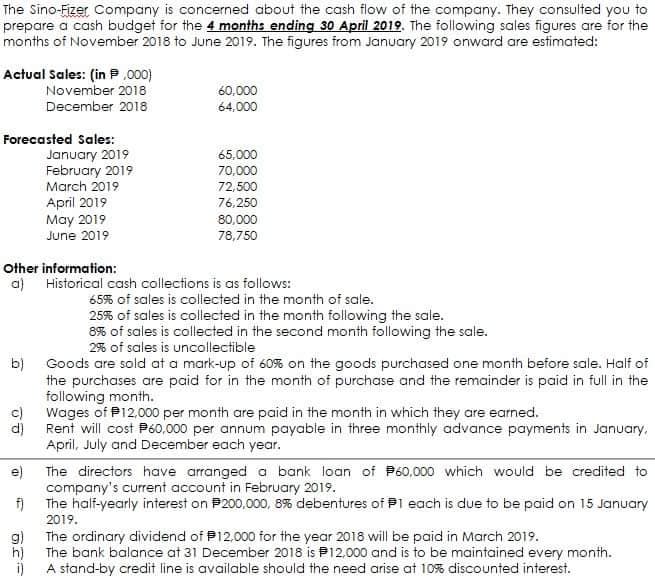

The Sino-Fizer Company is concerned about the cash flow of the company. They consulted you to prepare a cash budget for the 4 months ending 30 April 2019. The following sales figures are for the months of November 2018 to June 2019. The figures from January 2019 onward are estimated: Actual Sales: (in P ,000) November 2018 60,000 December 2018 64,000 Forecasted Sales: January 2019 February 2019 March 2019 65,000 70,000 72,500 April 2019 May 2019 June 2019 76,250 80,000 78,750 Other information: a) Historical cash collections is as follows: 65% of sales is collected in the month of sale. 25% of sales is collected in the month following the sale. 8% of sales is collected in the second month following the sale. 2% of sales is uncollectible b) Goods are sold at a mark-up of 60% on the goods purchased one month before sale. Half of the purchases are paid for in the month of purchase and the remainder is paid in full in the following month. c) Wages of P12,000 per month are paid in the month in which they are earned. d) Rent will cost P60.000 per annum payable in three monthly advance payments in January. April, July and December each year. The directors have arranged a bank loan of P60,000 which would be credited to company's current account in February 2019. f) The half-yearly interest on P200,000, 8% debentures of P1 each is due to be paid on 15 January 2019. 9) The ordinary dividend of P12,000 for the year 2018 will be paid in March 2019. h) The bank balance at 31 December 2018 is P12,000 and is to be maintained every month. e)

The Sino-Fizer Company is concerned about the cash flow of the company. They consulted you to prepare a cash budget for the 4 months ending 30 April 2019. The following sales figures are for the months of November 2018 to June 2019. The figures from January 2019 onward are estimated: Actual Sales: (in P ,000) November 2018 60,000 December 2018 64,000 Forecasted Sales: January 2019 February 2019 March 2019 65,000 70,000 72,500 April 2019 May 2019 June 2019 76,250 80,000 78,750 Other information: a) Historical cash collections is as follows: 65% of sales is collected in the month of sale. 25% of sales is collected in the month following the sale. 8% of sales is collected in the second month following the sale. 2% of sales is uncollectible b) Goods are sold at a mark-up of 60% on the goods purchased one month before sale. Half of the purchases are paid for in the month of purchase and the remainder is paid in full in the following month. c) Wages of P12,000 per month are paid in the month in which they are earned. d) Rent will cost P60.000 per annum payable in three monthly advance payments in January. April, July and December each year. The directors have arranged a bank loan of P60,000 which would be credited to company's current account in February 2019. f) The half-yearly interest on P200,000, 8% debentures of P1 each is due to be paid on 15 January 2019. 9) The ordinary dividend of P12,000 for the year 2018 will be paid in March 2019. h) The bank balance at 31 December 2018 is P12,000 and is to be maintained every month. e)

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 34E: A companys sales for the coming months are as follows: About 20 percent of sales are cash sales, and...

Related questions

Question

100%

PREPARE A

Transcribed Image Text:The Sino-Fizer Company is concerned about the cash flow of the company. They consulted you to

prepare a cash budget for the 4 months ending 30 April 2019. The following sales figures are for the

months of November 2018 to June 2019. The figures from January 2019 onward are estimated:

Actual Sales: (in P ,000)

November 2018

December 2018

60,000

64,000

Forecasted Sales:

January 2019

February 2019

March 2019

April 2019

May 2019

65,000

70,000

72,500

76,250

80,000

June 2019

78,750

Other information:

a) Historical cash collections is as follows:

65% of sales is collected in the month of sale.

25% of sales is collected in the month following the sale.

8% of sales is collected in the second month following the sale.

2% of sales is uncollectible

b)

Goods are sold at a mark-up of 60% on the goods purchased one month before sale. Half of

the purchases are paid for in the month of purchase and the remainder is paid in full in the

following month.

Wages of P12,000 per month are paid in the month in which they are earned.

d)

Rent will cost P60,000 per annum payabie in three monthly advance payments in January,

April, July and December each year.

e)

The directors have arranged a bank loan of P60,000 which would be credited to

company's current account in February 2019.

f)

The half-yearly interest on P200,000, 8% debentures of Pl each is due to be paid on 15 January

2019.

g)

The ordinary dividend of P12,000 for the year 2018 will be paid in March 2019.

h)

The bank balance at 31 December 2018 is P12,000 and is to be maintained every month.

A stand-by credit line is available should the need arise at 10% discounted interest.

i)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning