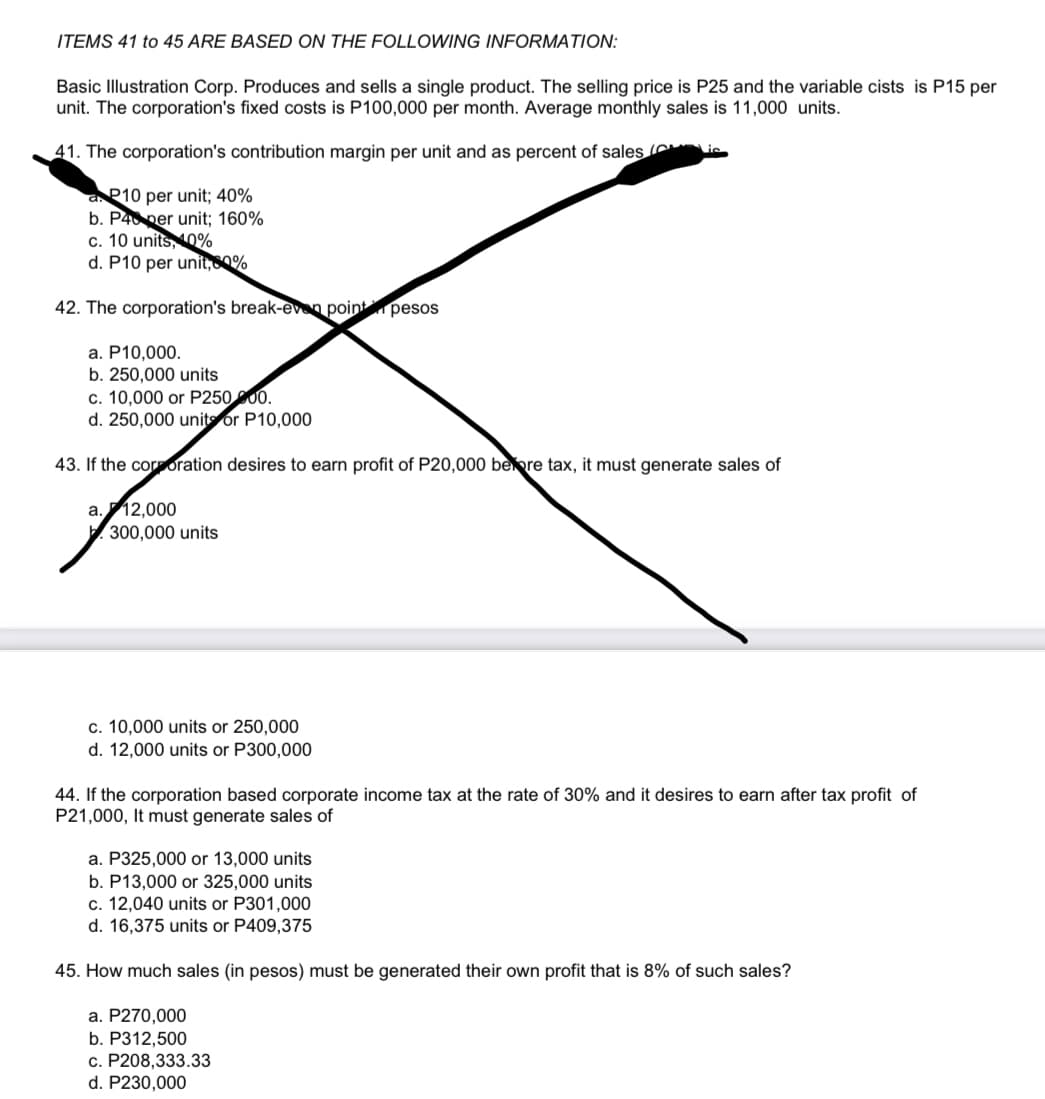

Transcribed Image Text:ITEMS 41 to 45 ARE BASED ON THE FOLLOWING INFORMATION:

Basic Illustration Corp. Produces and sells a single product. The selling price is P25 and the variable cists is P15 per

unit. The corporation's fixed costs is P100,000 per month. Average monthly sales is 11,000 units.

41. The corporation's contribution margin per unit and as percent of sales is

a P10 per unit; 40%

b. P40 per unit; 160%

c. 10 units, 40%

d. P10 per unit,80%

42. The corporation's break-even point pesos

a. P10,000.

b. 250,000 units

c. 10,000 or P250 200.

d. 250,000 units or P10,000

43. If the corporation desires to earn profit of P20,000 bere tax, it must generate sales of

a. 12,000

300,000 units

c. 10,000 units or 250,000

d. 12,000 units or P300,000

44. If the corporation based corporate income tax at the rate of 30% and it desires to earn after tax profit of

P21,000, It must generate sales of

a. P325,000 or 13,000 units

b. P13,000 or 325,000 units

c. 12,040 units or P301,000

d. 16,375 units or P409,375

45. How much sales (in pesos) must be generated their own profit that is 8% of such sales?

a. P270,000

b. P312,500

c. P208,333.33

d. P230,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning