answer). Now suppose a specific tax, t > 0, is imposed on this market that has to be paid to the government by sellers. Denote the new equilibrium price (i.e., the price that is at the intersection of the demand and the shifted supply curve) by P*(t) . Give the new price that is paid by buyers (buyers' price) and the new price that is effectively received by sellers (sellers' price) in terms of P*(t) and t. Afterwards, derive an expression for the buyers' and sellers' prices and the new equilibrium quantity (call it Q*(t)) in terms of the parameters of the demand and supply equations given in the problem and the tax amount t. How does the tax incidence on the buyer vary with B. Provide an economic explanation in terms of price elasticity of demand. Now, imagine that the tax is imposed on the buyers. Explain in no more than three sentences how the buyers' and sellers' prices and the new equilibrium quantity would compare with your answers to parts (b).

answer). Now suppose a specific tax, t > 0, is imposed on this market that has to be paid to the government by sellers. Denote the new equilibrium price (i.e., the price that is at the intersection of the demand and the shifted supply curve) by P*(t) . Give the new price that is paid by buyers (buyers' price) and the new price that is effectively received by sellers (sellers' price) in terms of P*(t) and t. Afterwards, derive an expression for the buyers' and sellers' prices and the new equilibrium quantity (call it Q*(t)) in terms of the parameters of the demand and supply equations given in the problem and the tax amount t. How does the tax incidence on the buyer vary with B. Provide an economic explanation in terms of price elasticity of demand. Now, imagine that the tax is imposed on the buyers. Explain in no more than three sentences how the buyers' and sellers' prices and the new equilibrium quantity would compare with your answers to parts (b).

Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781305971509

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Supply, Demand, And Government Policies

Section: Chapter Questions

Problem 10PA

Related questions

Question

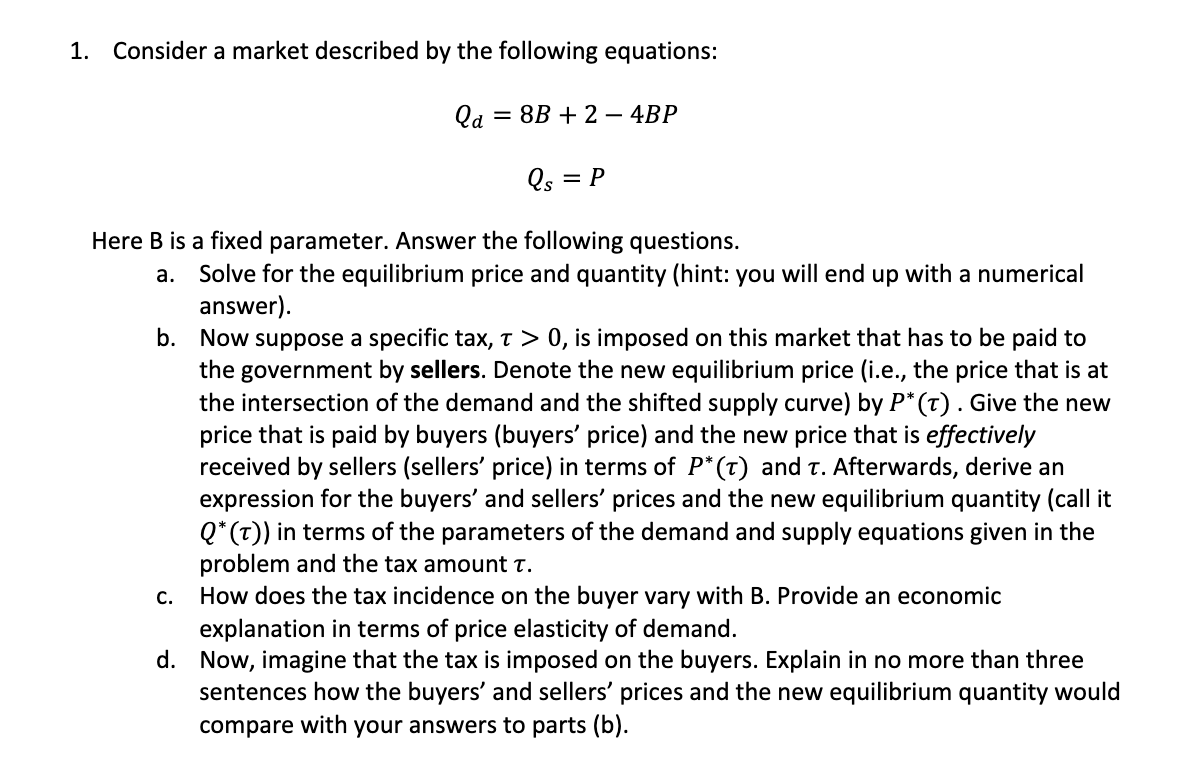

Transcribed Image Text:1. Consider a market described by the following equations:

Qa

= 8B + 2 – 4BP

Qs

= P

Here B is a fixed parameter. Answer the following questions.

Solve for the equilibrium price and quantity (hint: you will end up with a numerical

answer).

b. Now suppose a specific tax, t > 0, is imposed on this market that has to be paid to

the government by sellers. Denote the new equilibrium price (i.e., the price that is at

the intersection of the demand and the shifted supply curve) by P* (t). Give the new

price that is paid by buyers (buyers' price) and the new price that is effectively

received by sellers (sellers' price) in terms of P*(T) and t. Afterwards, derive an

expression for the buyers' and sellers' prices and the new equilibrium quantity (call it

Q* (t)) in terms of the parameters of the demand and supply equations given in the

problem and the tax amount t.

How does the tax incidence on the buyer vary with B. Provide an economic

explanation in terms of price elasticity of demand.

d. Now, imagine that the tax is imposed on the buyers. Explain in no more than three

sentences how the buyers' and sellers' prices and the new equilibrium quantity would

compare with your answers to parts (b).

а.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning