Answer the following: 1. How much is the net purchases? 2. How much is the "change in inventory" in 20x1? 3. How much is the cost of goods sold? 4. How much is the total selling expense? 5. How much is the total general and administrative expense?

Answer the following: 1. How much is the net purchases? 2. How much is the "change in inventory" in 20x1? 3. How much is the cost of goods sold? 4. How much is the total selling expense? 5. How much is the total general and administrative expense?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 45E

Related questions

Question

100%

Answer the following:

1. How much is the net purchases?

2. How much is the "change in inventory" in 20x1?

3. How much is the cost of goods sold?

4. How much is the total selling expense?

5. How much is the total general and administrative expense?

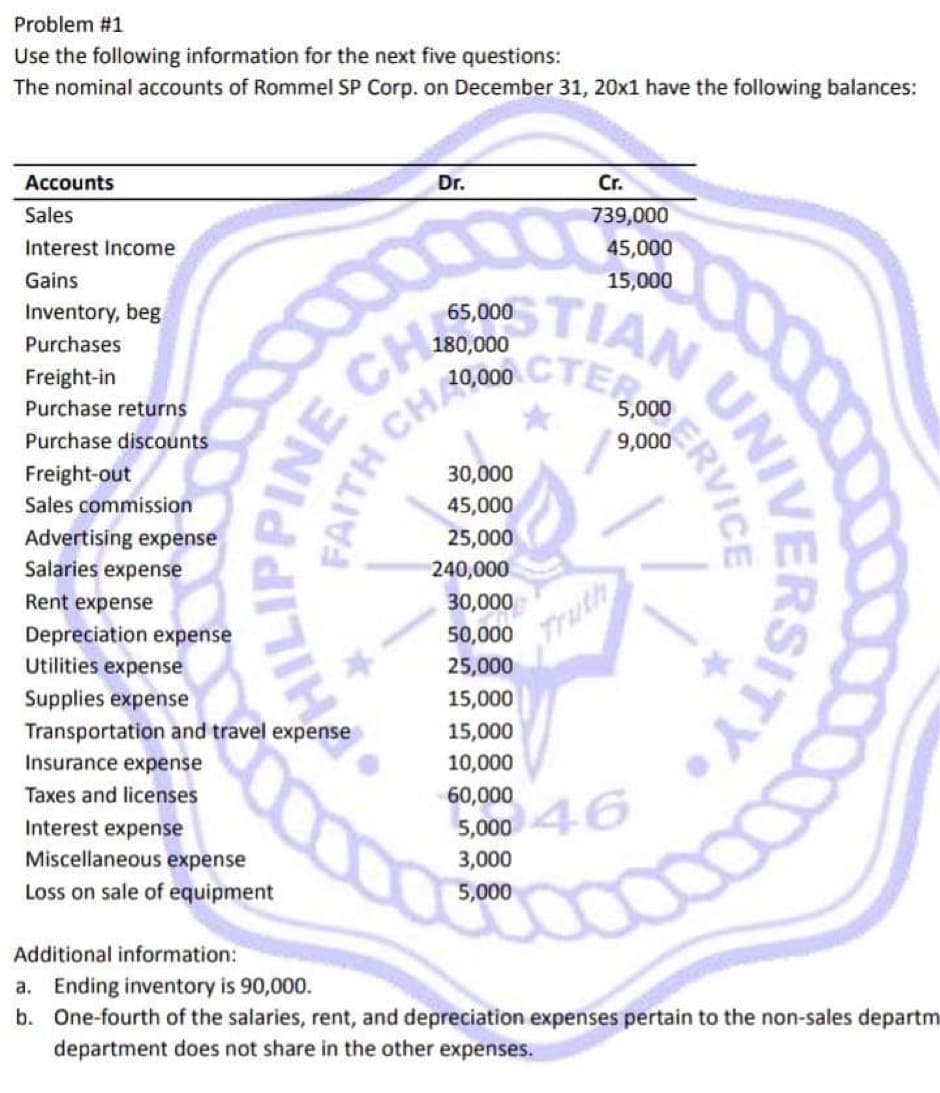

Transcribed Image Text:Problem #1

Use the following information for the next five questions:

The nominal accounts of Rommel SP Corp. on December 31, 20x1 have the following balances:

Accounts

Sales

Interest Income

Gains

Inventory, beg

Purchases

Freight-in

Purchase returns

Purchase discounts

Freight-out

Sales commission

Advertising expense

Salaries expense

Rent expense

Depreciation expense

Utilities expense

Supplies expense

HILIPPINE

Transportation and travel expense

Insurance expense

Taxes and licenses

Interest expense

Miscellaneous expense

Loss on sale of equipment

Dr.

65,000

180,000

CH

TH CH 20,000 CTER

30,000

45,000

25,000

240,000

30,000

50,000

25,000

15,000

15,000

10,000

60,000

5,000

Cr.

739,000

45,000

15,000

STIAN

3,000

5,000

5,000

9,000

ERVICE

Additional information:

a. Ending inventory is 90,000.

b. One-fourth of the salaries, rent, and depreciation expenses pertain to the non-sales departm

department does not share in the other expenses.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning