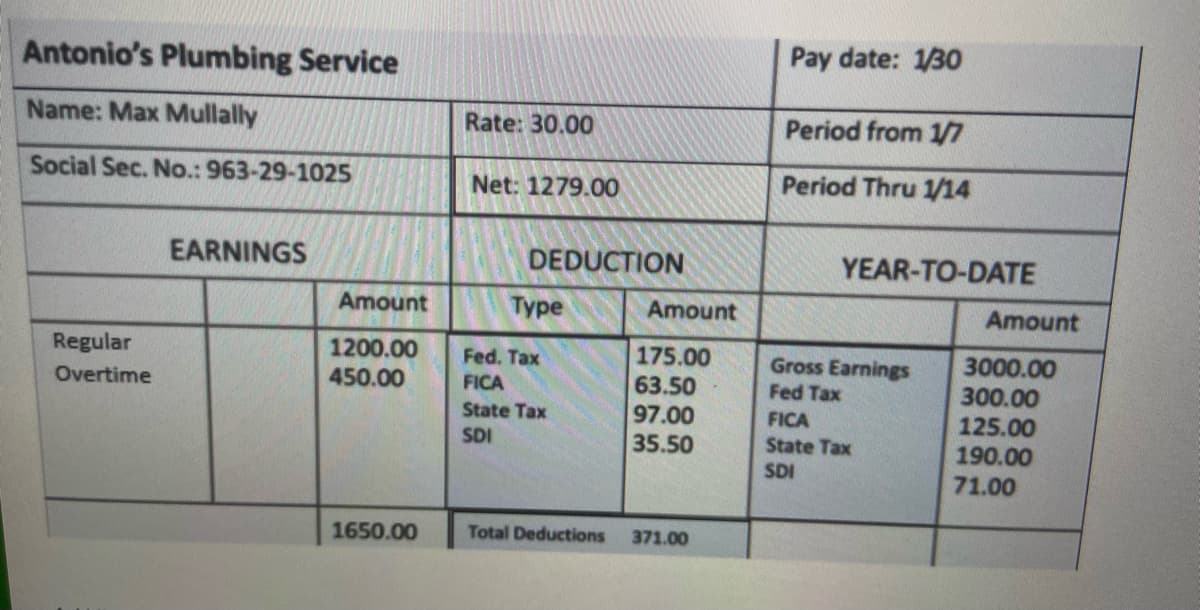

Antonio's Plumbing Service Name: Max Mullally Social Sec. No.: 963-29-1025 Regular Overtime EARNINGS Amount 1200.00 450.00 1650.00 Rate: 30.00 Net: 1279.00 DEDUCTION Type Fed. Tax FICA State Tax SDI Total Deductions Amount 175.00 63.50 97.00 35.50 371.00 Pay date: 1/30 Period from 1/7 Period Thru 1/14 YEAR-TO-DATE Gross Earnings Fed Tax FICA State Tax SDI Amount 3000.00 300.00 125.00 190.00 71.00

Antonio's Plumbing Service Name: Max Mullally Social Sec. No.: 963-29-1025 Regular Overtime EARNINGS Amount 1200.00 450.00 1650.00 Rate: 30.00 Net: 1279.00 DEDUCTION Type Fed. Tax FICA State Tax SDI Total Deductions Amount 175.00 63.50 97.00 35.50 371.00 Pay date: 1/30 Period from 1/7 Period Thru 1/14 YEAR-TO-DATE Gross Earnings Fed Tax FICA State Tax SDI Amount 3000.00 300.00 125.00 190.00 71.00

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 36P

Related questions

Question

1. How much FICA was taken out per pay period?

2. How much SDI has been taken out year-to-date?

3. How many hours of overtime did Max work this pay period?

4. What date did Max receive his check?

Transcribed Image Text:Antonio's Plumbing Service

Name: Max Mullally

Social Sec. No.: 963-29-1025

Regular

Overtime

EARNINGS

Amount

1200.00

450.00

1650.00

Rate: 30.00

Net: 1279.00

DEDUCTION

Type

Fed. Tax

FICA

State Tax

SDI

Total Deductions

Amount

175.00

63.50

97.00

35.50

371.00

Pay date: 1/30

Period from 1/7

Period Thru 1/14

YEAR-TO-DATE

Gross Earnings

Fed Tax

FICA

State Tax

SDI

Amount

3000.00

300.00

125.00

190.00

71.00

Expert Solution

Step 1

A payroll register is a document in which the details regarding net salaries or wages of the employees are recorded, maintained, and calculated. It contains gross pay, deductions allowed, net pay, the period of the current pay (as per company policy), the total period up to date, the calculations of the total period up to date, and the nature of employment for calculation purposes like hourly wages, contractual employment, fixed salaried employee, etc.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning