Answer the following questions: Required: a-1. Find the discussion of Property, Plant, and Equipment and depreciation methods used by Campbell's. Use data from the Campbell Soup Company annual report O Straight-line method O Double declining method O Written down value method a-2. Why the particular method is used for the purpose described. O Straight-line depreciation is used for financial reporting purposes because depreciation expense will be lower than under any of the accelerated depreciation methods. O Straight-line depreciation is used for financial reporting purposes because depreciation expense will be higher than under any of the accelerated depreciation methods. a-3. What method do you think the company uses for income tax purposes? O Accelerated depreciation using the MACRS rates is probably used for tax purposes to minimize taxes payable. O Straight line Method using the MACRS rates is probably used for tax purposes to minimize taxes payable. O Written down value Method using the MACRS rates is probably used for tax purposes to minimize taxes payable.

Answer the following questions: Required: a-1. Find the discussion of Property, Plant, and Equipment and depreciation methods used by Campbell's. Use data from the Campbell Soup Company annual report O Straight-line method O Double declining method O Written down value method a-2. Why the particular method is used for the purpose described. O Straight-line depreciation is used for financial reporting purposes because depreciation expense will be lower than under any of the accelerated depreciation methods. O Straight-line depreciation is used for financial reporting purposes because depreciation expense will be higher than under any of the accelerated depreciation methods. a-3. What method do you think the company uses for income tax purposes? O Accelerated depreciation using the MACRS rates is probably used for tax purposes to minimize taxes payable. O Straight line Method using the MACRS rates is probably used for tax purposes to minimize taxes payable. O Written down value Method using the MACRS rates is probably used for tax purposes to minimize taxes payable.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section19.5: Declining-balance Method Of Depreciation

Problem 1OYO

Related questions

Question

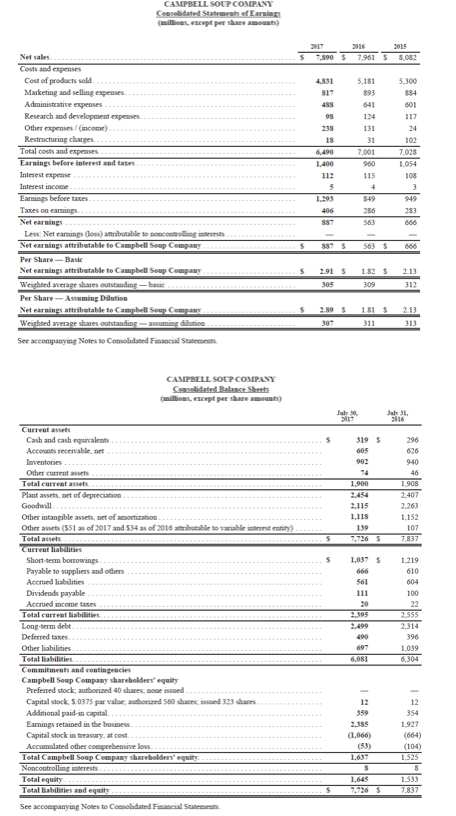

Transcribed Image Text:CAMPBELL SOUP COMPANY

Consolidated Statements of EarninE

(millioas, escept per share amounts)

217

2016

2015

Net sales

7,390 S

7,961 S

8,082

Costs and expenses

Cost of products sold.

Marketing and selling expenses

4,831

5,181

5,300

S17

893

884

Administrative expenses

488

641

601

Research and development expenses.

98

124

117

Other expenses / (mcome).

238

131

24

Restructuring charges.

18

31

102

Total costs and expenses

7,028

6,490

7,001

Earnings before interest and tases

1,400

960

1,054

Interest expense..

112

115

108

Interest income

3

Earmings before taxes

1.293

849

949

Taxes on earmings.

406

286

283

Net earnings.

Less: Net earmings (loss) attributable to noncontrolling terests

Net earnings attributable to Campbell Soup Company

S87

563

666

S87 S

563 S

606

Per Share-Basic

Net earnings attributable to Campbell Soup Company

2.91 $

182 $

2.13

Weighted average shares outstanding -basic

Per Share- Assuming Dilution

Net earnings attributable to Campbell Soup Company

Weighted average shares outstanding-assuming dilution

See accompanying Notes to Comolidated Financial Statements.

305

309

312

2.89 S

181 S

213

307

311

313

CAMPBELL SOUP COMPANY

Censelidated Balance Sheets

(millions, escept per share amounts)

Juh 0.

July 31,

Current assets

Cash and cash equvalents

319 S

296

Accounts receivable, net

605

626

Inventories

902

940

Other current assets

74

46

Total current assets.

1,900

1,908

Plant assets, net of depreciation

2,454

2,407

Goodwill.

2.115

2,263

Other intangible assets, net of amortization

1.118

1,152

Other assets (S51 as of 2017 and $34 as of 2016 attributable to variable interest entity)

Tetal assets.

Current liabalities

Short-term borrowings..

Payable to suppliers and others

139

107

7,726 S

7,837

1,037 S

1,219

666

610

Accrued liabilities

561

604

Dividends payable

111

100

Асспed ncome taxes

20

22

Total current liabilities.

2.395

2,555

Long-term debt.

Deferred taxes.

2,499

2,314

490

396

Other liabilities

697

1.039

Tetal liabilities.

6,081

6.304

Commitments and contingencies

Campbell Soup Company shareholders' equity

Preferred stock; authorized 40 shares, none issued

Capital stock, S.0375 par value, audorized 560 shares, isued 323 shares

12

12

Additional paid-in capital.

359

354

Eamings retained in the business.

Capital stock in treasury, at cost.

2,385

1,927

(1.066)

(53)

1637

(664)

Accumulated other comprehensive lovs

Total Campbell Soup Company shareholders' equity

Noncontrolling interests

Tetal equity.....

Total liabilities and equity

(104)

1,525

1,645

1,533

7,726 S

7.837

See accompanying Notes to Consolidated Financial Statements

Transcribed Image Text:Answer the following questions:

Required:

a-1. Find the discussion of Property, Plant, and Equipment and depreciation methods used by Campbell's. Use data from the Campbell

Soup Company annual report

O Straight-line method

O Double declining method

O Written down value method

a-2. Why the particular method is used for the purpose described.

Straight-line depreciation is used for financial reporting purposes because depreciation expense will be lower than under any

of the accelerated depreciation methods.

O Straight-line depreciation is used for financial reporting purposes because depreciation expense will be higher than under any

of the accelerated depreciation methods.

a-3. What method do you think the company uses for income tax purposes?

O Accelerated depreciation using the MACRS rates is probably used for tax purposes to minimize taxes payable.

O Straight line Method using the MACRS rates is probably used for tax purposes to minimize taxes payable.

Written down value Method using the MACRS rates is probably used for tax purposes to minimize taxes payable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage