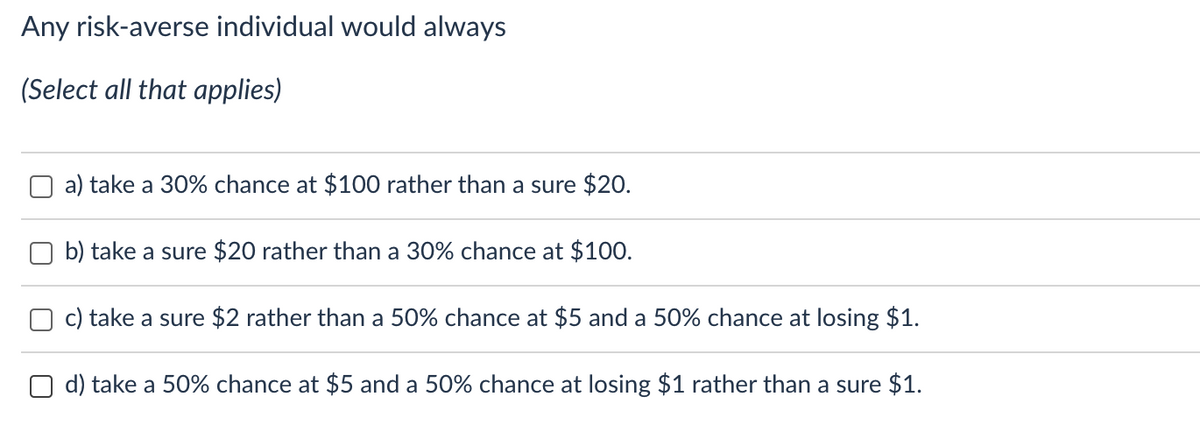

Any risk-averse individual would always (Select all that applies) a) take a 30% chance at $100 rather than a sure $20. b) take a sure $20 rather than a 30% chance at $100. c) take a sure $2 rather than a 50% chance at $5 and a 50% chance at losing $1. d) take a 50% chance at $5 and a 50% chance at losing $1 rather than a sure $1.

Q: In this topic, you are to research globalisation. The business press bombards us with ideas about…

A: Globalization is a process of exchange of products, beliefs, culture, ideas and business operations…

Q: Assume that there is fairly free entry into the field of psychotherapy and that demand for…

A: Assume that there is fairly free entry into the field of psychotherapy and that demand for…

Q: (2) (Assume that s = 0 (there is no subsidy.) (a) Write down firm A’s profit function. (No work…

A: Introduction Here are two firms in Karhide. Firm A is foreign firm and firm B is domestic firm. For…

Q: Why would offshore deposits be a more appropriate term?

A: Offshore is a term used often in the banking and financial industries to identify places where rules…

Q: Suppose the society's preferences (w) for quantity (q) and variety (n) can be categorized by the…

A: Optimal input proportions are utilized when an extra dollar spent on any input yields a similar…

Q: (a) According to data from the Office of National Statistics, in January 2022 the UK public sector…

A: In this question, in January 2022 the UK public sector spent less than it received in taxes…

Q: If the Fed's recent contractionary monetary policy causing rise in interest rates, what is the most…

A: The velocity of money measures how many times a unit of currency is exchanged in the economy. The…

Q: however, option e mentions upward sloping straight line, did you simply mean upward sloping curve or…

A: The preferences of Goluki are determined by U(q1, q2) = q11/3 + q21/3 Where, q1 is the number of…

Q: 2. A bridge connecting two towns costs $15,000,000, has an average annual operating cost of $450,000…

A: The measure that depicts the expected stream of income that is determined on the date of valuation…

Q: Use the AD/AS framework to explain how the economy adjusts in the short run and the long run to each…

A: Disclaimer :- As you posted multipart questions we are supposed to solve the first 3 questions only…

Q: In macroeconomics the term investment mostly refers to O businesses' purchases of new buildings and…

A: Macroeconomics is the branch of economics that deals with issues concerning the economy as a whole.

Q: Please define in your own words the following terms: contractual savings institution, hedge fund,…

A: Contractual savings institutions: The contractual savings institutions are those that generally keep…

Q: Only in the short run and not in the long-run, humankind itself will be the one to benefit when…

A: Environmental and ecological considerations are very important for any modern busineww because of…

Q: What is the social welfare of the (pure) Nash equilibrium in the Prisoner's Dilemma game? Player 2…

A: "Nash equilibrium represent the optimal choice of players such that no player have an incentive to…

Q: 9. The treasurer of XYZ Corp. knows that the company will need to borrow $100 million in one year…

A: Derivatives refers to a contract that derives its value from the performance of an underlying…

Q: Suppose you are hired as an economic consultant for Promax Consulting Company. Your job is to…

A: The perfectly competitive firm, maximize its benefit when its minimal expense is equivalent to the…

Q: 6. Figure: Random Allocation Under Price Ceilings A $34 B 30 с 24 D 20 Price Celling 17 1200 1500…

A: When the price charged is greater than or less than the equilibrium price set by market forces of…

Q: In 1950, Congress raised the federal minimum wage to seventy-five cents ($0.75) per hour. The CPI in…

A: Consumer price index is one of the measures to calculate inflation.

Q: 6. (b) Consider an exchange economy with two agents Á and B, and two goods i and y. Consumption of…

A: Competitive equilibrium is accomplished while benefit maximizing producers and utility-maximizing…

Q: You have been recently hired by the National Works Agency (NWA) to oversee the construction of the…

A: Infrastructure investment Infrastructure investment is the investment that is made by the…

Q: Long run elasticity of supply is known as

A: Answer: Note: the question seems to be asking about whether the long-run supply is elastic or…

Q: Suppose that the demand for DVD players is given by QP=400-4P, where Q is the quantity demanded per…

A: Given demand function Q(P)=400-4P And P=50

Q: What is the foot-in-the-door technique? How does selfperception theory relate to this effect?

A: The foot-in-the-door (FITD) approach is a compliance strategy that entails persuading someone to…

Q: Question 35 Classical Growth theory predicts that O aggregate income always returns to the…

A: Question 35) "Classical growth theory's fundamental principle is that the economy is…

Q: 9. The treasurer of XYZ Corp. knows that the company will need to borrow $100 million in one year…

A: Derivatives refer to a contract that derives its value from the performance of an underlying entity.…

Q: Explain why it is difficult to deal with (reduce/eliminate) hidden unemployment in less developed…

A: In developing countries, unemployment is a persistent problem that results in the loss of human…

Q: PROBLEM NUMBER 1 A farmer can plant up to 8 acres of land with wheat and barley. He can earn…

A: A company's optimal point is when it is producing a large amount of items at the lowest feasible…

Q: (a)lf we allow for the possibility of satiation, the consumer's budget constraint takes the form pxs…

A: Walras' law is a statement in general equilibrium theory that states that, regardless of whether the…

Q: Assume that the unemployment rate decreases substantially and that there is very high inflation.…

A: The policies that are implemented by the government are called fiscal policies and the policies that…

Q: D. - $489 billion.

A:

Q: Consider the following data on the GDP of Z-product: i) What was the growth rate of nominal GDP…

A: Dear student, you have asked multiple sub-part questions in a single post.In such a case, I will be…

Q: You were familiarized with GDP in this module. Sometimes, economic topics seem pretty remote and…

A: The COVID-19 crisis appears to have the potential to hasten or exacerbate a number of already…

Q: Sales had been slow at Martha's Fresh Flowers for several months, but then business starting picking…

A: Business cycles are defined as the alternate periods of expansion and contraction in the business…

Q: Directions: Discuss each task of a professional safety engineer using well thought of responses. The…

A: A very much planned mishap obstacle program can downsize laborer injury, awfulness and passing…

Q: Find the net present worth of the following cash flow series at an interest rate of 9%.

A: Net present value (NPV) formula: NPV = ∑i=1nCi(1+r)i - Initial investment. Where Ci is cash flow in…

Q: Aggregate supply and aggregate demand at various levels of aggregate expenditures for a fictitious…

A: Answer - GDP = GDP is the sum of all the product and services produced in a country in a year is…

Q: Classical Growth theory predicts that O aggregate income always returns to the subsistence income O…

A:

Q: A profit maximizing firm produces output using capital, K, and labour, L, in the following…

A:

Q: Assume that a country is endowed with 33 units of oil reserve. (a) the marginal willingness to pay…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Explain how Friedman’s Natural Rate Theory is different from the New Classical theory

A: Milton Friedman characterized the natural rate of unemployment as the degree of unemployment that…

Q: Consider the following economy with two goods, x and y, and two consumers, A and B. The tastes of…

A: Pareto -efficient points refers to those equilibrium points deviating from which no person can be…

Q: ppose a basket of goods and services has been selected to calculate the CPI and 2012 has been…

A: consumer price index is a index which measure the change in price of basket of goods and services…

Q: Discuss how the above risk can be managed by commercial bank.

A: Risk management of the board in banking is hypothetically characterized as "the consistent turn of…

Q: An alumni of CSUN's engineering department would like to donate to the department's scholarship…

A: Answer is given below

Q: For each of the following monetary policy tools: A. The BSP buys securities in the open market. B.…

A: The Central Bank of a nation uses the monetary policy to check and balances the interest rate and…

Q: You are one of two identical firms producing homogeneous good. (a) If you have an option of…

A: A good with uniform qualities means that every unit of the good is the same. Goods with varying…

Q: Explain how search frictions arise in the labour market.

A: The market where demand and supply of jobs tend to meet with workers that provide services that tend…

Q: Question 3 of 10 Given the piecewise function shown below, select al of the statements that are true…

A: a piecewise-defined function is a function defined by various sub-functions, where each sub-function…

Q: Q.16 Which of the following can decrease money supply? (i) Open Market Sale (ii) Open Market…

A: The central bank can regulate the money by using various tools. Monetary Policy includes all the…

Q: Discuss the main contributions of 1 economist that influenced by John Maynard Keynes (Keynesianism,…

A: Joan Violet Robinson was a Keynesian economist who was undoubtedly the only great female economist…

Step by step

Solved in 2 steps

- A risk-averse manager is considering a project that will cost £100. There is a 10 percent chance the project will generate revenues of £100, an 80 percent chance it will yield revenues of £50, and a 10 percent chance it will yield revenues of £500. Should the manager adopt the project? Explain. What will a risk-neutral and risk-loving manager do in the same situation?If a risk‐neutral individual owns a home worth $200,000 and there is a three percent chance the home will be destroyed by fire in the next year, then we know that:a) He is willing to pay much more than $6,000 for full cover.b) He is willing to pay much less than $6,000 for full cover.c) He is willing to pay at most $6,000 for full cover.d) None of the above are correct.e) All of the above are correct.could you answer part b to this question or if you have time part a and part b but part is more important. thank you Priyanka has an income of £90,000 and is a von Neumann-Morgenstern expected utility maximiser with von Neumann-Morgenstern utility index . There is a 1 % probability that there is flooding damage at her house. The repair of the damage would cost £80,000 which would reduce the income to £10,000. a) Would Priyanka be willing to spend £500 to purchase an insurance policy that would fully insure her against this loss? Explain. b) What would be the highest price (premium) that she would be willing to pay for an insurance policy that fully insures her against the flooding damage?

- Scenario 2 Tess and Lex earn $40,000 per year and all earnings are spent on consumption (c). Tess and Lex both have the utility function ( sqrt c) . Both could experience an adverse event that results in earnings of $0 per year. Tess has a 1% chance of experiencing an adverse event and Lex has a 12% chance of experiencing an adverse event. Tess and Lex are both aware of their risk of an adverse event. Refer to Scenario 2 Calculate Lex’s and Tess' expected utilities without insurance. (each one separated) Round to two decimal places for bothScenario 2 Tess and Lex earn $40,000 per year and all earnings are spent on consumption (c). Tess and Lex both have the utility function (sqrt c) . Both could experience an adverse event that results in earnings of $0 per year. Tess has a 1% chance of experiencing an adverse event and Lex has a 12% chance of experiencing an adverse event. Tess and Lex are both aware of their risk of an adverse event. Refer to Scenario 2 Suppose that insurance companies do not know specific probabilities of adverse events for Tess or Lex, but do know the average probability of an adverse event. If they assumed that both Tess and Lex purchase full insurance, what is the actuarially fair premium charged? Round to two decimal placesScenario 2 Tess and Lex earn $40,000 per year and all earnings are spent on consumption (c). Tess and Lex both have the utility function (sqrt c) . Both could experience an adverse event that results in earnings of $0 per year. Tess has a 1% chance of experiencing an adverse event and Lex has a 12% chance of experiencing an adverse event. Tess and Lex are both aware of their risk of an adverse event. Refer to Scenario 2 If an insurance company knows the probability of Tess experiencing an adverse event, what is the actuarially fair premium charged to Tess per $1 of benefit? Round to two decimal places

- A risk-averse manager is considering two projects. The first project involves expanding the market for bologna; the second involves expanding the market for caviar. There is a 10 percent chance of a recession and a 90 percent chance of an economic boom. During a boom, the bologna project will lose $10,000, whereas the caviar project will earn $20,000. During a recession, the bologna project will earn $12,000 and the caviar project will lose $8,000. If the alternative is earning $3,000 on a safe asset (say, a Treasury bill), what should the manager do? Why?Obi-Wan is considering whether to buy a lightsaber. With probability 0.50 he will value the lightsaber at $4,000, and with probability 0.50 he will value it at $1,000. If new lightsabers sell for $2,500, then buying a new lightsaber is a: Multiple Choice fair gamble. better-than-fair gamble. less-than-fair gamble. less-than-fair gamble if Obi-Wan risk neutral.. Priyanka has an income of £90,000 and is a von Neumann-Morgenstern expected utility maximiser with von Neumann-Morgenstern utility index u(x) = square root x. There is a 1 % probability that there is flooding damage at her house. The repair of the damage would cost £80,000 which would reduce the income to £10,000. a) Would Priyanka be willing to spend £500 to purchase an insurance policy that would fully insure her against this loss? Explain. b) What would be the highest price (premium) that she would be willing to pay for an insurance policy that fully insures her against the flooding damage?

- Ebony Reigns owns a studio that would cost ¢ 120,000 to replace should it ever be destroyed by fire. There is a 25% chance that the studio could be destroyed by fire during the course of the year. If the fire occurs, Ebony Reign's studio will be worth only ¢ 60,000. An insurance company has offered Ebony a false insurance policy that requires her to pay a yearly premium of ¢ 15,000 in the good state of nature (no fire) Ebony has fully insured her studio to eliminate the risk. Assuming that Ebony Reigns is risk averse has another wealth answer the following questions: A) Calculate the variance of the value of Ebony's studio with fair insurance. B) Is Ebony better off with the fair insurance ? Why ?Define risk aversion and give an example of a risk-averse person?Tess and Lex earn $40,000 per year and all earnings are spent on consumption (c). Tess and Lex both have the utility function c. Both could experience an adverse event that results in earnings of $0 per year. Tess has a 1% chance of experiencing an adverse event and Lex has a 12% chance of experiencing an adverse event. Tess and Lex are both aware of their risk of an adverse event. 1. Suppose the actuarially fair premium charge is 2600, Calculate Tess’ expected utility with full insurance if she is charged the premium. Round to two decimal places. 2. What is the premium that private insurance companies will charge for full insurance? Round to two decimal places. 3.Assume the social welfare function is the sum of the Tess’ and Lex’s utility functions. Select the correct statement regarding the explanation for what has happened in the private market and the role of social insurance. a.Adverse section has lead to market failure. The government could improve social welfare by…