Answer the following 2 questions: Question1: Ashraf Company began operations in 2020 and determined its ending inventory at cost and at NRV on December 31, 2020, and December 31, 2021. This information is presented below. Cost Net Realizable Value 12/31/2020 $120,000 $110,000 12/31/2021 230,000 265,000 What is the effect of applying LCNRV (lower of cost or net realizable value) on income for 2021? v a- No effect b- Increases for $10,000 C- Increases for $35,000 d- Increases for $20,000 11 and the cost to complete product Z is $20, what is the amount that should be

Answer the following 2 questions: Question1: Ashraf Company began operations in 2020 and determined its ending inventory at cost and at NRV on December 31, 2020, and December 31, 2021. This information is presented below. Cost Net Realizable Value 12/31/2020 $120,000 $110,000 12/31/2021 230,000 265,000 What is the effect of applying LCNRV (lower of cost or net realizable value) on income for 2021? v a- No effect b- Increases for $10,000 C- Increases for $35,000 d- Increases for $20,000 11 and the cost to complete product Z is $20, what is the amount that should be

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 16P: (Appendix 8.1) Inventory Write-Down Frost Companys inventory records tor the years 2019 and 2020...

Related questions

Topic Video

Question

Transcribed Image Text:Quèstion 1

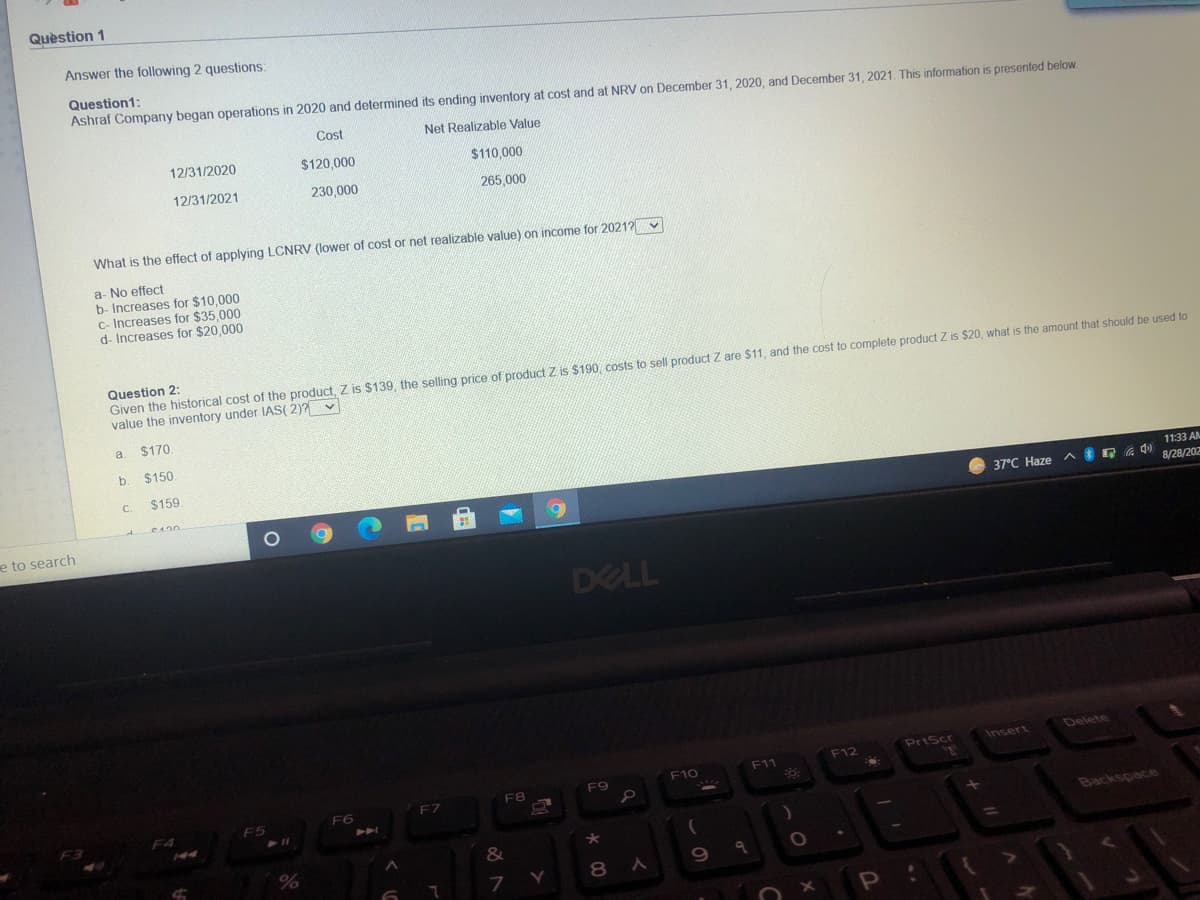

Answer the following 2 questions:

Question1:

Ashraf Company began operations in 2020 and determined its ending inventory at cost and at NRV on December 31 , 2020, and December 31, 2021. This information is presented below.

Cost

Net Realizable Value

12/31/2020

$120,000

$110,000

12/31/2021

230,000

265,000

What is the effect of applying LCNRV (lower of cost or net realizable value) on income for 20212

a- No effect

b- Increases for $10,000

C- Increases for $35,000

d- Increases for $20,000

Question 2:

Given the historical cost of the product, Z is $139, the selling price of product Z is $190, costs to sell product Z are $11, and the cost to complete product Z is $20, what is the amount that should be used to

value the inventory under IIAS( 2)? v

a.

$170.

b. $150.

C.

$159.

11:33 AM

C420

37°C Haze

8/28/202

e to search

DELL

Delete

PrtScr

Insert

F12

F10

F11

F9

F7

F8

F6

F5

F3

Backspace

&

8 A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning