Appe EX 1 V Net cash flow from The operating activities, selec $123,860 Pr the di

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 16.22EX

Related questions

Question

100%

EX 13-22 THANK YOU!

Transcribed Image Text:Appendix 2

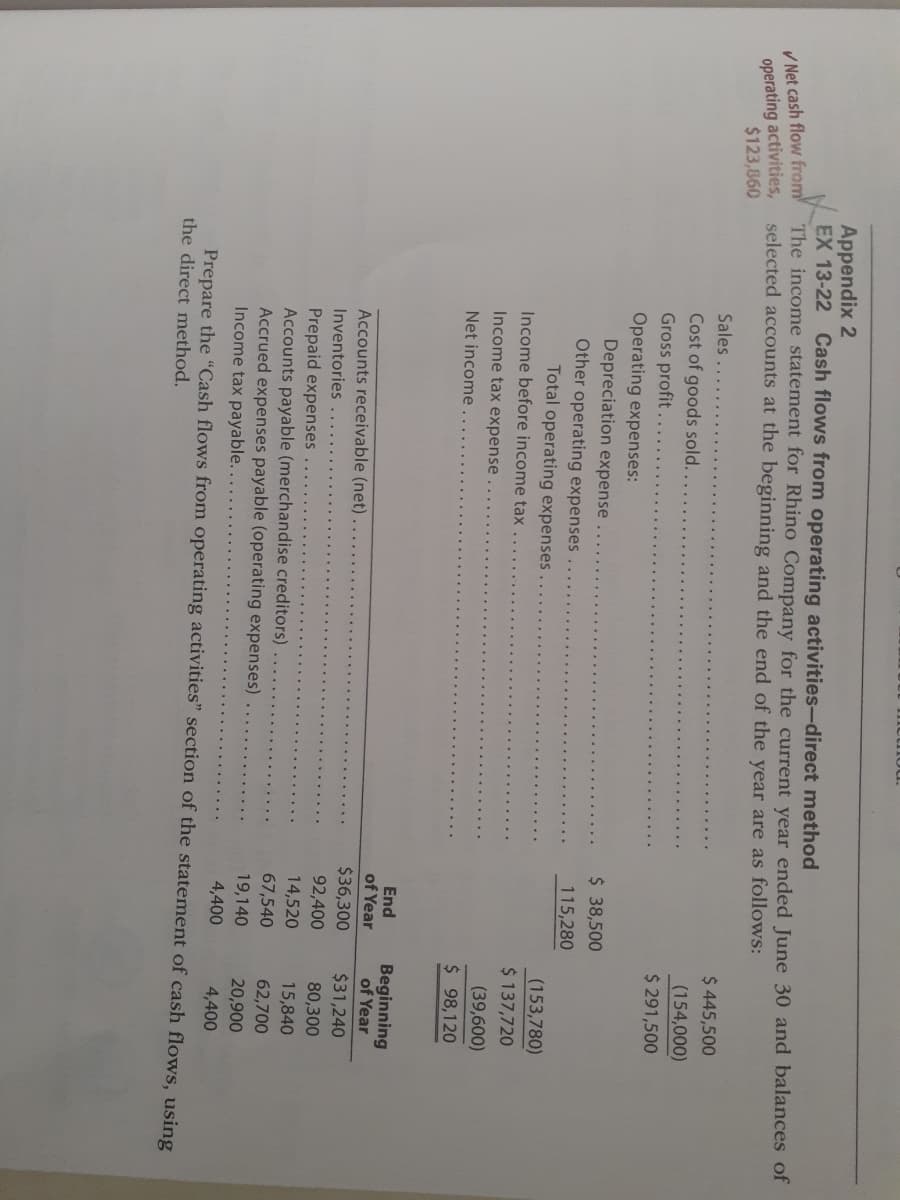

EX 13-22 Cash flows from operating activities-direct method

A Net cash flow from The income statement for Rhino Company for the current year ended June 30 and balances of

selected accounts at the beginning and the end of the year are as follows:

operating activities,

$123,860

Sales..

$ 445,500

Cost of goods sold.

Gross profit.

(154,000)

$ 291,500

Operating expenses:

Depreciation expense

$ 38,500

Other operating expenses

115,280

Total operating expenses

(153,780)

$ 137,720

Income before income tax

Income tax expense

(39,600)

Net income

$ 98,120

End

Beginning

of Year

of Year

Accounts receivable (net)

$36,300

92,400

$31,240

Inventories

80,300

Prepaid expenses

Accounts payable (merchandise creditors)

Accrued expenses payable (operating expenses)

Income tax payable.

14,520

15,840

67,540

62,700

19,140

20,900

4,400

4,400

Prepare the “Cash flows from operating activities" section of the statement of cash flows, using

the direct method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning